- United Kingdom

- /

- Metals and Mining

- /

- AIM:GDP

3 Penny Stocks On The UK Exchange With At Least £7M Market Cap

Reviewed by Simply Wall St

The UK market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices experiencing declines following disappointing trade data from China, highlighting global economic challenges. Despite these broader market pressures, penny stocks continue to attract attention as a niche investment category that can offer unique opportunities. Although the term "penny stocks" might seem outdated, these smaller or newer companies can still present compelling growth potential when backed by solid financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.65 | £178.85M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.89 | £482.95M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.145 | £806.38M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.21M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.25 | £83.91M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.205 | £337.16M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.37 | £40.9M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.716 | £2.08B | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.445 | £182.11M | ★★★★★☆ |

| Helios Underwriting (AIM:HUW) | £2.17 | £154.1M | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Goldplat (AIM:GDP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Goldplat PLC, with a market cap of £11.49 million, operates as a mining services company in South Africa and Ghana.

Operations: The company generates revenue primarily from its recovery operations, with £53.56 million from West African Recovery Operations, £19.34 million from South African Recovery Operations, and £1.72 million from South American Recovery Operations.

Market Cap: £11.49M

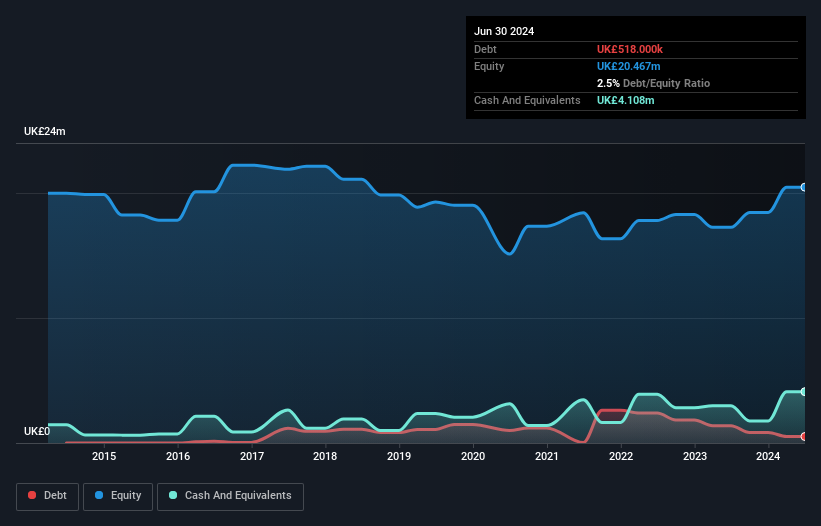

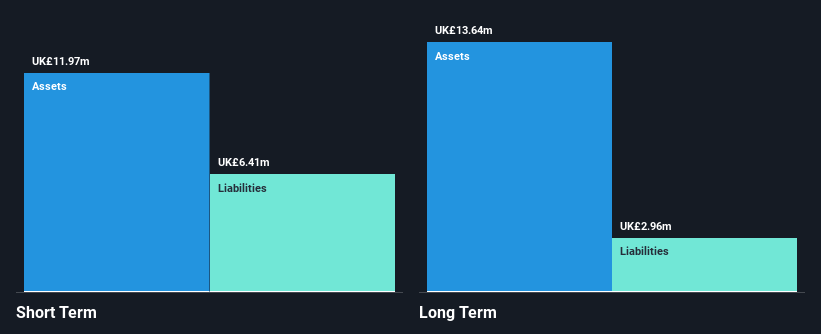

Goldplat PLC, with a market cap of £11.49 million, shows promising financial health for a penny stock. The company has strong short-term asset coverage over liabilities and more cash than debt, indicating sound liquidity. Its earnings have grown significantly by 50.4% over the past year, surpassing industry averages and reflecting high-quality earnings with a return on equity of 21.1%. Despite recent board changes, including appointing John Cross as an independent director and Gerard Kisbey-Green as Chairman, Goldplat maintains stability in its operations with no shareholder dilution over the past year and improved debt levels from previous years.

- Jump into the full analysis health report here for a deeper understanding of Goldplat.

- Learn about Goldplat's future growth trajectory here.

LPA Group (AIM:LPA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LPA Group Plc, with a market cap of £7.00 million, designs, manufactures, and markets industrial electrical and electronic products for the rail, aerospace and defense, aircraft, infrastructure, and industrial markets primarily in the United Kingdom as well as Europe and internationally.

Operations: The company generates revenue of £23.55 million from its operations in designing, manufacturing, and marketing industrial electrical and electronic products.

Market Cap: £7M

LPA Group Plc, with a market cap of £7.00 million, is navigating challenges as it remains unprofitable despite reducing losses over five years by 17.1% annually. Its short-term assets of £12.0 million comfortably cover both short and long-term liabilities, suggesting solid financial footing in terms of liquidity. Recent contracts, including significant deals with SNCF Voyageurs and Siemens Mobility for LED lighting projects, highlight growth potential in the rail sector. However, volatility remains high compared to UK peers and recent earnings showed a net loss of £0.325 million for the year ended September 2024 amidst revenue growth to £23.55 million.

- Click to explore a detailed breakdown of our findings in LPA Group's financial health report.

- Assess LPA Group's future earnings estimates with our detailed growth reports.

M&C Saatchi (AIM:SAA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: M&C Saatchi plc is a global advertising and marketing communications company operating across the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of £223.12 million.

Operations: Revenue segments for M&C Saatchi are not reported.

Market Cap: £223.12M

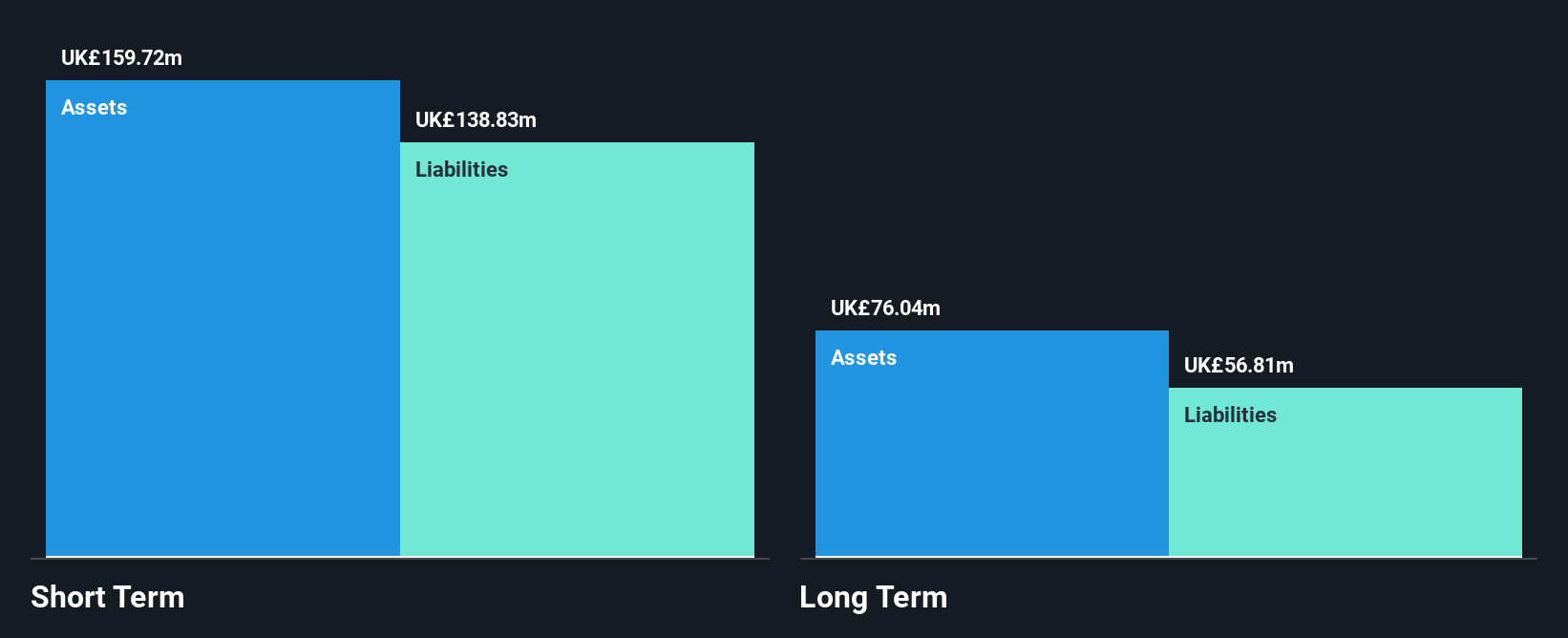

M&C Saatchi plc, with a market cap of £223.12 million, has shown resilience by becoming profitable in the last year despite a significant one-off loss of £17.3 million impacting recent results. The company’s short-term assets exceed both its short and long-term liabilities, reflecting strong liquidity management. Analysts suggest the stock is trading below its estimated fair value and predict earnings growth of 27.45% annually. Recent corporate guidance indicates that profit before tax will align with expectations, supported by strategic reinvestments and steady revenue growth across diverse portfolios including Media and operations in the UAE.

- Navigate through the intricacies of M&C Saatchi with our comprehensive balance sheet health report here.

- Examine M&C Saatchi's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Investigate our full lineup of 444 UK Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GDP

Goldplat

Operates as a mining services company in South Africa and Ghana.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives