The United Kingdom market has shown a steady upward trend, climbing 1.1% in the last week and 12% over the past year, with earnings expected to grow by 14% annually in the coming years. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—can still present valuable opportunities. With strong financial health, these stocks have the potential to offer growth at lower price points while maintaining greater stability.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.055 | £796.84M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.245 | £433.13M | ★★★★☆☆ |

| FRP Advisory Group (AIM:FRP) | £1.355 | £324.93M | ★★★★★★ |

| Brickability Group (AIM:BRCK) | £0.605 | £193.31M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.52 | £181.33M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.505 | £191.03M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.638 | £246.15M | ★★★★★☆ |

| Serabi Gold (AIM:SRB) | £0.845 | £65.13M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.725 | £188.22M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.42 | $265.67M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Alphawave IP Group (LSE:AWE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alphawave IP Group plc develops and sells connectivity solutions across various global regions, including North America, China, and Europe, with a market cap of £755.40 million.

Operations: The company generates $225.52 million in revenue from its communications equipment segment.

Market Cap: £755.4M

Alphawave IP Group's recent developments, including the launch of a 3nm UCIe Die-to-Die IP subsystem in collaboration with TSMC, underscore its focus on high-performance computing and AI applications. Despite generating US$90.98 million in H1 2024 sales, the company remains unprofitable with a net loss of US$39.96 million. The management team is experienced, and while shareholders faced dilution last year, Alphawave maintains a satisfactory net debt to equity ratio of 32.2%. Short-term liabilities exceed assets; however, it has more than three years' cash runway even as free cash flow shrinks annually by 9.7%.

- Dive into the specifics of Alphawave IP Group here with our thorough balance sheet health report.

- Explore Alphawave IP Group's analyst forecasts in our growth report.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Baltic Classifieds Group PLC operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania with a market cap of £1.57 billion.

Operations: The company's revenue is divided into four main segments: Automotive (€27.54 million), Real Estate (€18.04 million), Jobs & Services (€13.85 million), and Generalist (€12.64 million).

Market Cap: £1.57B

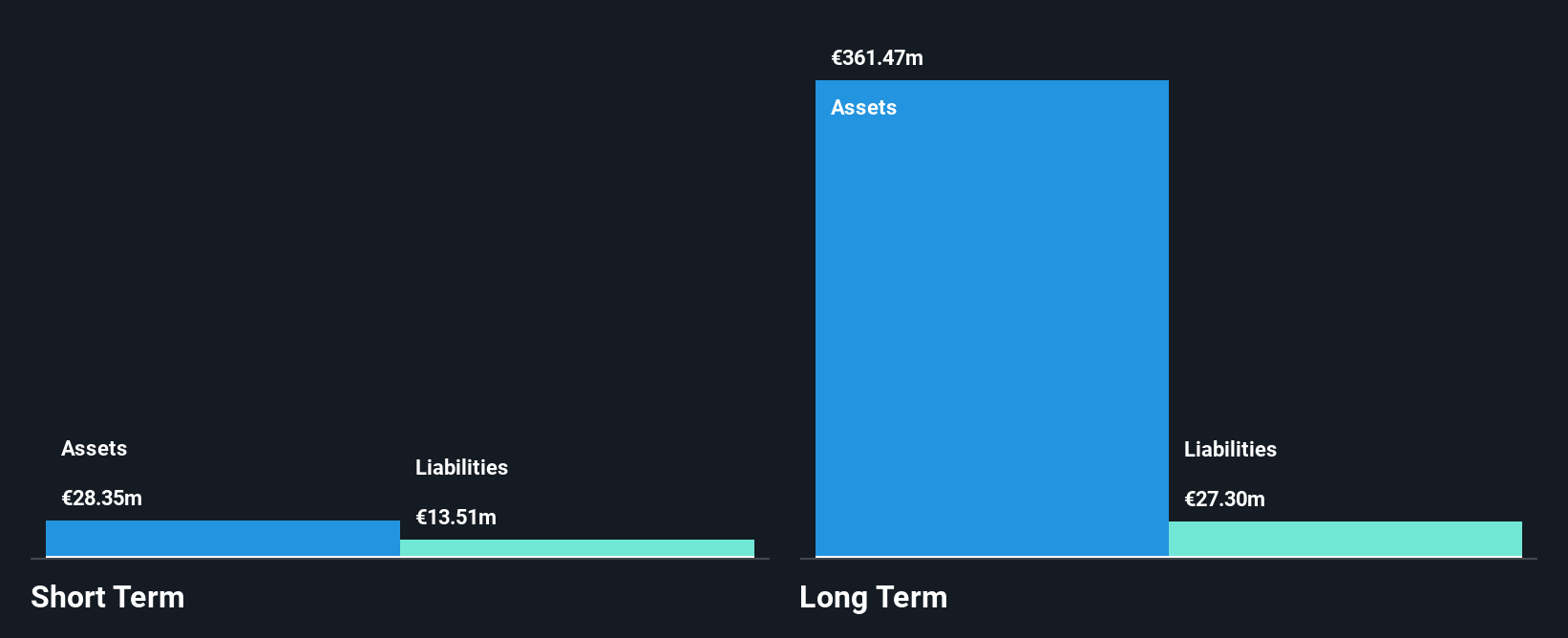

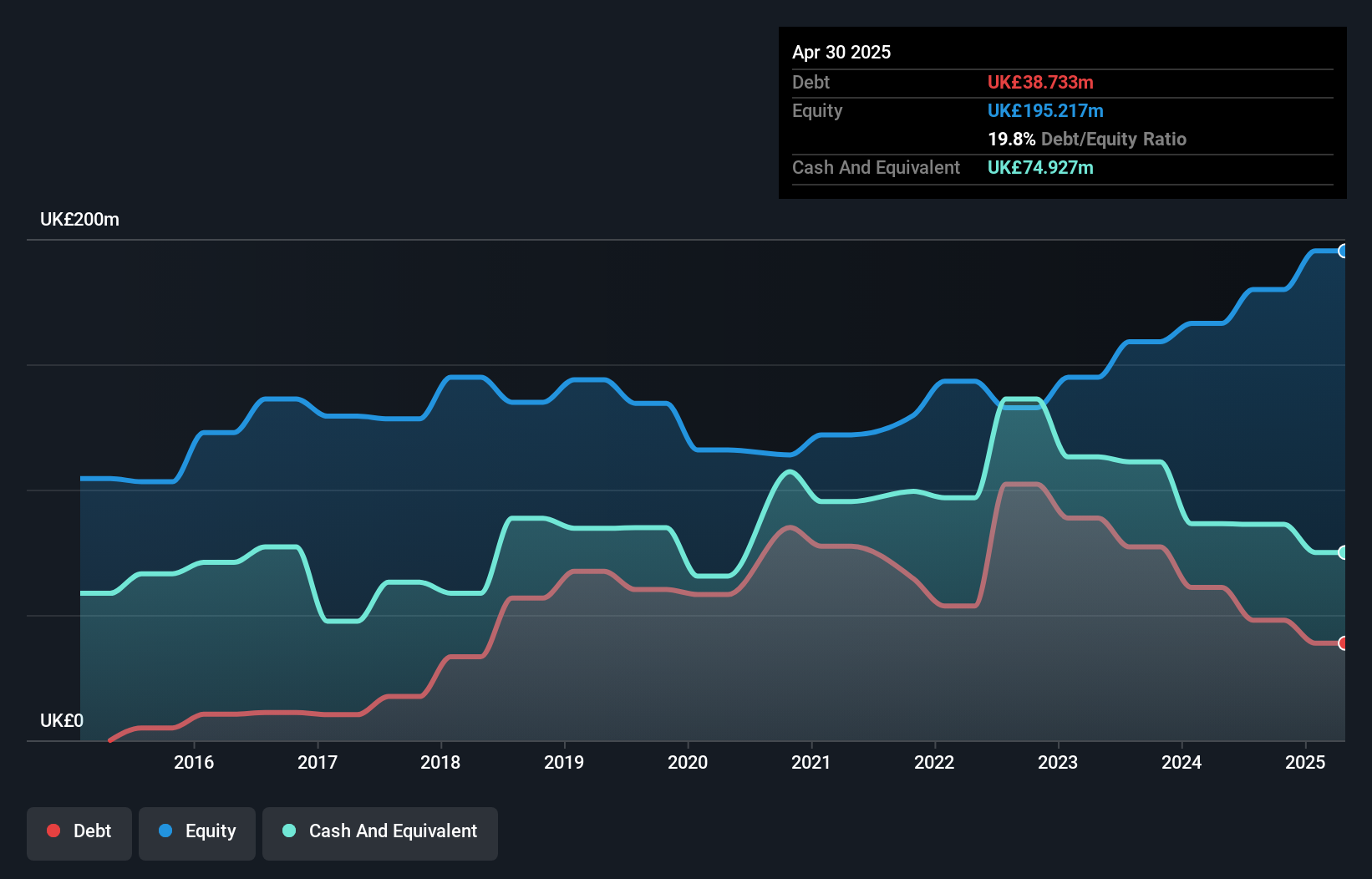

Baltic Classifieds Group PLC demonstrates stable financial health with its debt well covered by operating cash flow and a satisfactory net debt to equity ratio of 7.3%. The company has shown strong earnings growth, outpacing the industry with a 38% increase over the past year, and maintains high-quality earnings. Despite low return on equity at 9.6%, profit margins have improved to 44.5%. Short-term assets exceed liabilities, though long-term liabilities remain uncovered by short-term assets. The board and management are experienced, providing stability as the company continues its growth trajectory in online classifieds across Baltic regions.

- Click here to discover the nuances of Baltic Classifieds Group with our detailed analytical financial health report.

- Evaluate Baltic Classifieds Group's prospects by accessing our earnings growth report.

ME Group International (LSE:MEGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market cap of £796.84 million.

Operations: The company's revenue from Personal Services - Others amounts to £304.20 million.

Market Cap: £796.84M

ME Group International plc presents a compelling profile within the penny stock segment, demonstrating strong financial stability with its short-term assets surpassing both short-term and long-term liabilities. The company's earnings have consistently grown, with a notable 23.8% increase over the past year, outpacing industry averages. Its high return on equity of 31.8% and well-covered debt by operating cash flow further underscore its financial health. Recent developments include a strategic partnership with Motor Fuel Limited to expand laundry services across the UK, potentially enhancing revenue streams and market presence in the coming years.

- Click here and access our complete financial health analysis report to understand the dynamics of ME Group International.

- Review our growth performance report to gain insights into ME Group International's future.

Make It Happen

- Click through to start exploring the rest of the 462 UK Penny Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baltic Classifieds Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BCG

Baltic Classifieds Group

Owns and operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania.

Adequate balance sheet with moderate growth potential.