- United Kingdom

- /

- Pharma

- /

- LSE:AZN

AstraZeneca (LSE:AZN) Reports Positive Phase 3 Trial Results For Breast Cancer Treatment

Reviewed by Simply Wall St

AstraZeneca (LSE:AZN) recently experienced positive developments, including the European approval of Calquence for mantle cell lymphoma and promising Phase III trial results for ENHERTU in breast cancer. These advances in oncology could add depth to the company's market performance. Meanwhile, broader market trends showed mixed movements, with the Dow Jones and S&P 500 rising, while Nasdaq slipped slightly. Despite a flat market overall last week due to investor anticipation of the Federal Reserve's interest rate decision, AstraZeneca's recent approvals and trial successes likely provided additional support to the company's steady market presence.

We've identified 2 warning signs for AstraZeneca that you should be aware of.

The European approval of Calquence and promising Phase III results for ENHERTU have the potential to support AstraZeneca's revenue and earnings growth. Over the past five years, the company achieved total returns, including share price and dividends, of 35.64%. This contrasts with its recent one-year underperformance compared to the UK Pharmaceuticals industry, which returned 9.6%. These developments could enhance the company's market share and product offering, though the competitive and regulatory landscapes present challenges.

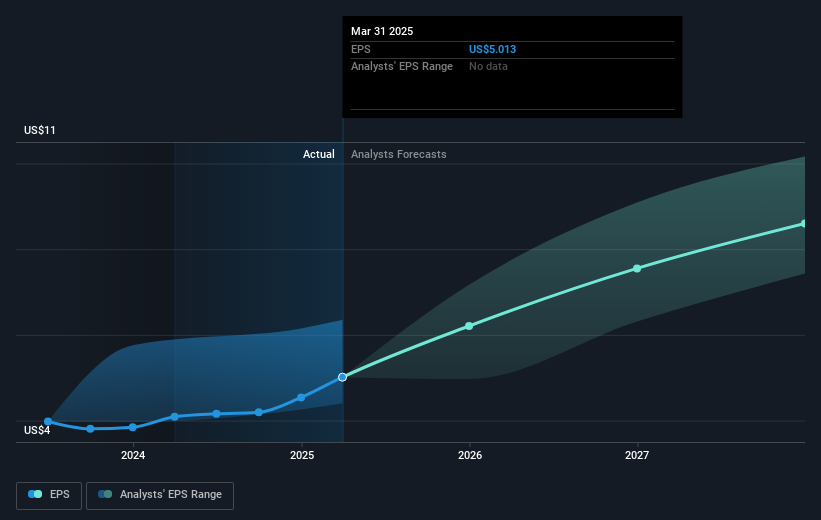

Analysts’ forecasts for AstraZeneca's future appear optimistic, projecting revenues to grow to $65.3 billion, with earnings rising to $13.5 billion by 2028. However, these outcomes depend on maintaining a PE ratio of 24.8x, lower than the current industry average. The stock currently trades at approximately £107.28, a 19.7% discount to the analyst price target of £133.57, suggesting potential for upward movement. Nonetheless, investors should weigh these factors against existing risks, including pricing pressures and biosimilar competition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives