- United Kingdom

- /

- Media

- /

- LSE:ITV

ITV plc's (LON:ITV) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

With its stock down 18% over the past three months, it is easy to disregard ITV (LON:ITV). But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Specifically, we decided to study ITV's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for ITV

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for ITV is:

23% = UK£435m ÷ UK£1.9b (Based on the trailing twelve months to December 2022).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every £1 worth of equity, the company was able to earn £0.23 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

ITV's Earnings Growth And 23% ROE

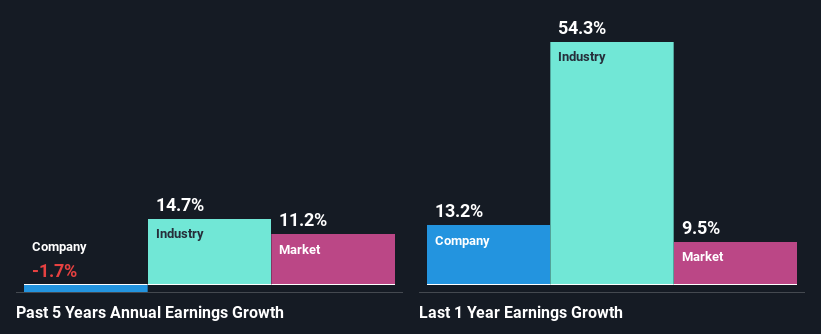

Firstly, we acknowledge that ITV has a significantly high ROE. Additionally, the company's ROE is higher compared to the industry average of 7.5% which is quite remarkable. Despite this, ITV's five year net income growth was quite flat over the past five years. We reckon that there could be some other factors at play here that's limiting the company's growth. Such as, the company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

As a next step, we compared ITV's net income growth with the industry and discovered that the industry saw an average growth of 15% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if ITV is trading on a high P/E or a low P/E, relative to its industry.

Is ITV Making Efficient Use Of Its Profits?

Despite having a normal three-year median payout ratio of 35% (implying that the company keeps 65% of its income) over the last three years, ITV has seen a negligible amount of growth in earnings as we saw above. Therefore, there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

In addition, ITV has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Our latest analyst data shows that the future payout ratio of the company is expected to rise to 48% over the next three years. However, the company's ROE is not expected to change by much despite the higher expected payout ratio.

Conclusion

Overall, we feel that ITV certainly does have some positive factors to consider. However, given the high ROE and high profit retention, we would expect the company to be delivering strong earnings growth, but that isn't the case here. This suggests that there might be some external threat to the business, that's hampering its growth. Having said that, we studied the latest analyst forecasts, and found that analysts are expecting the company's earnings growth to improve slightly. The company's existing shareholders might have some respite after all. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ITV

ITV

A vertically integrated production, broadcasting, and streaming company, which creates, owns, and distributes content on various platforms worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion