- United Kingdom

- /

- Pharma

- /

- LSE:AZN

AstraZeneca (LSE:AZN) Showcases Promising Results For Gefurulimab In Global Myasthenia Gravis Study

Reviewed by Simply Wall St

AstraZeneca (LSE:AZN) announced promising trial results for gefurulimab, a potential new treatment for generalized myasthenia gravis, marking a significant advancement in their product line. Last week, the company’s share price increased by 6%, coinciding with a strong market performance where major indices like the S&P 500 and Nasdaq reached new highs. This positive movement aligns with broader market trends, supported by encouraging corporate earnings and economic data. Additionally, AstraZeneca's substantial investment in U.S. R&D and manufacturing could have further reinforced investor confidence in the company’s growth potential, complementing the broader market uplift.

We've identified 3 warning signs for AstraZeneca that you should be aware of.

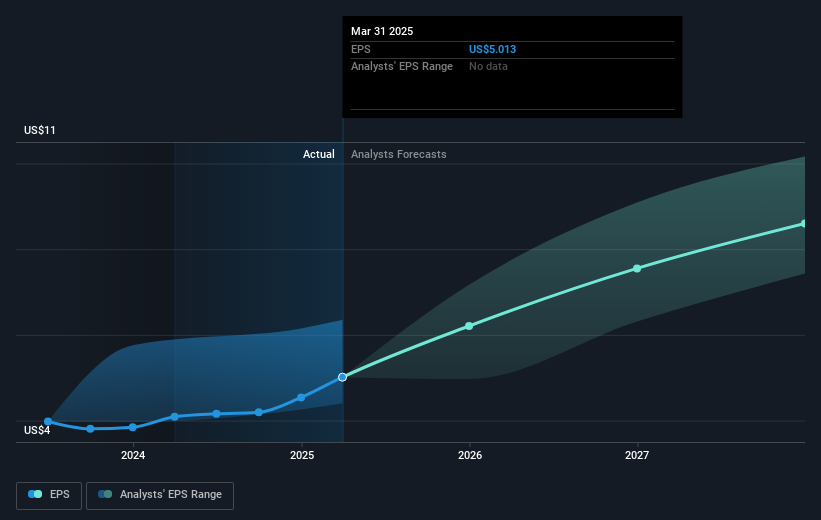

AstraZeneca's recent trial success with gefurulimab for generalized myasthenia gravis could bolster projected revenue and earnings forecasts by enhancing the company's innovative product portfolio. This development aligns with analysts' assumptions of a 6% annual revenue growth, potentially boosting investor confidence and positively impacting future cash flows. The strong market response, reflected in a 6% share price increase, signals optimism around the company's drug pipeline and could further support its ambitious growth targets outlined in the analyst consensus.

Over the past five years, AstraZeneca has achieved a total shareholder return of 39.91%, demonstrating robust long-term performance. This context underscores the potential upside if positive news continues to materialize, potentially narrowing the current share price discount to the analysts' consensus price target of £136.14. Despite recent performance challenges over the past year, where AstraZeneca underperformed both the UK market and its industry peers, the promising trial results could be a turning point for enhancing its competitive edge.

Shareholders may also be encouraged by the fair value assessment indicating a strong growth potential relative to its current trading price of £109.06. With the analyst price target representing a significant 24.83% increase from current levels, this gap highlights potential investor optimism contingent on AstraZeneca's ability to sustain revenue and earnings growth, mitigate industry risks, and capitalize on its research and development investments. The company's future performance will hinge on successfully navigating these opportunities and challenges, particularly in emerging markets and its strategic acquisitions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives