- United Kingdom

- /

- Pharma

- /

- AIM:FUM

Futura Medical plc (LON:FUM) Shares Slammed 48% But Getting In Cheap Might Be Difficult Regardless

The Futura Medical plc (LON:FUM) share price has fared very poorly over the last month, falling by a substantial 48%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

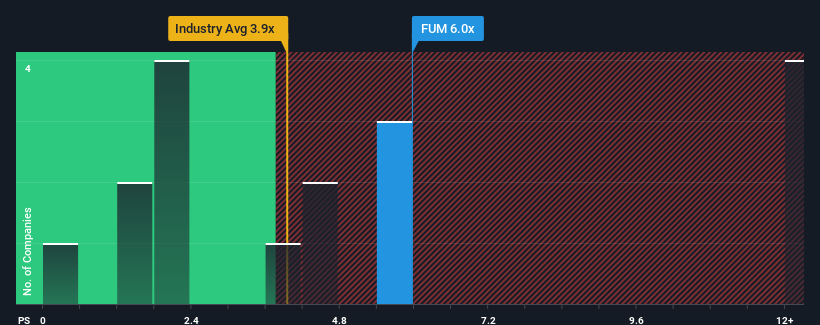

Although its price has dipped substantially, you could still be forgiven for thinking Futura Medical is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6x, considering almost half the companies in the United Kingdom's Pharmaceuticals industry have P/S ratios below 3.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Futura Medical

How Has Futura Medical Performed Recently?

Futura Medical certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Futura Medical will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Futura Medical's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an explosive gain to the company's top line. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 91% during the coming year according to the three analysts following the company. With the industry only predicted to deliver 7.7%, the company is positioned for a stronger revenue result.

With this information, we can see why Futura Medical is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Futura Medical's P/S?

A significant share price dive has done very little to deflate Futura Medical's very lofty P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Futura Medical's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Futura Medical (1 shouldn't be ignored) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FUM

Futura Medical

Research, develops, and commercializes pharmaceutical and healthcare products for sexual health.

Flawless balance sheet and fair value.

Market Insights

Community Narratives