- United Kingdom

- /

- Consumer Durables

- /

- LSE:BTRW

Analysts Are Betting On Barratt Developments plc (LON:BDEV) With A Big Upgrade This Week

Barratt Developments plc (LON:BDEV) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

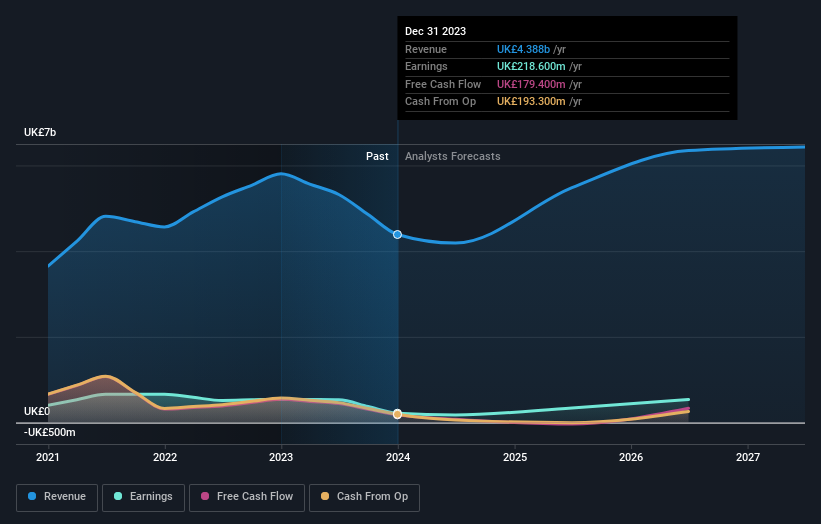

After the upgrade, the seven analysts covering Barratt Developments are now predicting revenues of UK£5.3b in 2025. If met, this would reflect a sizeable 22% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing UK£4.2b of revenue in 2025. The consensus has definitely become more optimistic, showing a very substantial lift in revenue forecasts.

Check out our latest analysis for Barratt Developments

Additionally, the consensus price target for Barratt Developments increased 5.1% to UK£5.71, showing a clear increase in optimism from the analysts involved.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting Barratt Developments' growth to accelerate, with the forecast 22% annualised growth to the end of 2025 ranking favourably alongside historical growth of 3.2% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 8.1% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Barratt Developments is expected to grow much faster than its industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for Barratt Developments this year. Analysts also expect revenues to grow faster than the wider market. There was also a nice increase in the price target, with analysts apparently feeling that the intrinsic value of the business is improving. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Barratt Developments.

Analysts are definitely bullish on Barratt Developments, but no company is perfect. Indeed, you should know that there are several potential concerns to be aware of, including the risk of cutting its dividend. You can learn more, and discover the 3 other warning signs we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Barratt Redrow might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BTRW

Barratt Redrow

Engages in the housebuilding business in the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion