VK Company Limited (LON:VKCO) Soars 26% But It's A Story Of Risk Vs Reward

VK Company Limited (LON:VKCO) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

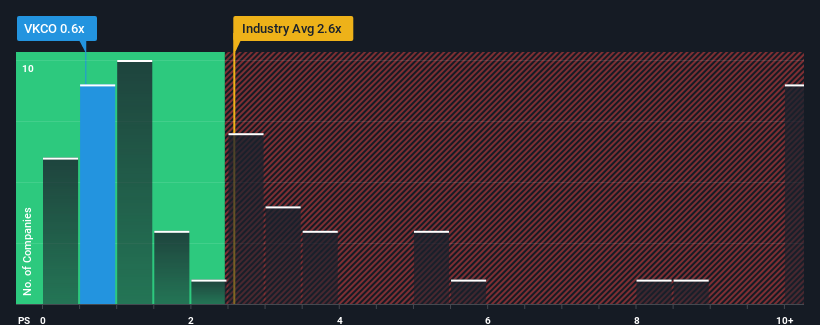

Although its price has surged higher, VK's price-to-sales (or "P/S") ratio of 0.6x might still make it look like a buy right now compared to the Interactive Media and Services industry in the United Kingdom, where around half of the companies have P/S ratios above 2.2x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for VK

What Does VK's P/S Mean For Shareholders?

VK's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on VK will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on VK.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, VK would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 27% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 10.0%, which is noticeably less attractive.

With this information, we find it odd that VK is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Despite VK's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems VK currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It is also worth noting that we have found 1 warning sign for VK that you need to take into consideration.

If you're unsure about the strength of VK's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:VKCO

VK

VK Company Limited operates as a technology company in Russia and internationally.

Slightly overvalued with questionable track record.

Similar Companies

Market Insights

Community Narratives