- United Kingdom

- /

- Pharma

- /

- LSE:AZN

How the White House Drug Price Deal Impacts AstraZeneca’s Current Valuation in 2025

Reviewed by Bailey Pemberton

If you are watching AstraZeneca right now and wondering whether it makes sense to buy, sell, or hold, you are not alone. The past month has been a whirlwind for the stock, and investors are trying to make sense of what it all means. After a quick dip of -1.8% in the last week, AstraZeneca's shares have still managed a strong comeback, up 10.2% over the past 30 days and an impressive 18.1% year-to-date. That suggests a shift in sentiment, possibly connected to big headlines about the company striking a deal with the White House to lower drug prices in the U.S. This agreement put AstraZeneca in the spotlight, boosting its profile among all sorts of investors and highlighting the potential for growth, or at least a reduction in risk, as regulatory uncertainty eases.

But is all this good news already "priced in" to the stock, or is there still value to unlock? Looking at long-term performance, AstraZeneca has delivered 77.3% returns over five years and 37.7% over the last three, outpacing many of its peers. On a pure valuation basis, though, it gets a middling score right now. Three out of six checks signal that it's undervalued, which means there is potential here but not an overwhelming bargain. Still, numbers only tell part of the story.

Let’s break down the most common ways analysts evaluate AstraZeneca’s valuation, and then explore a smarter long-term approach that can help you make an even more informed decision about the stock.

Approach 1: AstraZeneca Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by forecasting a company's future cash flows and then discounting those projections back to today's value. This process provides an estimate of the business's true worth. For AstraZeneca, this approach gives investors a window into how much the company is expected to generate in cash earnings over time and what that is worth in present-day dollars.

Right now, AstraZeneca's latest twelve months Free Cash Flow stands at $8.7 billion. Analysts project steady growth in the coming years, with cash flow expected to reach $19.5 billion by 2029. While analyst forecasts typically only go out five years, platforms like Simply Wall St extend these projections further to help paint a longer-term picture using a two-stage Free Cash Flow to Equity model.

Taking all projected future cash flows together and discounting them to today’s value, the DCF estimate suggests AstraZeneca has an intrinsic fair value of $238.80 per share. Compared to the recent share price, this model implies the stock is trading at a 47.4% discount. This may indicate potential undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AstraZeneca is undervalued by 47.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: AstraZeneca Price vs Earnings

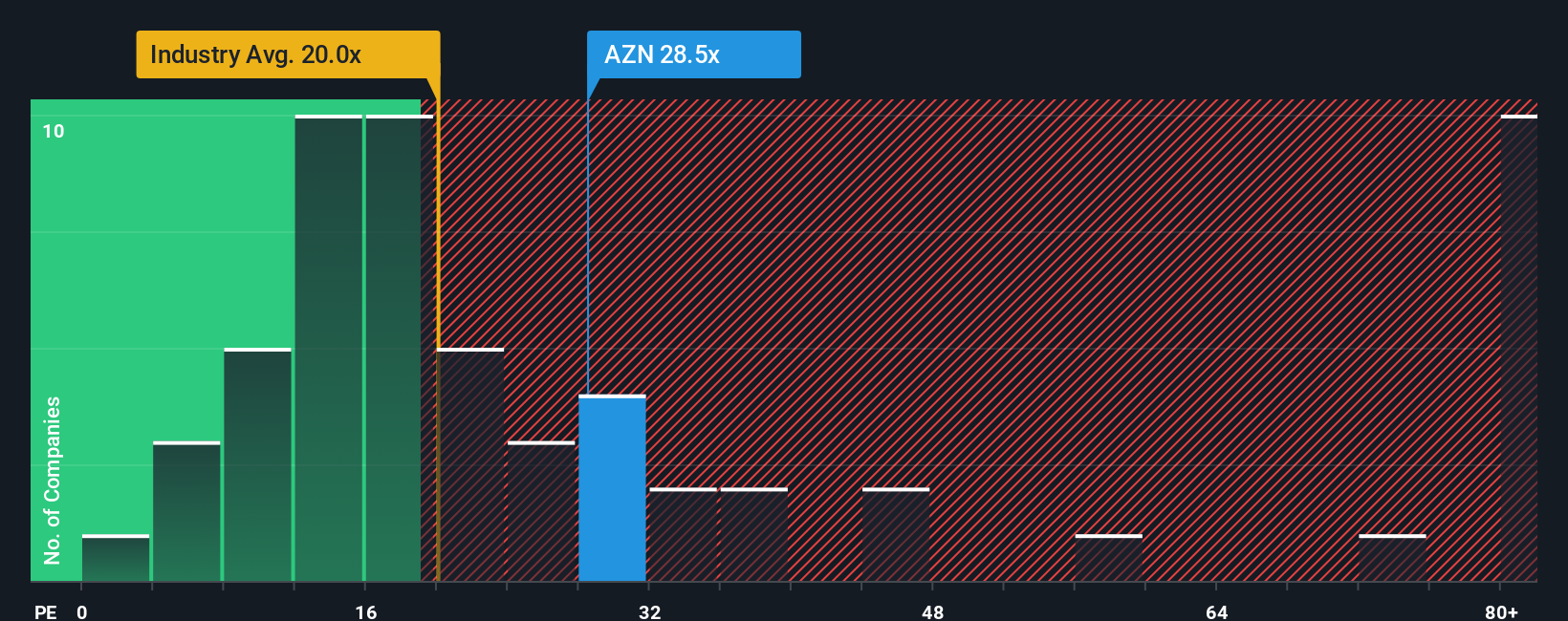

The Price-to-Earnings (PE) ratio is one of the most widely used metrics to value profitable companies like AstraZeneca, because it reflects how much investors are willing to pay today for a pound of current earnings. A higher PE can be justified when investors expect strong growth and lower risks in the future, while a lower PE typically reflects weaker growth prospects or more uncertainty.

AstraZeneca currently has a PE ratio of 31.5x, which sits well above the Pharmaceuticals industry average of 24.5x, and is more than double the peer group average of 14.5x. On the surface, this might signal the stock is trading at a rich premium. However, it is important to look deeper, since growth, profitability, and risk profiles can vary widely even within an industry.

This is where Simply Wall St’s "Fair Ratio" comes in. It is a proprietary metric that determines what AstraZeneca’s PE ratio should reasonably be, not just compared to peers but factoring in company-specific traits like earnings growth, profit margins, scale, and risk. For AstraZeneca, the Fair Ratio is calculated at 33.2x, slightly above its current PE.

Because AstraZeneca’s actual PE ratio and its Fair Ratio are within a very close range, this suggests the stock’s valuation is balanced. Investors are paying close to a fair price based on its growth outlook and risk factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AstraZeneca Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful framework that lets you capture your perspective on AstraZeneca by connecting its story—what you believe about its pipeline, risks, and opportunities—to a set of financial forecasts and a resulting fair value. Rather than just relying on numbers, Narratives start with your assumptions about AstraZeneca’s future revenue growth, profit margins, and market challenges, transforming those beliefs into a fair value estimate and making your reasoning transparent.

On Simply Wall St’s Community page, where millions of investors share insights, Narratives are an easy and accessible tool that help you answer the big question: should you buy or sell now? Narratives let you directly compare your calculated Fair Value to today’s Price. These Narratives update dynamically when new facts, like earnings or regulatory news, arrive, ensuring your view always reflects the latest developments. For example, some investors see AstraZeneca’s breakthrough therapies and expansion in emerging markets driving revenue growth above the industry, supporting a Fair Value as high as £180.93. Others, cautious about patent risks and pricing pressures, arrive at a much lower Fair Value around £108.24.

Do you think there's more to the story for AstraZeneca? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives