- United Kingdom

- /

- Media

- /

- LSE:RCH

3 UK Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the UK market grapples with challenges stemming from weak global cues and faltering trade data from China, the FTSE 100 index has recently experienced a downturn, reflecting broader economic uncertainties. In such an environment, dividend stocks can offer a degree of stability and income potential, making them a compelling consideration for investors seeking to enhance their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 6.37% | ★★★★★★ |

| Man Group (LSE:EMG) | 6.70% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.46% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.17% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.69% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.26% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.87% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.76% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.59% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.41% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

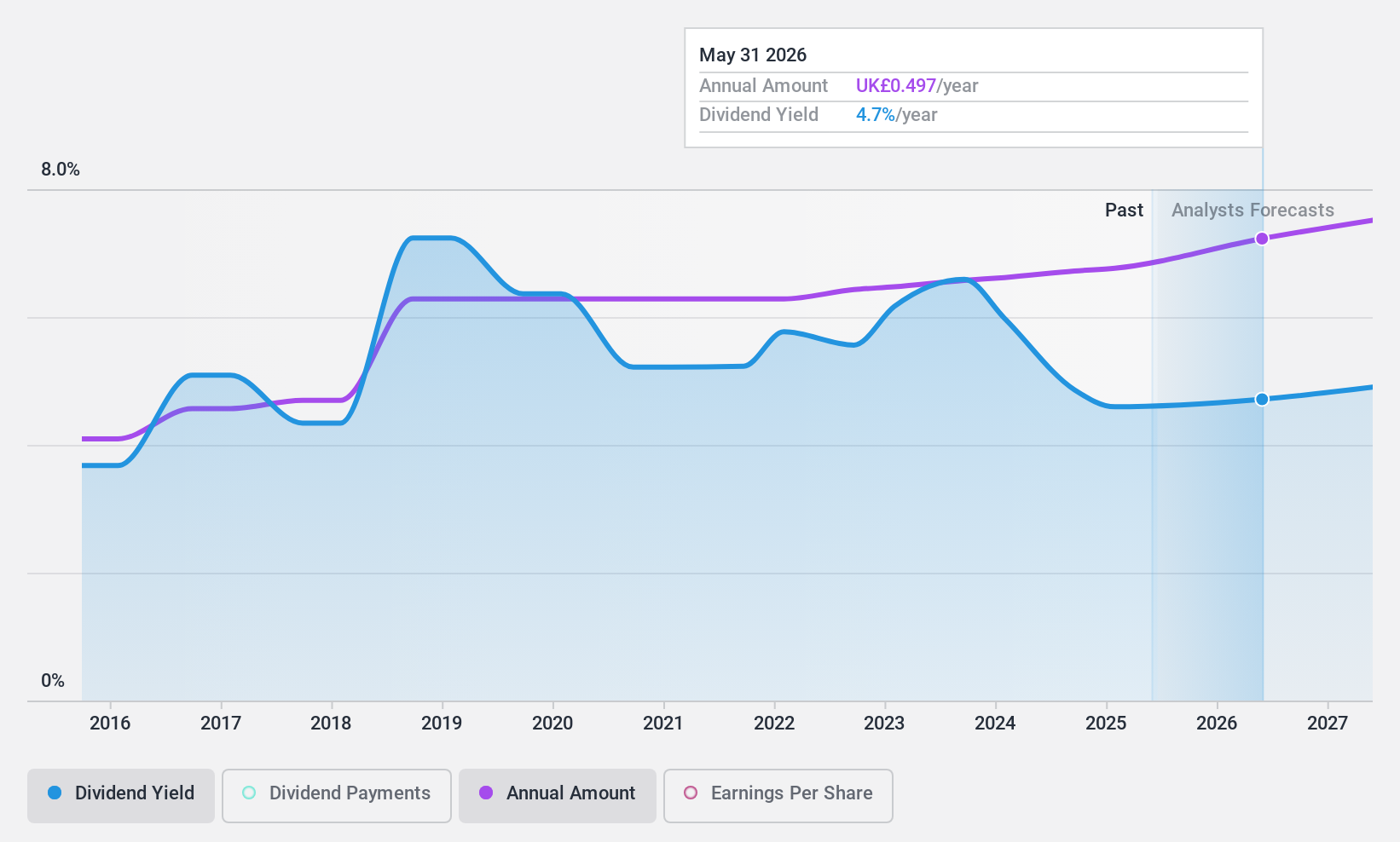

IG Group Holdings (LSE:IGG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IG Group Holdings plc is a fintech company that operates in the online trading business globally, with a market cap of £3.32 billion.

Operations: IG Group Holdings plc generates revenue primarily from its brokerage segment, amounting to £1.01 billion.

Dividend Yield: 4.9%

IG Group Holdings has demonstrated consistent dividend reliability and growth over the past decade, with recent increases in interim dividends to 13.86 pence per share. The company's dividends are well-covered by earnings and cash flows, boasting a payout ratio of 47.5% and a cash payout ratio of 28.9%. While its dividend yield of 4.92% is below the UK market's top quartile, IGG trades at a favorable valuation relative to its peers and industry benchmarks. Recent buybacks totaling £250.75 million underscore strong capital management strategies alongside ongoing M&A pursuits aimed at closing product gaps without compromising financial stability or shareholder returns.

- Navigate through the intricacies of IG Group Holdings with our comprehensive dividend report here.

- The analysis detailed in our IG Group Holdings valuation report hints at an deflated share price compared to its estimated value.

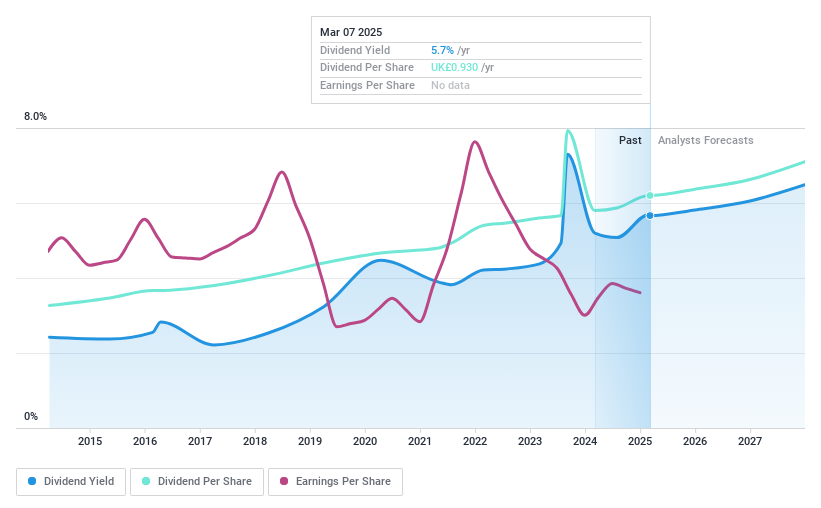

Rathbones Group (LSE:RAT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rathbones Group Plc, with a market cap of £1.69 billion, provides wealth and asset management services to private clients, charities, trustees, and professional partners in the UK, Channel Islands, and internationally.

Operations: Rathbones Group Plc generates revenue through its Asset Management segment, which contributes £81.70 million, and its Wealth Management segment, which accounts for £814.20 million.

Dividend Yield: 5.8%

Rathbones Group's dividend yield of 5.78% places it among the top UK payers, though its high payout ratio of 147.3% indicates dividends aren't well covered by earnings. Despite this, cash flows sufficiently cover payouts with a lower cash payout ratio of 41.1%. Recent earnings growth and a proposed final dividend increase to 63 pence highlight positive momentum, but past volatility and shareholder dilution remain concerns for stability-focused investors.

- Unlock comprehensive insights into our analysis of Rathbones Group stock in this dividend report.

- Upon reviewing our latest valuation report, Rathbones Group's share price might be too optimistic.

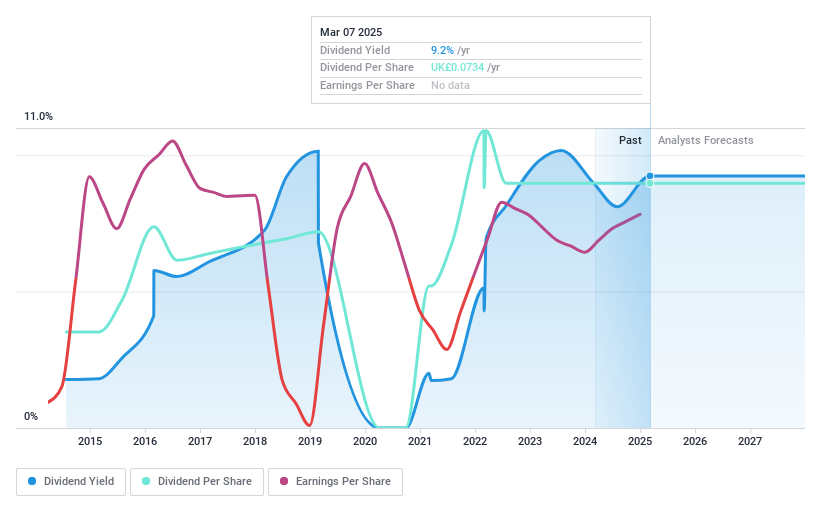

Reach (LSE:RCH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Reach plc is a national and regional commercial news publisher operating in the United Kingdom and Ireland, with a market cap of £271.47 million.

Operations: Reach plc generates revenue through its operations as a commercial news publisher across national and regional markets in the United Kingdom and Ireland.

Dividend Yield: 8.5%

Reach plc's recent proposal of a 4.46 pence final dividend for 2024, totaling £14.1 million, positions it among the top UK dividend payers with an 8.53% yield. However, this high yield is not well-supported by free cash flows or earnings, evidenced by a cash payout ratio of 231.4%. Despite improved net income and low price-to-earnings ratio (6.5x), concerns over volatile share prices and past unreliable dividends may deter stability-focused investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Reach.

- Insights from our recent valuation report point to the potential undervaluation of Reach shares in the market.

Seize The Opportunity

- Unlock our comprehensive list of 60 Top UK Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RCH

Reach

Operates as commercial news publisher in the United Kingdom, rest of Europe, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives