- United Kingdom

- /

- Marine and Shipping

- /

- LSE:ICGC

Undiscovered Gems In The United Kingdom To Watch This September 2024

Reviewed by Simply Wall St

The market in the United Kingdom has been flat over the last week but is up 9.7% over the past year, with earnings forecast to grow by 14% annually. In this environment, identifying stocks with strong growth potential and solid fundamentals can offer promising opportunities for investors looking to capitalize on these trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| FW Thorpe | 3.34% | 11.37% | 9.41% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Cairn Homes plc, a holding company with a market cap of £1.05 billion, operates as a home and community builder in Ireland.

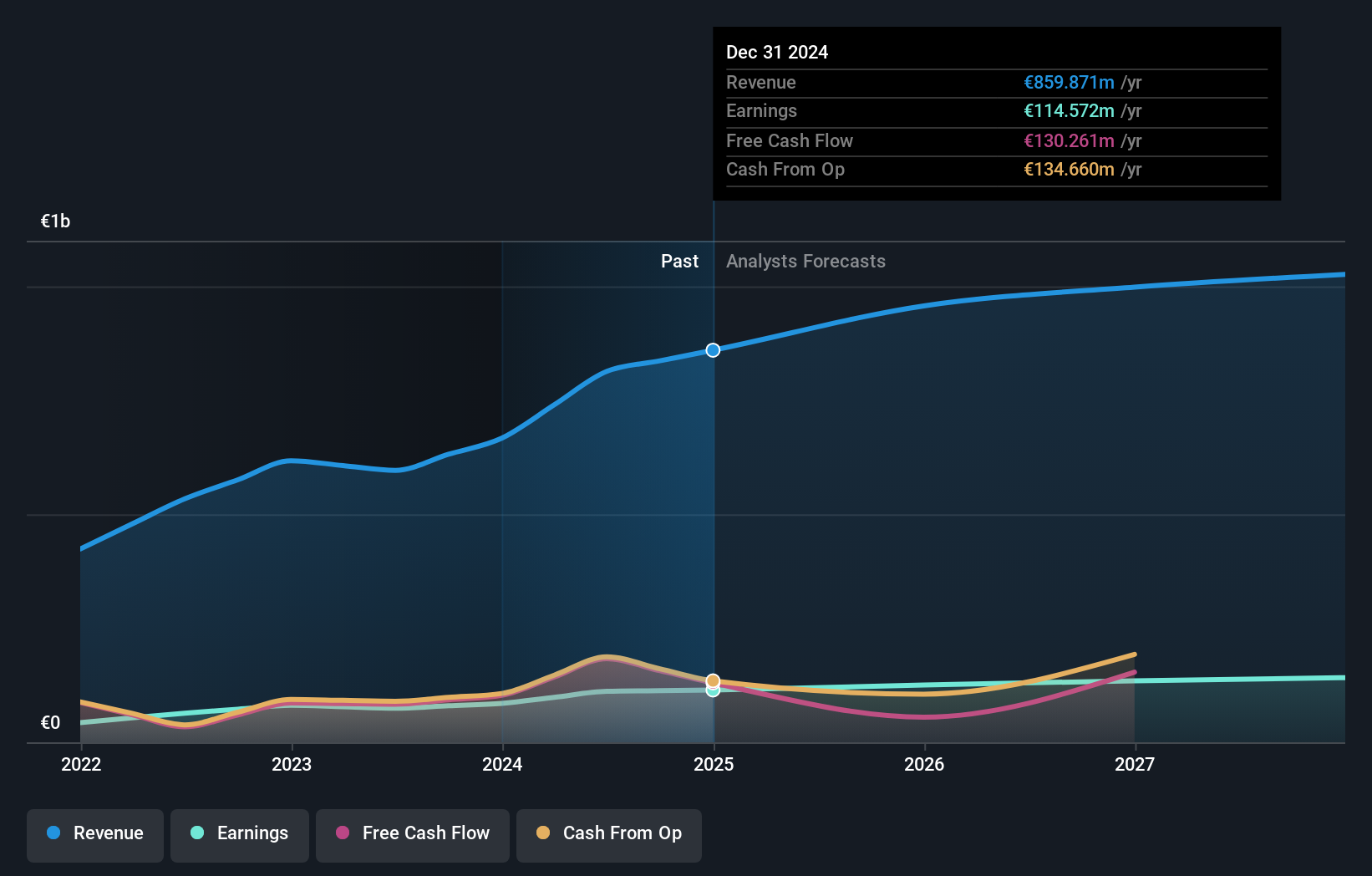

Operations: Cairn Homes generates revenue primarily from building and property development, totaling €666.81 million. The company incurs costs associated with these activities, impacting its net profit margin.

Cairn Homes, a notable player in the UK market, has shown promising signs with its earnings growth of 5.4% over the past year, outperforming the Consumer Durables industry. The company's P/E ratio stands at 14.5x, below the UK market average of 17x, indicating good value. Cairn's net debt to equity ratio is a satisfactory 19.6%, and its EBIT covers interest payments by 8.4 times. Additionally, their debt to equity ratio has improved from 26% to 23% over five years.

- Navigate through the intricacies of Cairn Homes with our comprehensive health report here.

Review our historical performance report to gain insights into Cairn Homes''s past performance.

Irish Continental Group (LSE:ICGC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Irish Continental Group plc operates as a maritime transport company with a market cap of £774.94 million.

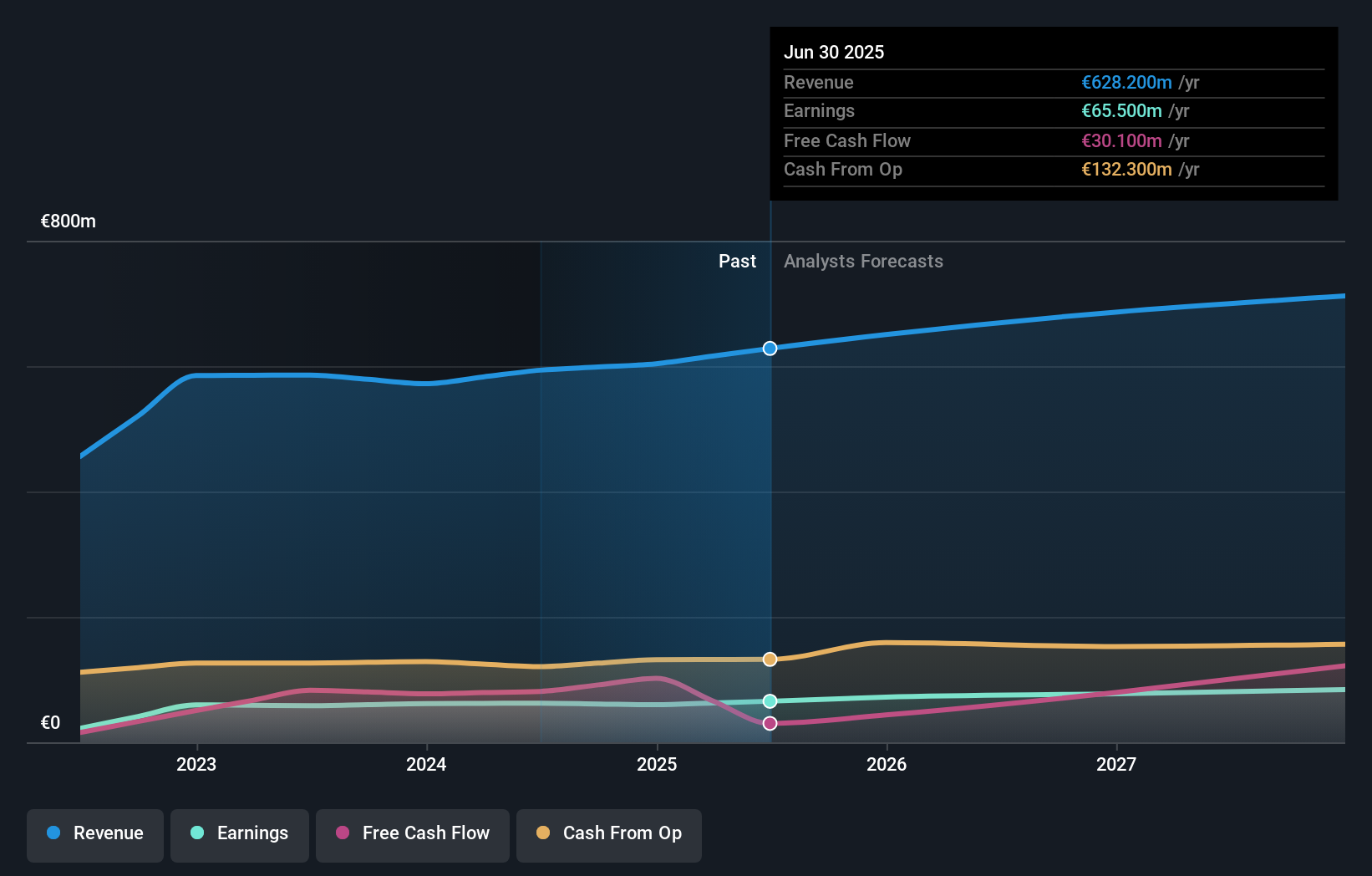

Operations: Revenue for Irish Continental Group comes primarily from its Ferries segment (€430.10 million) and Container and Terminal segment (€195.80 million).

Irish Continental Group (ICG) showcases a blend of solid financial health and growth potential. With earnings growing 7.2% over the past year, significantly outpacing the shipping industry’s -25.5%, ICG demonstrates robust performance. Trading at 13.3% below its estimated fair value, it offers an attractive entry point for investors. The company’s net debt to equity ratio stands at a satisfactory 35.2%, and interest payments are well covered by EBIT at 10x coverage, indicating strong financial stability.

- Click here to discover the nuances of Irish Continental Group with our detailed analytical health report.

Understand Irish Continental Group's track record by examining our Past report.

Seplat Energy (LSE:SEPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Seplat Energy Plc engages in oil and gas exploration, production, and gas processing activities across Nigeria, the Bahamas, Italy, Switzerland, Barbados, and England with a market cap of £1.07 billion.

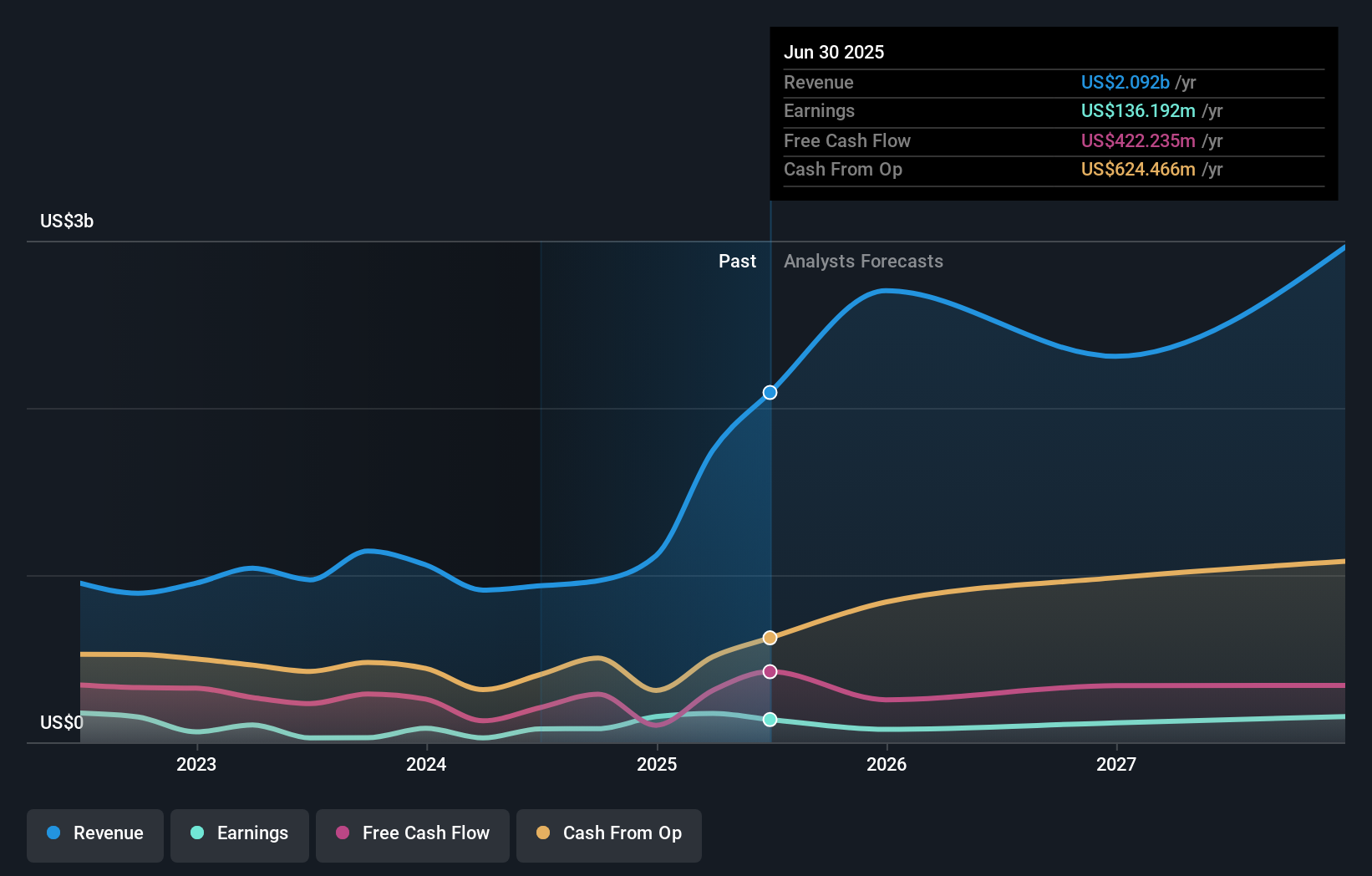

Operations: Seplat Energy generates revenue from two primary segments: oil ($815.03 million) and gas ($120.87 million). The company's net profit margin is 13.50%.

Seplat Energy, a small cap in the UK, has shown impressive earnings growth of 207.6% over the past year, far outpacing the Oil and Gas industry’s -55.3%. Its net debt to equity ratio stands at 20.6%, which is considered satisfactory. The company reported sales of US$241.82 million in Q2 2024 compared to US$216.03 million a year ago and net income of US$39.72 million against a prior loss of US$14.63 million, indicating strong financial performance and high-quality earnings.

Key Takeaways

- Investigate our full lineup of 80 UK Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ICGC

Solid track record with adequate balance sheet and pays a dividend.