- United Kingdom

- /

- Media

- /

- LSE:INF

High Growth Tech Stocks To Explore In October 2024

Reviewed by Simply Wall St

The United Kingdom market has shown robust performance, climbing 1.6% over the last week and rising 11% over the past year, with earnings forecasted to grow by 14% annually. In this favorable environment, identifying high-growth tech stocks involves looking for companies with strong innovation potential and scalability that can capitalize on these positive market conditions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Thruvision Group | 20.76% | 63.31% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

GB Group (AIM:GBG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence solutions across the UK, US, Australia, and globally, with a market cap of £824.92 million.

Operations: The company generates revenue through three main segments: Identity (£156.06 million), Location (£81.07 million), and Fraud (£40.20 million).

GB Group, amid a challenging landscape for tech firms in the UK, is navigating its path towards profitability with an expected revenue growth of 6.3% annually, outpacing the broader UK market's 3.5%. Despite current unprofitability, the company's strategic focus on innovation is evident from its R&D investments and a projected sharp rise in earnings by 89.8% annually. Recently declaring a dividend increase to 4.20 pence reflects confidence in its financial health and future prospects. With these developments and an anticipated shift into profitability within three years, GB Group is positioning itself as a resilient contender in the evolving tech sector.

- Click here to discover the nuances of GB Group with our detailed analytical health report.

Explore historical data to track GB Group's performance over time in our Past section.

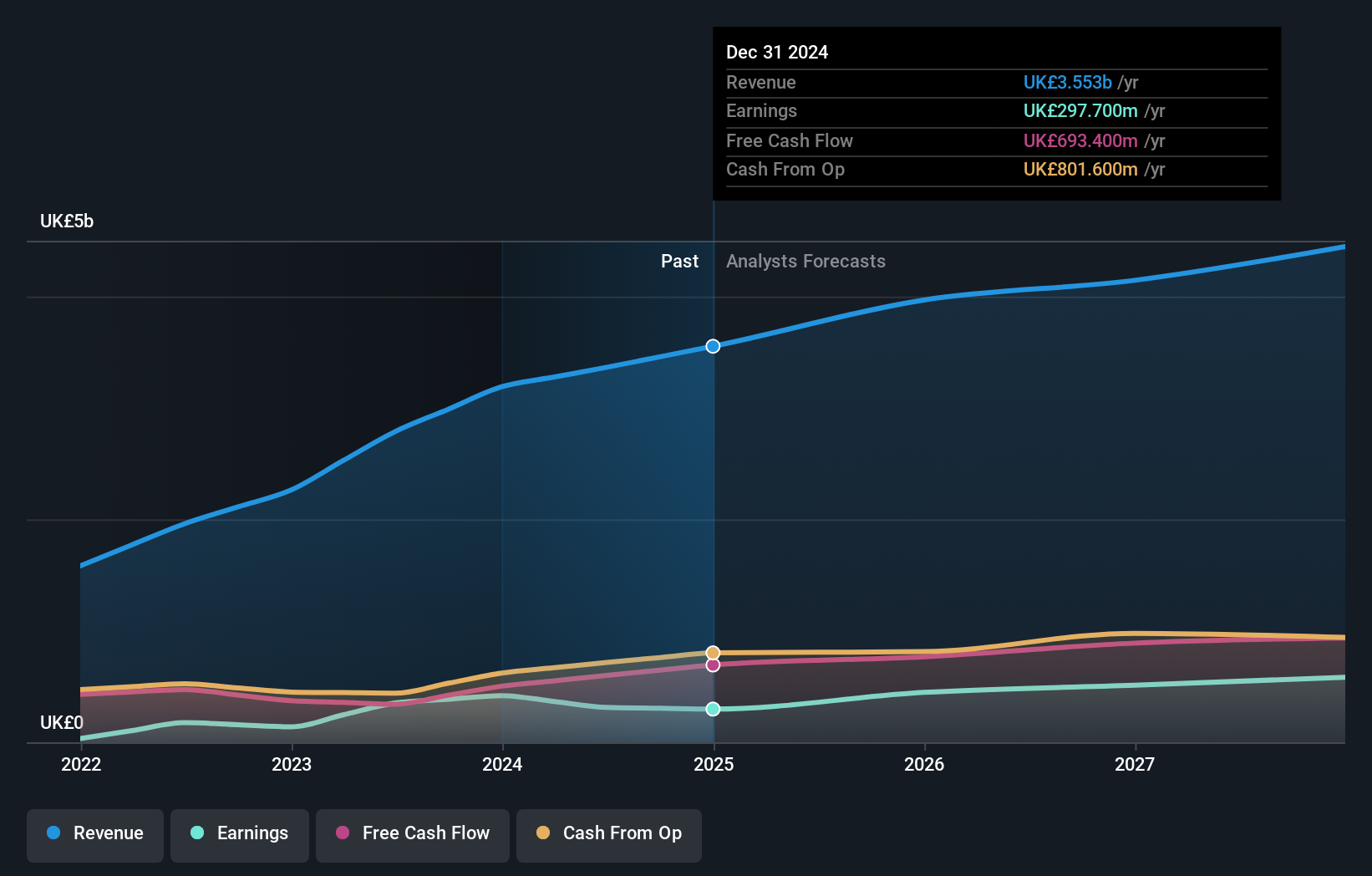

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc is an international company that specializes in events, digital services, and academic research across the United Kingdom, Continental Europe, the United States, China, and other global markets with a market capitalization of £11.11 billion.

Operations: Informa generates revenue primarily through its segments: Informa Markets (£1.67 billion), Informa Connect (£630.2 million), Informa Tech (£426.7 million), and Taylor & Francis (£636.7 million). The company operates across various global markets, focusing on events, digital services, and academic research.

Informa, navigating a dynamic tech landscape, is poised for significant growth with its revenue projected to increase by 7.4% annually, outstripping the UK market's average of 3.5%. This growth is supported by strategic expansions and partnerships, such as its long-term collaboration with Monaco and the recent acquisition aimed at bolstering its Informa Festivals business. Notably, Informa's commitment to innovation is underscored by substantial R&D investments which have surged to £213.5 million this year alone, representing a sharp focus on developing cutting-edge solutions in media and technology sectors. These initiatives are complemented by a robust share buyback program where Informa repurchased shares worth £338.9 million in the first half of 2024, highlighting confidence in its financial strategy and future prospects.

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services tailored for small and medium enterprises across the United States, the United Kingdom, France, and other international markets, with a market capitalization of approximately £10.24 billion.

Operations: Sage Group generates revenue primarily from its operations in North America (£1.01 billion), Europe (£595 million), and the United Kingdom & Ireland (£488 million).

Sage Group, navigating through the competitive tech landscape, has demonstrated robust growth with its recent quarterly revenue rising by 9% to £585 million, driven by its expanding Sage Business Cloud portfolio. This growth is part of a broader trend where the company's annual revenue growth rate stands at 7.7%, outpacing the UK market average of 3.5%. The company's commitment to innovation is evident in its R&D spending which has bolstered its technological offerings and customer engagement strategies. Notably, Sage's earnings are expected to climb by 15.1% annually, reflecting strong operational efficiency and market adaptation despite a high level of debt which poses financial scrutiny. This performance is underpinned by strategic partnerships like with VoPay, enhancing payroll solutions for SMBs through integrated payment technologies that streamline financial operations and enhance user experience.

- Navigate through the intricacies of Sage Group with our comprehensive health report here.

Review our historical performance report to gain insights into Sage Group's's past performance.

Summing It All Up

- Embark on your investment journey to our 46 UK High Growth Tech and AI Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally.

Reasonable growth potential with adequate balance sheet.