- United Kingdom

- /

- Software

- /

- LSE:PINE

High Growth Tech Stocks to Watch in May 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 closing lower due to weak trade data from China and broader global economic concerns impacting key sectors such as mining and fund management. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience and innovation, leveraging technology to navigate economic headwinds while positioning themselves for future opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| YouGov | 4.12% | 64.42% | ★★★★★☆ |

| Audioboom Group | 8.84% | 59.33% | ★★★★★☆ |

| Pinewood Technologies Group | 24.99% | 42.22% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Huddled Group | 21.70% | 114.65% | ★★★★★☆ |

| Oxford Biomedica | 16.52% | 82.05% | ★★★★★☆ |

| Windar Photonics | 37.17% | 46.73% | ★★★★★☆ |

| Trustpilot Group | 15.02% | 40.20% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 55.41% | 56.79% | ★★★★★☆ |

| Cordel Group | 33.50% | 148.58% | ★★★★★☆ |

Click here to see the full list of 37 stocks from our UK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Faron Pharmaceuticals Oy (AIM:FARN)

Simply Wall St Growth Rating: ★★★★★☆

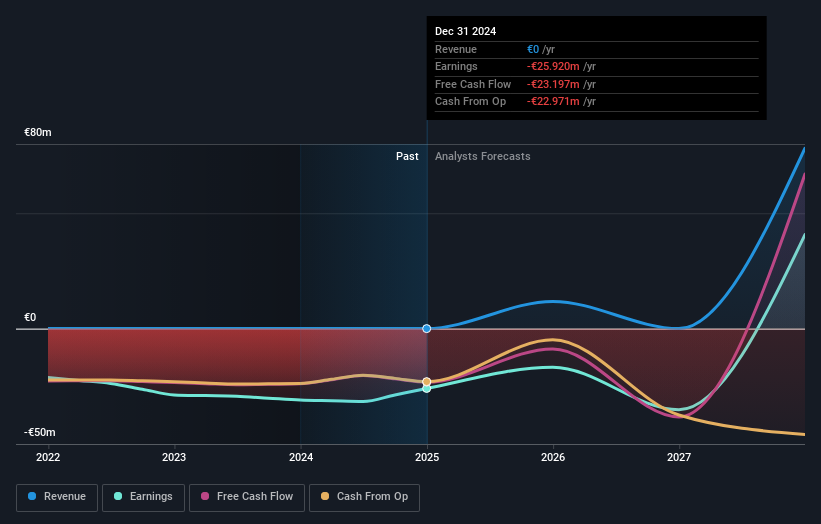

Overview: Faron Pharmaceuticals Oy is a clinical stage drug discovery and development company with a market cap of £264.83 million.

Operations: The company focuses on drug discovery and development at the clinical stage, with no recorded revenue segments in millions of euros.

Faron Pharmaceuticals Oy, amidst a transformative phase, recently secured EUR 35 million through convertible bonds, enhancing its financial flexibility for aggressive R&D pursuits. This strategic move coincides with significant board enhancements, including the appointment of Colin Bond and Dr. Juho Jalkanen, whose extensive biopharma and financial expertise are pivotal during this expansion phase. Despite a challenging past marked by a net loss reduction from EUR 30.94 million to EUR 25.92 million in 2024, Faron's forecasted revenue growth at an impressive rate of 55.4% annually signals robust potential in the biotech sector. These developments underscore Faron’s commitment to innovation and market adaptation in high-growth tech environments within the UK.

M&C Saatchi (AIM:SAA)

Simply Wall St Growth Rating: ★★★★☆☆

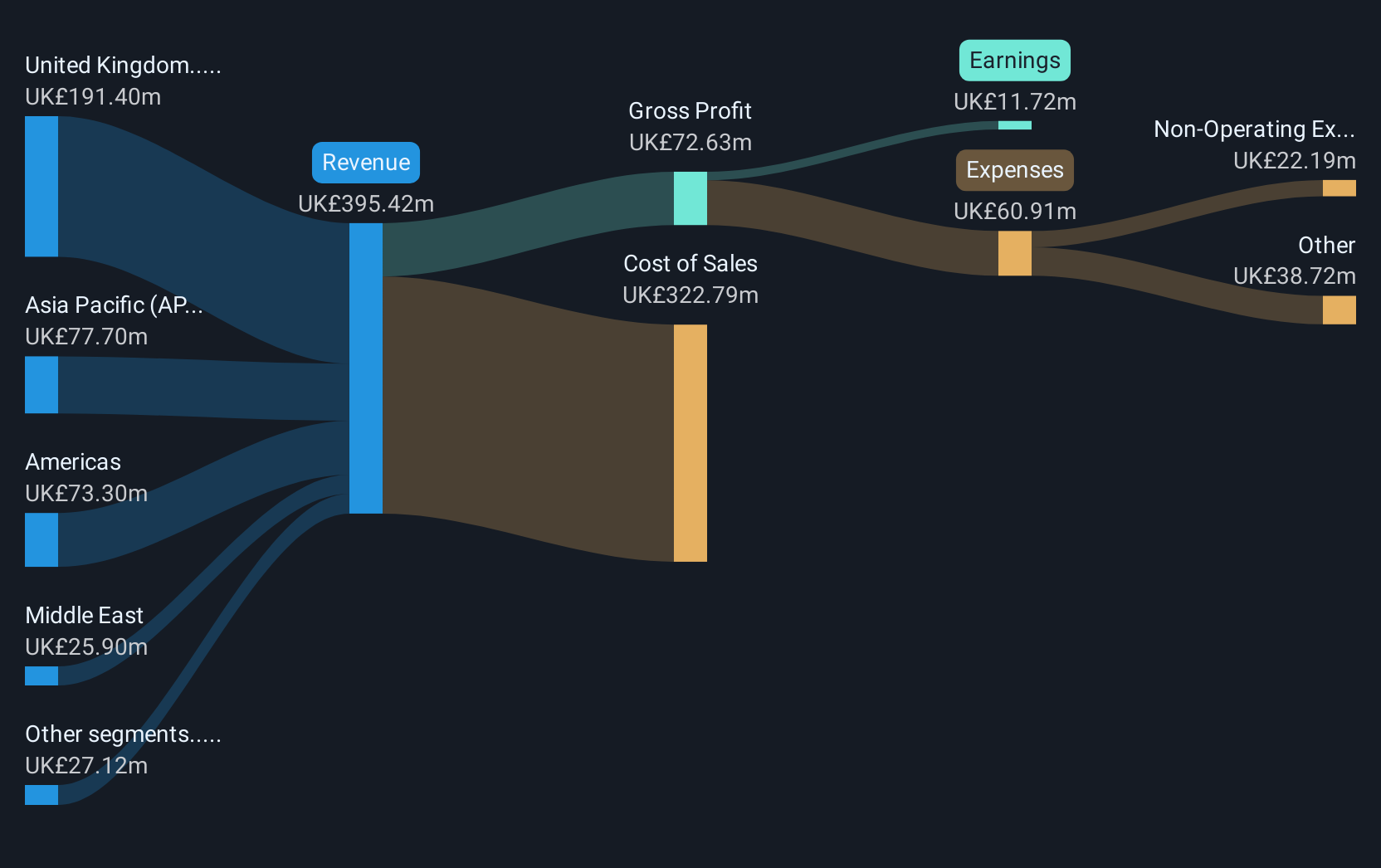

Overview: M&C Saatchi plc is a global advertising and marketing communications company operating across the UK, Europe, the Middle East, Asia Pacific, and the Americas with a market cap of £192.12 million.

Operations: The company generates revenue through its advertising and marketing communications services across multiple regions, including the UK, Europe, the Middle East, Asia Pacific, and the Americas. It operates with a market capitalization of £192.12 million.

M&C Saatchi's transition from a net loss of £3.53 million to a net income of £14.73 million in 2024 underscores its recovery and potential within the tech-driven marketing sector. Despite facing a projected annual revenue decline of 15.8%, the company's earnings are expected to grow by an impressive 25.2% annually, highlighting effective cost management and innovative strategies in adapting to market demands. The recent board changes, including Dame Heather Rabbatts' appointment as interim Non-Executive Chair, signal a strategic realignment that could further stabilize governance and drive growth amidst challenging conditions. Additionally, the increased final dividend of 1.95 pence per share reflects confidence in sustained profitability and shareholder value enhancement.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Growth Rating: ★★★★★☆

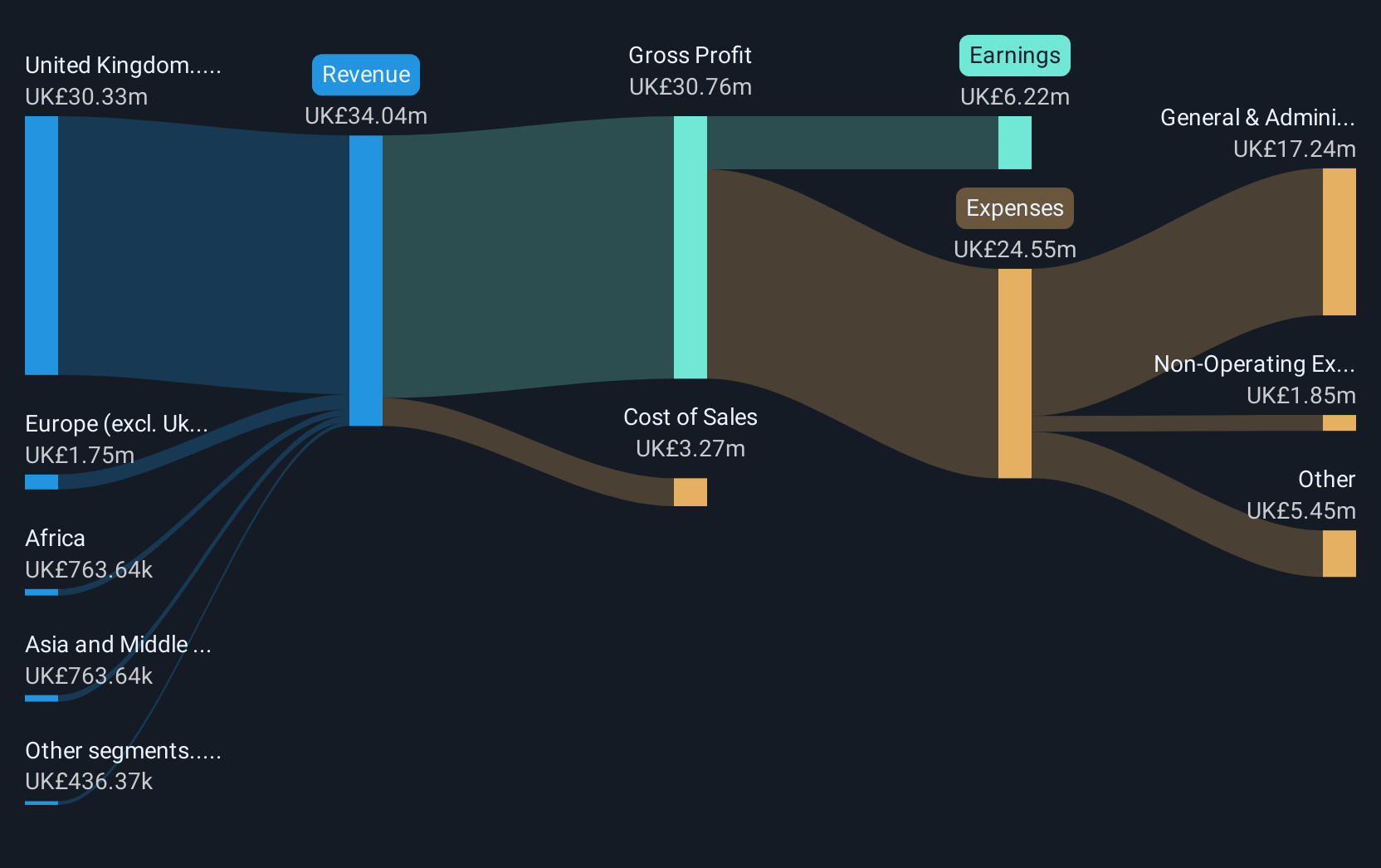

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving the automotive industry across various regions including the United Kingdom, Europe, Africa, Asia, the Middle East, and North America with a market cap of £388.57 million.

Operations: Pinewood Technologies Group PLC generates revenue through its cloud-based dealer management software solutions tailored for the automotive industry across multiple continents. The company focuses on providing comprehensive software services that streamline operations for automotive dealers in regions including Europe, Asia, and North America.

Pinewood Technologies Group PLC, a player in the automotive software sector, recently secured a significant contract with Volkswagen Group Japan, underlining its strategic expansion and potential revenue growth starting 2026. This follows an impressive earnings report for 2024, where the company posted sales of £31.2 million and net income of £5.7 million. The firm's commitment to innovation is evident from its R&D expenditure trends, which have consistently aligned with expanding its technological offerings in global markets. With projected annual revenue growth at 25% and earnings expected to surge by 42.2% annually, Pinewood is positioning itself as a strong contender in tech-driven automotive solutions despite broader market challenges.

Taking Advantage

- Discover the full array of 37 UK High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pinewood Technologies Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PINE

Pinewood Technologies Group

Operates as a cloud-based dealer management software provider that offers software solutions to the automotive industry in the United Kingdom, rest of Europe, Africa, Asia, the middle East, and North America.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives