- United Kingdom

- /

- Pharma

- /

- AIM:APH

Investors Aren't Entirely Convinced By Alliance Pharma plc's (LON:APH) Revenues

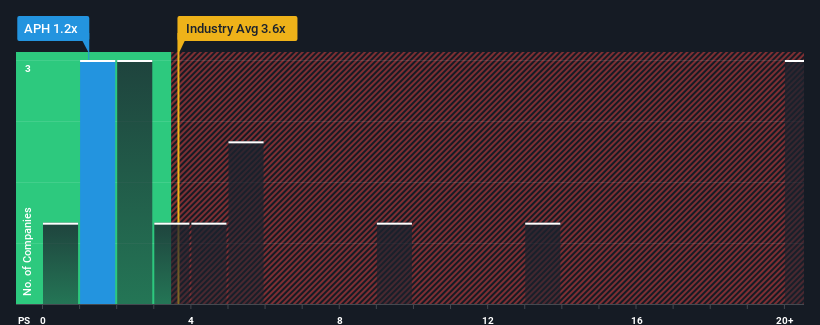

Alliance Pharma plc's (LON:APH) price-to-sales (or "P/S") ratio of 1.2x might make it look like a strong buy right now compared to the Pharmaceuticals industry in the United Kingdom, where around half of the companies have P/S ratios above 4.2x and even P/S above 17x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Alliance Pharma

How Has Alliance Pharma Performed Recently?

Recent revenue growth for Alliance Pharma has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Alliance Pharma will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Alliance Pharma?

The only time you'd be truly comfortable seeing a P/S as depressed as Alliance Pharma's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.9% last year. This was backed up an excellent period prior to see revenue up by 39% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 5.4% each year as estimated by the six analysts watching the company. With the industry predicted to deliver 7.1% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Alliance Pharma's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Alliance Pharma's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Alliance Pharma currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Alliance Pharma, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:APH

Alliance Pharma

A holding company, acquires, markets, and distributes consumer healthcare products and prescription medicines in Europe, the Middle East, Africa, the Asia Pacific, China, and the Americas.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives