- United Kingdom

- /

- Real Estate

- /

- AIM:TPFG

Top UK Growth Companies With High Insider Ownership September 2024

Reviewed by Simply Wall St

The market in the United Kingdom has been flat in the last week but is up 9.7% over the past year, with earnings forecast to grow by 14% annually. In this context, growth companies with high insider ownership can be particularly attractive as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.6% | 33.5% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.1% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Let's explore several standout options from the results in the screener.

Judges Scientific (AIM:JDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments with a market cap of £717.26 million.

Operations: Revenue segments for Judges Scientific plc are comprised of £63.60 million from Vacuum and £72.50 million from Materials Sciences.

Insider Ownership: 11.9%

Judges Scientific, a growth company with high insider ownership, is forecast to see its revenue grow faster than the UK market at 6.3% per year. Despite recent significant insider selling, earnings are expected to grow significantly at 26.88% annually over the next three years. However, profit margins have decreased from 11% to 7%. The recent appointment of Dr. Ian Wilcock as Group Commercial Director aims to bolster leadership and drive further innovation and commercialisation efforts within the company.

- Delve into the full analysis future growth report here for a deeper understanding of Judges Scientific.

- Our comprehensive valuation report raises the possibility that Judges Scientific is priced higher than what may be justified by its financials.

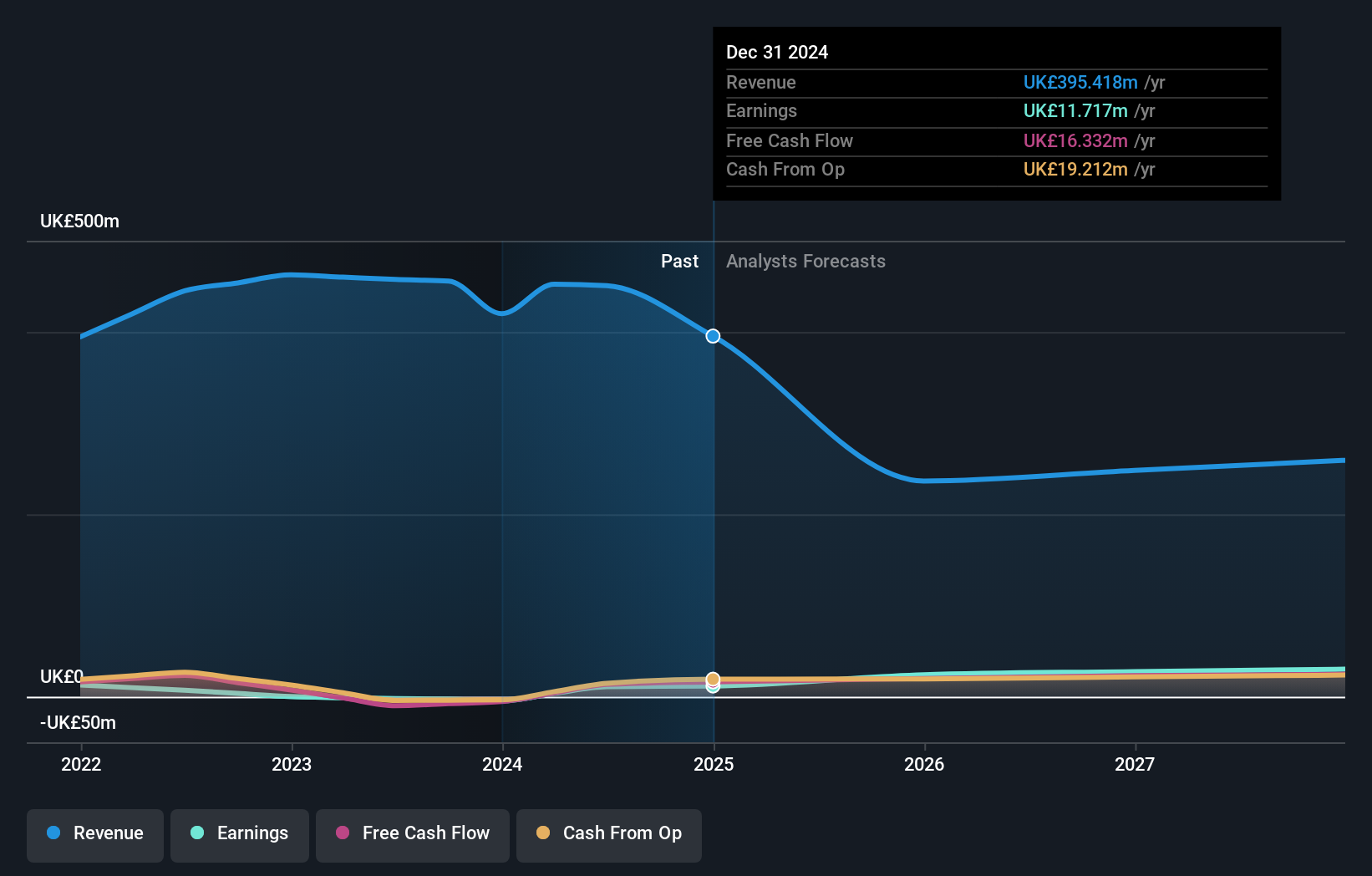

M&C Saatchi (AIM:SAA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: M&C Saatchi plc provides advertising and marketing communications services across the UK, Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of £260.41 million.

Operations: The company's revenue segments include advertising and marketing communications services across the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Insider Ownership: 16.1%

M&C Saatchi, with substantial insider ownership, is forecast to see a high return on equity of 45.5% in three years and earnings growth of 43.75% annually. Despite trading at 52.5% below its estimated fair value, revenue is expected to decline by 14.2% per year over the next three years. Recent leadership changes include Simon Fuller as CFO from July 2024, bringing extensive experience from Reach plc and McColl's Retail Group plc among others.

- Navigate through the intricacies of M&C Saatchi with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility M&C Saatchi's shares may be trading at a discount.

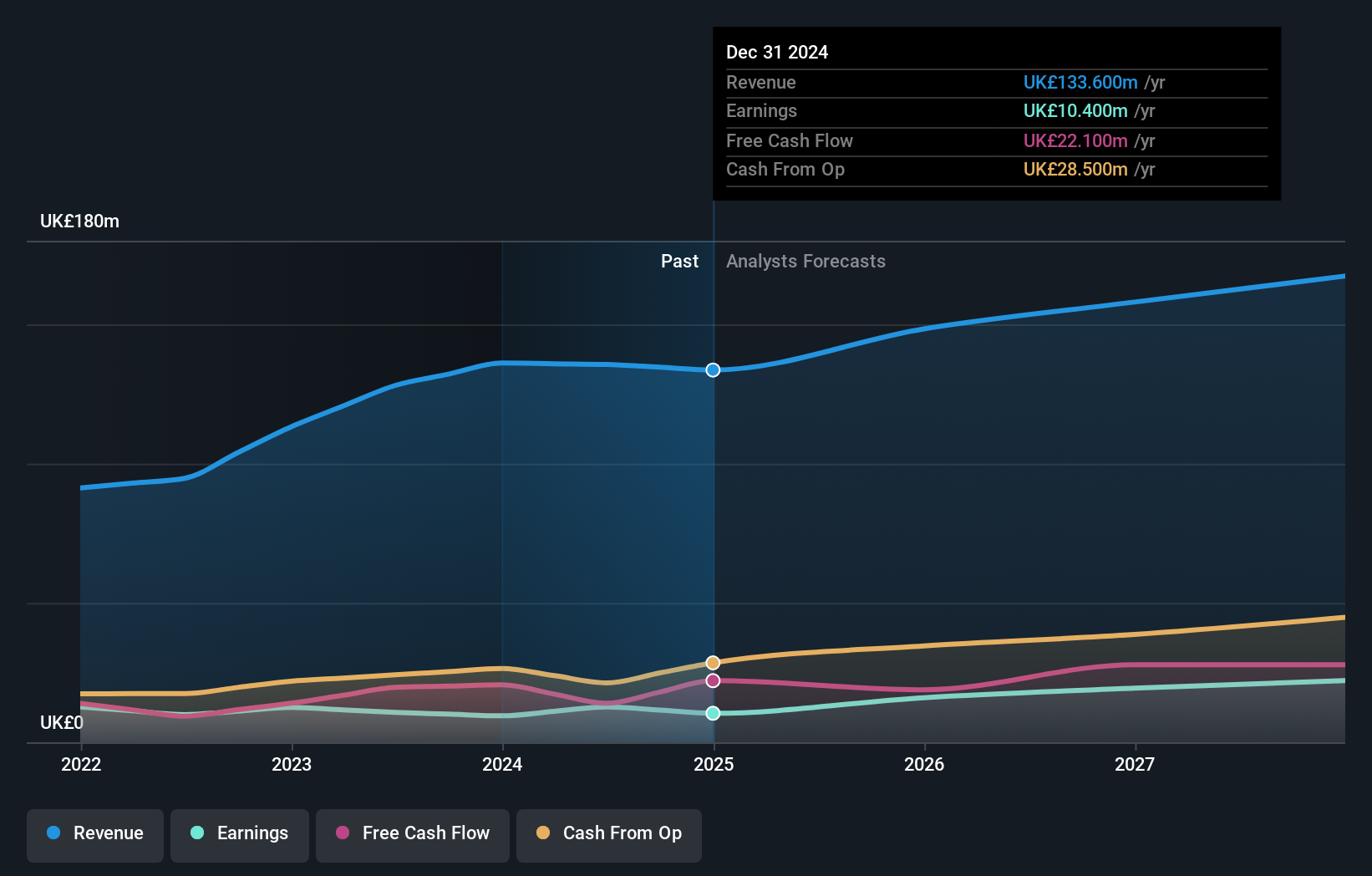

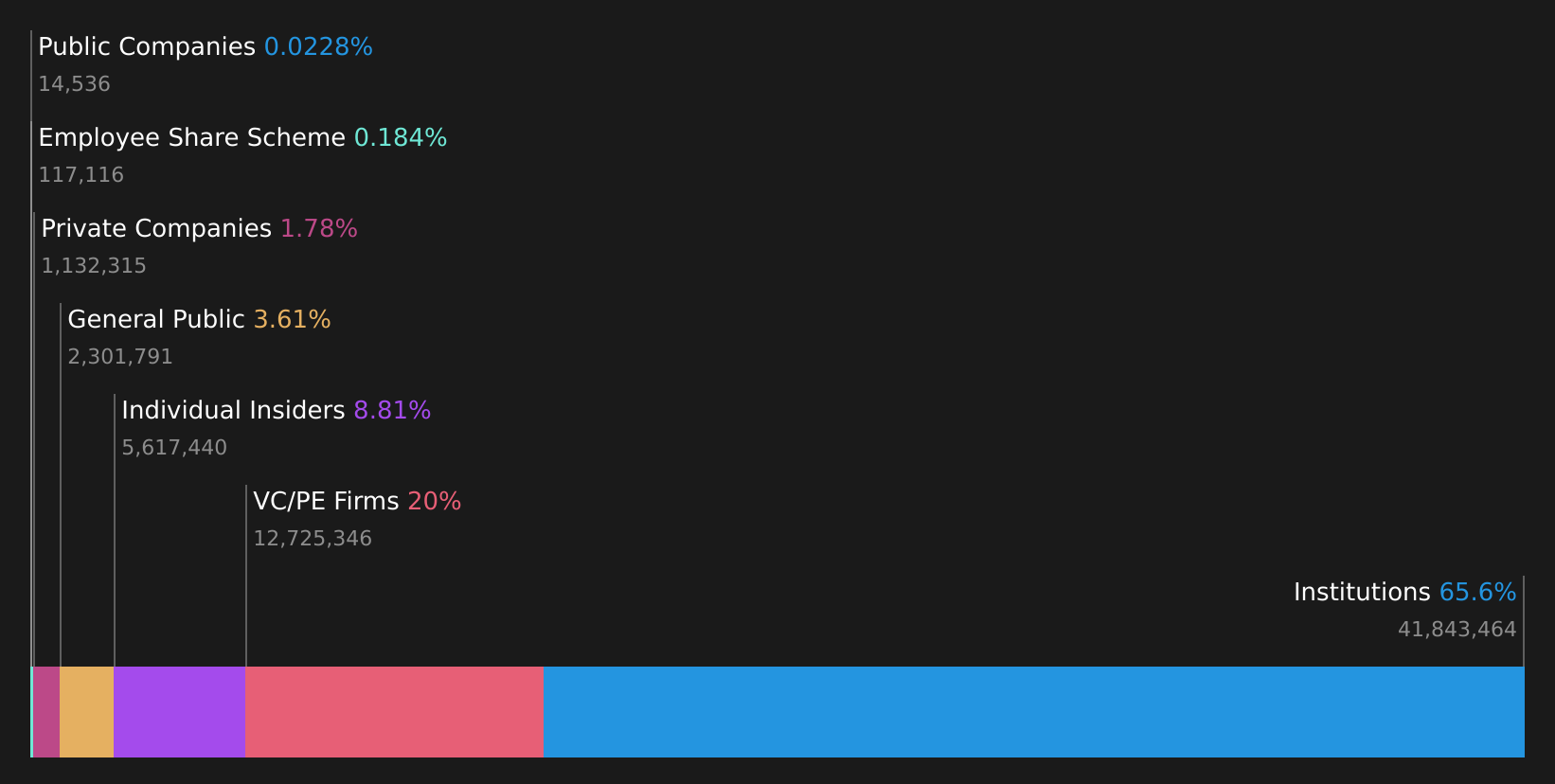

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC manages and leases residential real estate properties in the United Kingdom, with a market cap of £305.43 million.

Operations: The company's revenue segments include £1.50 million from Financial Services and £25.78 million from Property Franchising.

Insider Ownership: 14.2%

Property Franchise Group, with significant insider ownership, is forecast to achieve annual earnings growth of 42.8% and revenue growth of 47.9%, both surpassing UK market averages. Despite trading at 57.3% below its estimated fair value, the company has an unstable dividend track record and shareholders experienced substantial dilution over the past year. Recent news includes CFO David Raggett's planned retirement by end-2025 and upcoming presentations at Canaccord Genuity's Growth Conference in August 2024.

- Get an in-depth perspective on Property Franchise Group's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Property Franchise Group is trading beyond its estimated value.

Make It Happen

- Unlock our comprehensive list of 69 Fast Growing UK Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TPFG

Property Franchise Group

Manages and leases residential real estate properties in the United Kingdom.

Flawless balance sheet with high growth potential and pays a dividend.