- United Kingdom

- /

- Media

- /

- AIM:TMG

The Mission Group plc (LON:TMG) Stock Catapults 25% Though Its Price And Business Still Lag The Industry

Those holding The Mission Group plc (LON:TMG) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 58% share price decline over the last year.

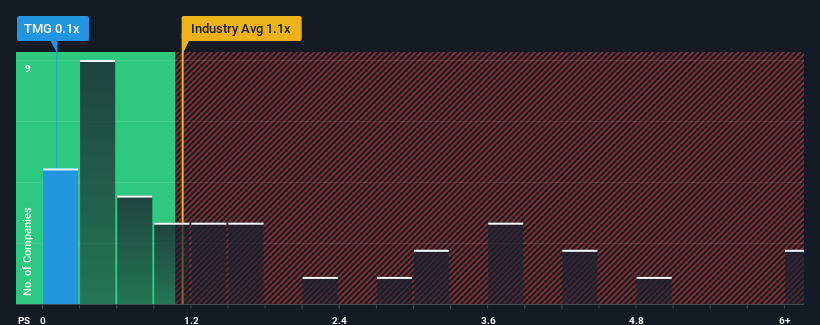

Although its price has surged higher, it would still be understandable if you think Mission Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in the United Kingdom's Media industry have P/S ratios above 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Mission Group

What Does Mission Group's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Mission Group has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Mission Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Mission Group?

The only time you'd be truly comfortable seeing a P/S as low as Mission Group's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. Pleasingly, revenue has also lifted 32% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth is heading into negative territory, declining 19% per annum over the next three years. Meanwhile, the broader industry is forecast to expand by 5.7% per year, which paints a poor picture.

With this in consideration, we find it intriguing that Mission Group's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Mission Group's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Mission Group's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that Mission Group maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for Mission Group (1 is significant!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TMG

Mission Group

Operates as a collective of creative and martech agencies company in the United Kingdom, the United States, Asia, and rest of Europe.

Good value with adequate balance sheet.

Market Insights

Community Narratives