- United Kingdom

- /

- Pharma

- /

- AIM:AGY

Allergy Therapeutics (LON:AGY) shareholder returns have been favorable, earning 69% in 1 year

Passive investing in index funds can generate returns that roughly match the overall market. But you can significantly boost your returns by picking above-average stocks. For example, the Allergy Therapeutics plc (LON:AGY) share price is up 69% in the last 1 year, clearly besting the market return of around 5.1% (not including dividends). That's a solid performance by our standards! In contrast, the longer term returns are negative, since the share price is 59% lower than it was three years ago.

Since it's been a strong week for Allergy Therapeutics shareholders, let's have a look at trend of the longer term fundamentals.

Allergy Therapeutics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last year Allergy Therapeutics saw its revenue grow by 4.5%. That's not a very high growth rate considering it doesn't make profits. In keeping with the revenue growth, the share price gained 69% in that time. While not a huge gain tht seems pretty reasonable. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

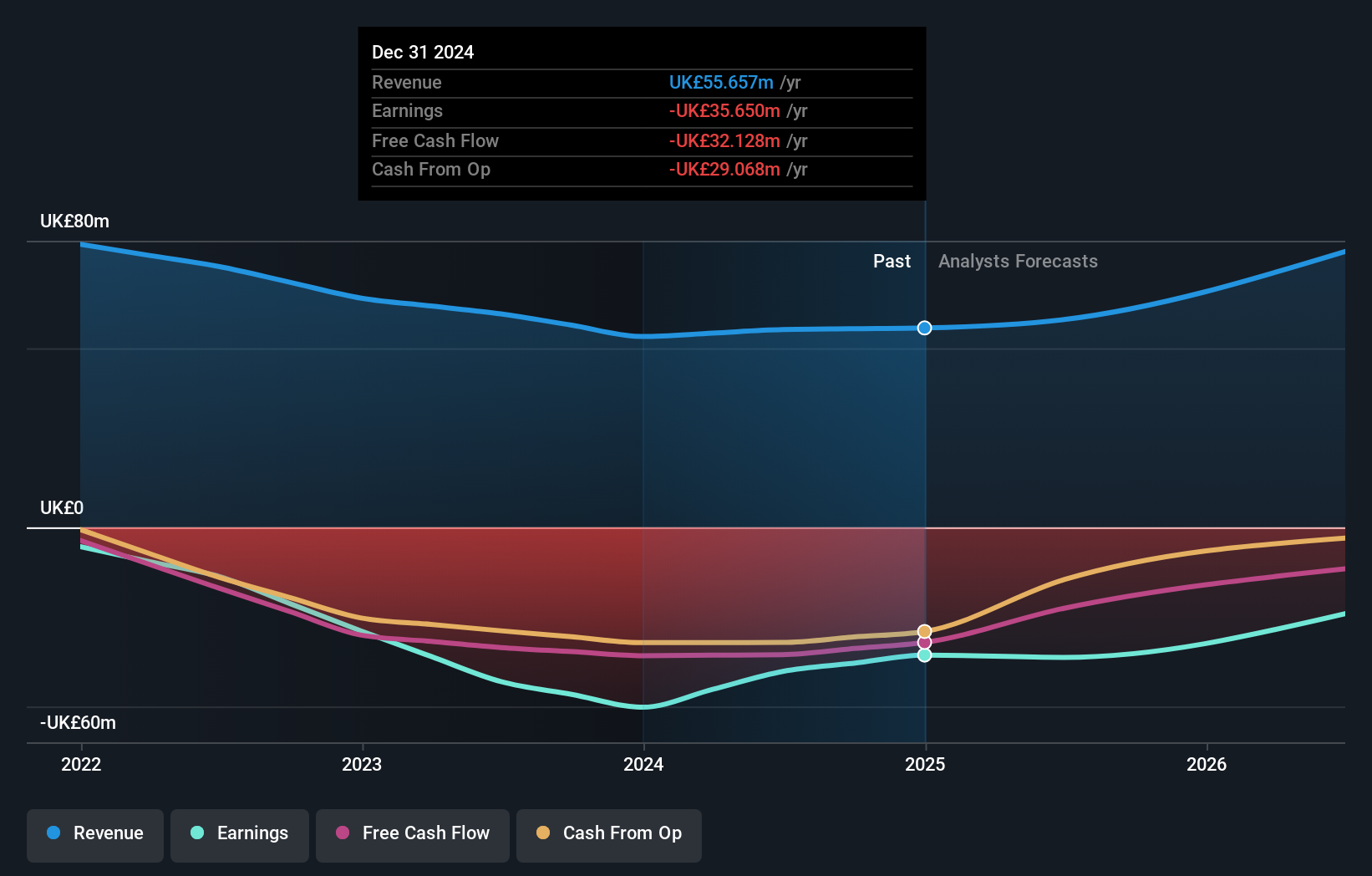

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Allergy Therapeutics

A Different Perspective

It's good to see that Allergy Therapeutics has rewarded shareholders with a total shareholder return of 69% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 22% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Allergy Therapeutics better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Allergy Therapeutics you should be aware of, and 2 of them can't be ignored.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AGY

Allergy Therapeutics

A commercial biotechnology company, focuses on the diagnosis and treatment of allergic disorders.

Slight with limited growth.

Market Insights

Community Narratives