- United Kingdom

- /

- Pharma

- /

- LSE:AZN

AstraZeneca (LSE:AZN) Reports Higher Earnings, Dividend Increase, and Clinical Trial Discontinuation

Reviewed by Simply Wall St

AstraZeneca (LSE:AZN) recently announced its first-quarter earnings for 2025, showcasing strong financial performance with revenue rising to USD 13,588 million, up from the previous year. Despite this, the halt of the CAPItello-280 clinical trial might have dimmed enthusiasm. In the context of last week, AstraZeneca's share price rose 4%, reflecting not only the robust earnings boost but also aligned with the broader market's upward trend. The planned dividend increase further substantiates the company's financial health, counterbalancing any negative impact from the trial discontinuation.

Be aware that AstraZeneca is showing 2 warning signs in our investment analysis.

The recent announcement of AstraZeneca’s halted CAPItello-280 clinical trial has raised concerns among shareholders despite the company’s strong financial performance in the first-quarter earnings report. The news could potentially affect revenue and earnings forecasts as investors weigh the implications of the trial discontinuation against the company’s expansion in emerging markets and ongoing pipeline development. AstraZeneca’s commitment to delivering 20 new medicines by 2030 and its investment in next-generation capabilities underscore its strategic focus on long-term growth, yet uncertainties remain regarding pricing challenges and competitive pressures.

Over the past five years, AstraZeneca's shares have delivered a total return of 41.33%, illustrating a solid performance amidst evolving industry dynamics. In contrast, recent analysis indicates that AstraZeneca underperformed the UK Pharmaceuticals industry, which experienced a significant decline of 10.4% over the last year, and it also fell short compared to the broader UK market's modest 0.7% gain. This mixed performance highlights the challenges faced by the company in sustaining its competitive edge in a rapidly changing market.

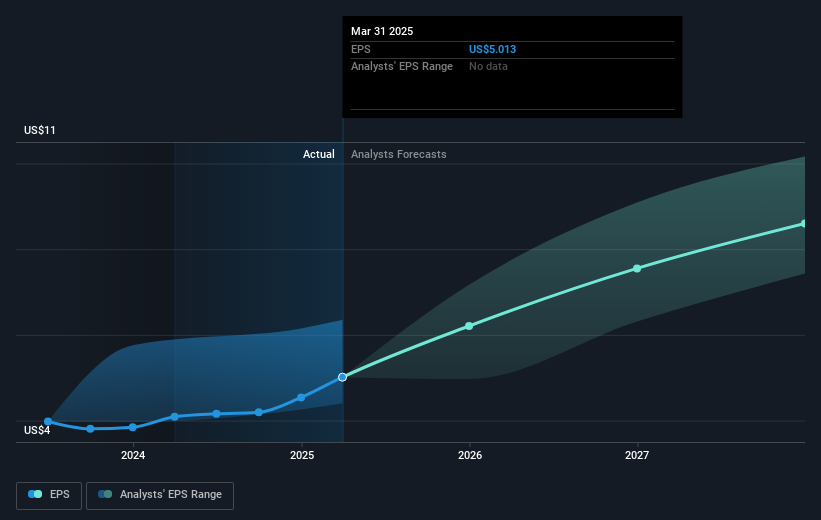

The company's current share price of £103.62 appears discounted compared to the consensus analyst price target of £135.15, suggesting a potential upside. While the announcement of dividend increases reflects financial health, the share price movement is closely aligned with the anticipated earnings growth of 15.44% per year. Continued execution on its strategic initiatives will be crucial in realizing its forecasted $64.5 billion revenue by 2028. Investors should remain mindful of potential liabilities and market challenges that could influence AstraZeneca's future financial outcomes.

Gain insights into AstraZeneca's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AZN

AstraZeneca

A biopharmaceutical company, focuses on the discovery, development, manufacture, and commercialization of prescription medicines.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives