- United Kingdom

- /

- IT

- /

- LSE:NCC

Renew Holdings And 2 Other Undervalued Small Caps With Insider Buying In UK

Reviewed by Simply Wall St

The United Kingdom's market has been experiencing fluctuations, with the FTSE 100 and FTSE 250 indices closing lower recently due to weak trade data from China impacting global sentiment. This environment underscores the importance of identifying small-cap stocks that demonstrate resilience and potential for growth, such as those with insider buying signals, which can indicate confidence in their future prospects despite broader economic challenges.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 20.7x | 5.3x | 22.84% | ★★★★★★ |

| Warpaint London | 18.8x | 3.3x | 35.80% | ★★★★★☆ |

| Stelrad Group | 11.7x | 0.6x | 18.27% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 26.34% | ★★★★★☆ |

| Gamma Communications | 23.5x | 2.4x | 31.77% | ★★★★☆☆ |

| CVS Group | 28.8x | 1.2x | 37.97% | ★★★★☆☆ |

| NCC Group | NA | 1.4x | 18.67% | ★★★★☆☆ |

| Franchise Brands | 39.8x | 2.1x | 23.28% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 47.73% | ★★★★☆☆ |

| Telecom Plus | 18.1x | 0.7x | 25.54% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Renew Holdings (AIM:RNWH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Renew Holdings is a UK-based engineering services group focused on infrastructure, energy, and environmental markets with a market capitalization of approximately £0.78 billion.

Operations: The company generates its revenue primarily from Engineering Services, with a recent figure of £1.01 billion. Over the periods analyzed, the gross profit margin has shown fluctuations, peaking at 15.23% and later adjusting to 14.04%. Operating expenses have consistently included significant general and administrative costs, most recently recorded at £74.67 million.

PE: 12.8x

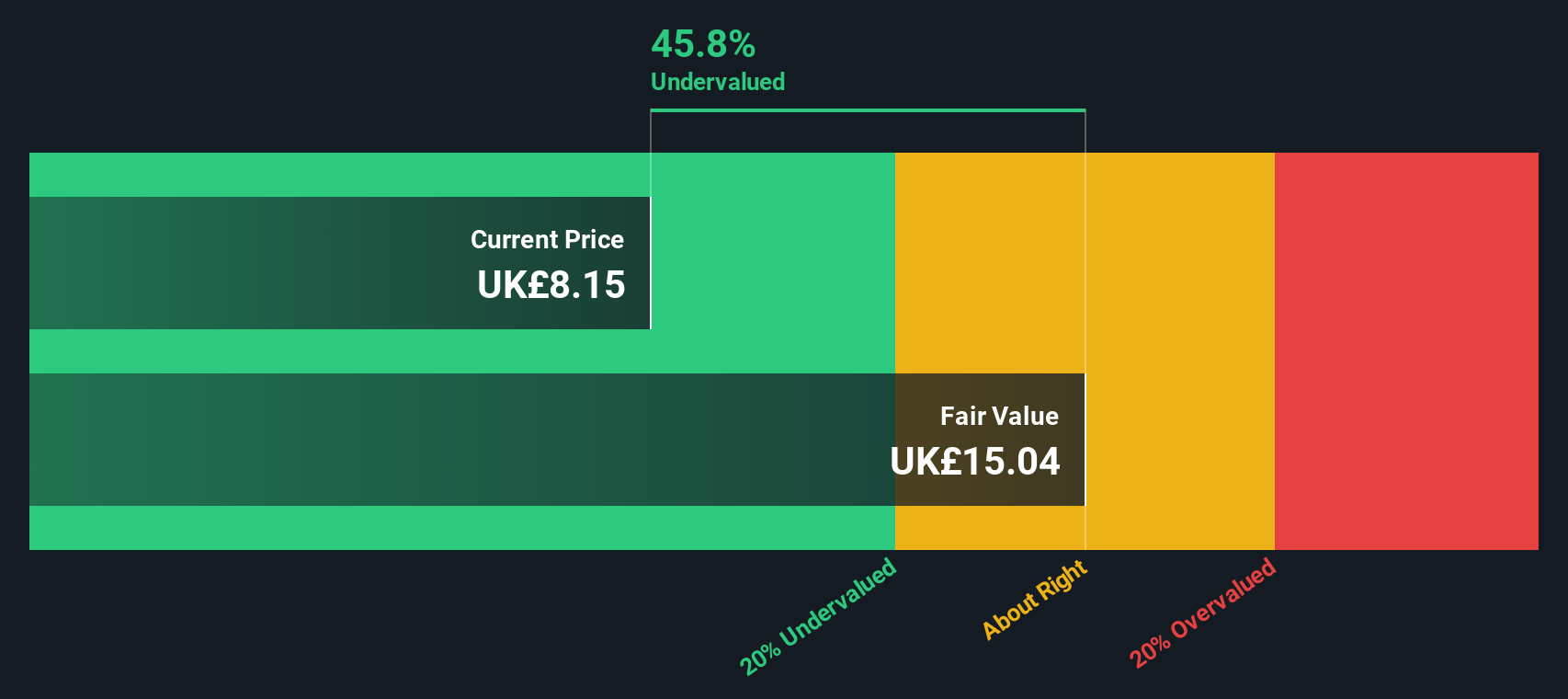

Renew Holdings, a UK-based company, recently reported a sales increase to £1.06 billion for the year ending September 2024, up from £887.6 million previously. Despite this growth in revenue, net income slightly decreased to £44 million from £46.1 million. Basic earnings per share rose to £0.659 from £0.623, indicating some operational efficiency improvements. Insider confidence is evident with recent share purchases by executives throughout 2024, suggesting belief in the company's potential despite reliance on higher-risk external borrowing for funding needs.

- Click here to discover the nuances of Renew Holdings with our detailed analytical valuation report.

Understand Renew Holdings' track record by examining our Past report.

Bloomsbury Publishing (LSE:BMY)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bloomsbury Publishing is a UK-based independent publishing house known for its diverse range of consumer and non-consumer books, with a focus on special interest and academic & professional segments, and it has a market capitalization of £291.10 million.

Operations: The company's revenue streams include significant contributions from Non-Consumer segments such as Special Interest and Academic & Professional. The gross profit margin has shown an upward trend, reaching 57.16% by August 2024. Operating expenses are primarily driven by General & Administrative and Sales & Marketing costs, with the latter amounting to £60.07 million in August 2024.

PE: 14.3x

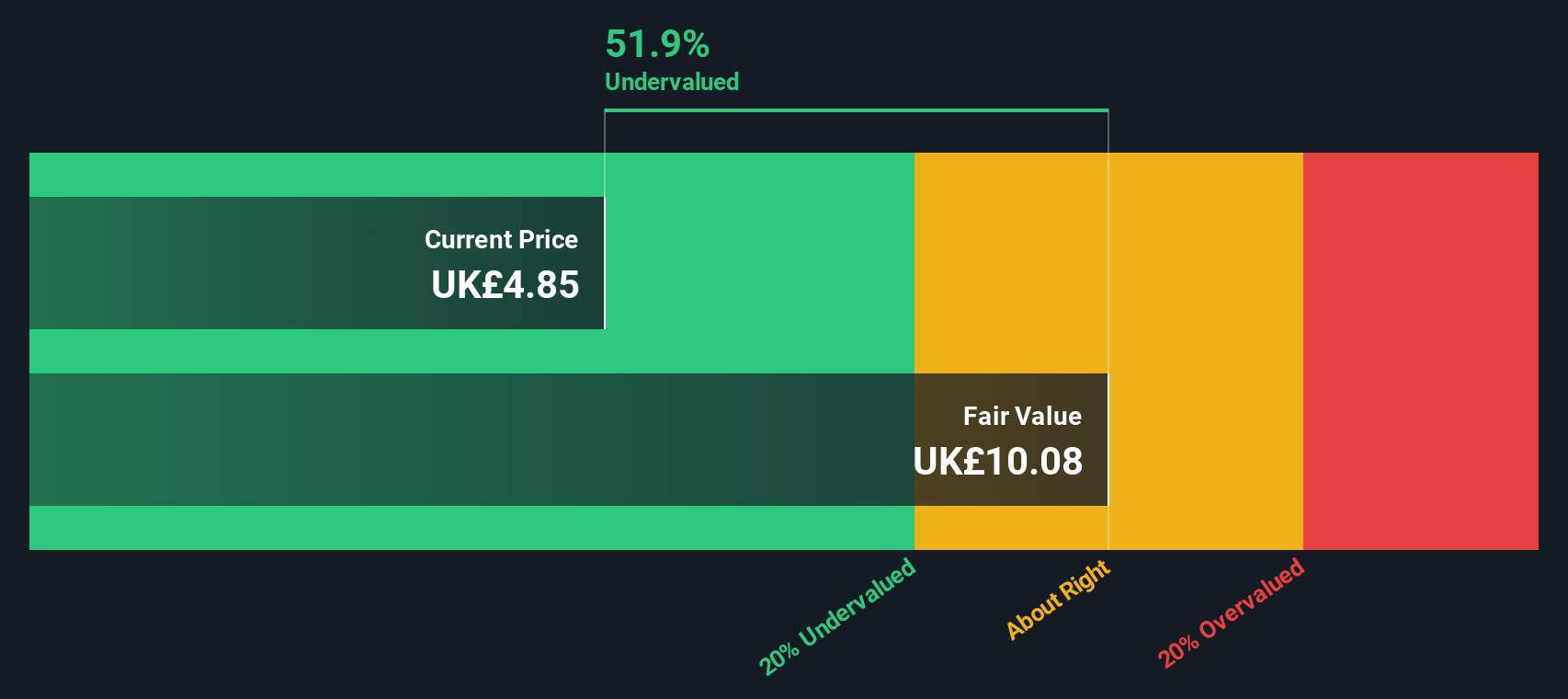

Bloomsbury Publishing, a smaller UK firm, is navigating a dynamic landscape with plans for acquisitions, leveraging its strong financial base. Recent insider confidence was demonstrated through share purchases between November 2024 and January 2025. The company anticipates revenue of £334 million and profit before tax of £39.6 million for the fiscal year ending February 28, 2025. However, earnings are expected to decline by an average of 3.7% annually over the next three years due to reliance on external borrowing for funding.

- Unlock comprehensive insights into our analysis of Bloomsbury Publishing stock in this valuation report.

Assess Bloomsbury Publishing's past performance with our detailed historical performance reports.

NCC Group (LSE:NCC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NCC Group specializes in cyber security and escrow services, with a market capitalization of £0.65 billion.

Operations: The company generates revenue primarily from its Cyber Security segment, with a smaller contribution from Escode. The gross profit margin has shown fluctuations, reaching 41.61% in recent periods. Operating expenses and non-operating expenses have been significant factors, impacting net income margins which have turned negative in the most recent periods.

PE: -17.8x

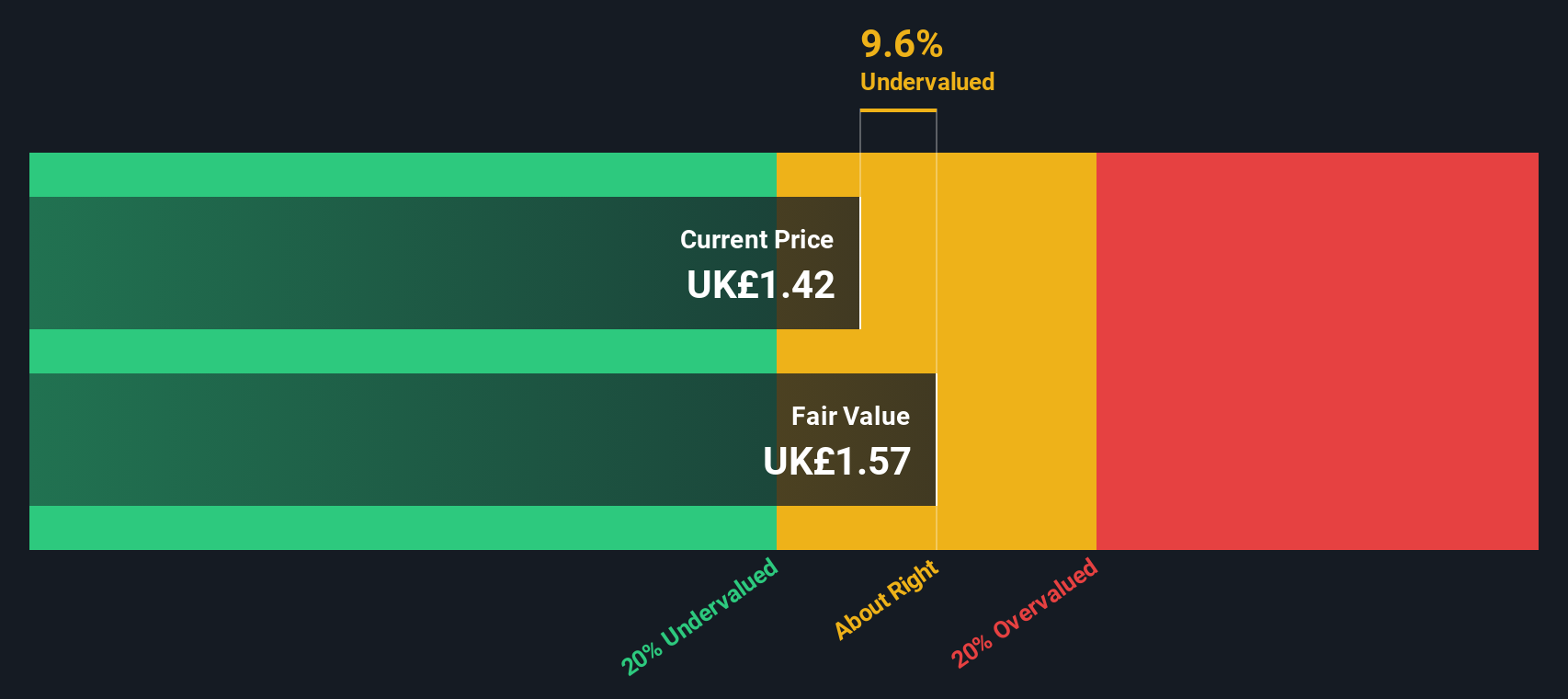

NCC Group, a UK-based tech security firm, recently secured a three-year contract with TikTok to bolster European data protection under Project Clover. This partnership highlights their role in setting new industry standards for data security. Despite reporting a net loss of £32.5 million for the 16 months ending September 2024, insider confidence is evident with recent share purchases by key figures. The company anticipates earnings growth of nearly 75% annually, suggesting potential future value in this niche market segment.

- Delve into the full analysis valuation report here for a deeper understanding of NCC Group.

Gain insights into NCC Group's past trends and performance with our Past report.

Taking Advantage

- Investigate our full lineup of 31 Undervalued UK Small Caps With Insider Buying right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCC Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:NCC

NCC Group

Engages in the cyber and software resilience business in the United Kingdom, the Asian-Pacific, North America, and Europe.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives