- United Kingdom

- /

- Entertainment

- /

- AIM:TBLD

tinyBuild, Inc.'s (LON:TBLD) 32% Share Price Surge Not Quite Adding Up

Despite an already strong run, tinyBuild, Inc. (LON:TBLD) shares have been powering on, with a gain of 32% in the last thirty days. The annual gain comes to 101% following the latest surge, making investors sit up and take notice.

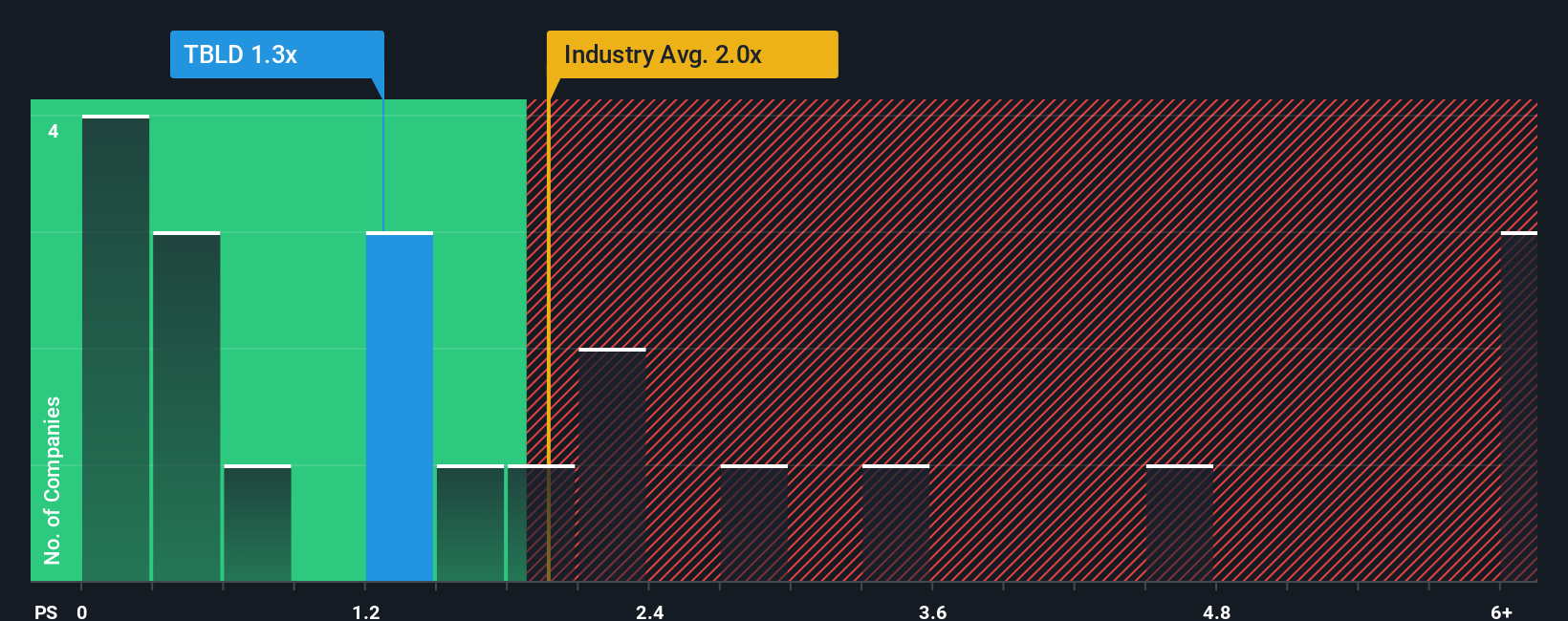

Although its price has surged higher, there still wouldn't be many who think tinyBuild's price-to-sales (or "P/S") ratio of 1.3x is worth a mention when the median P/S in the United Kingdom's Entertainment industry is similar at about 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for tinyBuild

What Does tinyBuild's Recent Performance Look Like?

While the industry has experienced revenue growth lately, tinyBuild's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on tinyBuild.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, tinyBuild would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. The last three years don't look nice either as the company has shrunk revenue by 33% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 5.5% per annum over the next three years. With the industry predicted to deliver 10% growth each year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that tinyBuild is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

tinyBuild's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that tinyBuild's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with tinyBuild, and understanding them should be part of your investment process.

If you're unsure about the strength of tinyBuild's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TBLD

tinyBuild

Engages in the development and publishing of video games in the United States and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.