- United Kingdom

- /

- IT

- /

- LSE:FDM

Discover UK Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The UK market has been facing challenges, with the FTSE 100 index recently faltering due to weak trade data from China, highlighting global economic interconnectedness. Despite these broader market pressures, investors often find potential in lesser-known areas like penny stocks—smaller or newer companies that can offer growth opportunities at more accessible price points. While the term "penny stocks" might seem outdated, they remain relevant as a category that can provide financial strength and resilience amidst fluctuating market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.215 | £834.53M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.33 | £169.38M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.18 | £415.73M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.89 | £67.4M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.23 | £104.97M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.292 | £199.26M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.215 | £411.4M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.404 | $234.86M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.40 | £209.85M | ★★★★★★ |

Click here to see the full list of 464 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Atlantic Lithium (AIM:ALL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlantic Lithium Limited focuses on the exploration and development of mineral properties in Australia, Ivory Coast, and Ghana, with a market cap of £86.48 million.

Operations: The company generates revenue of A$0.72 million from its exploration activities for base and precious metals.

Market Cap: £86.48M

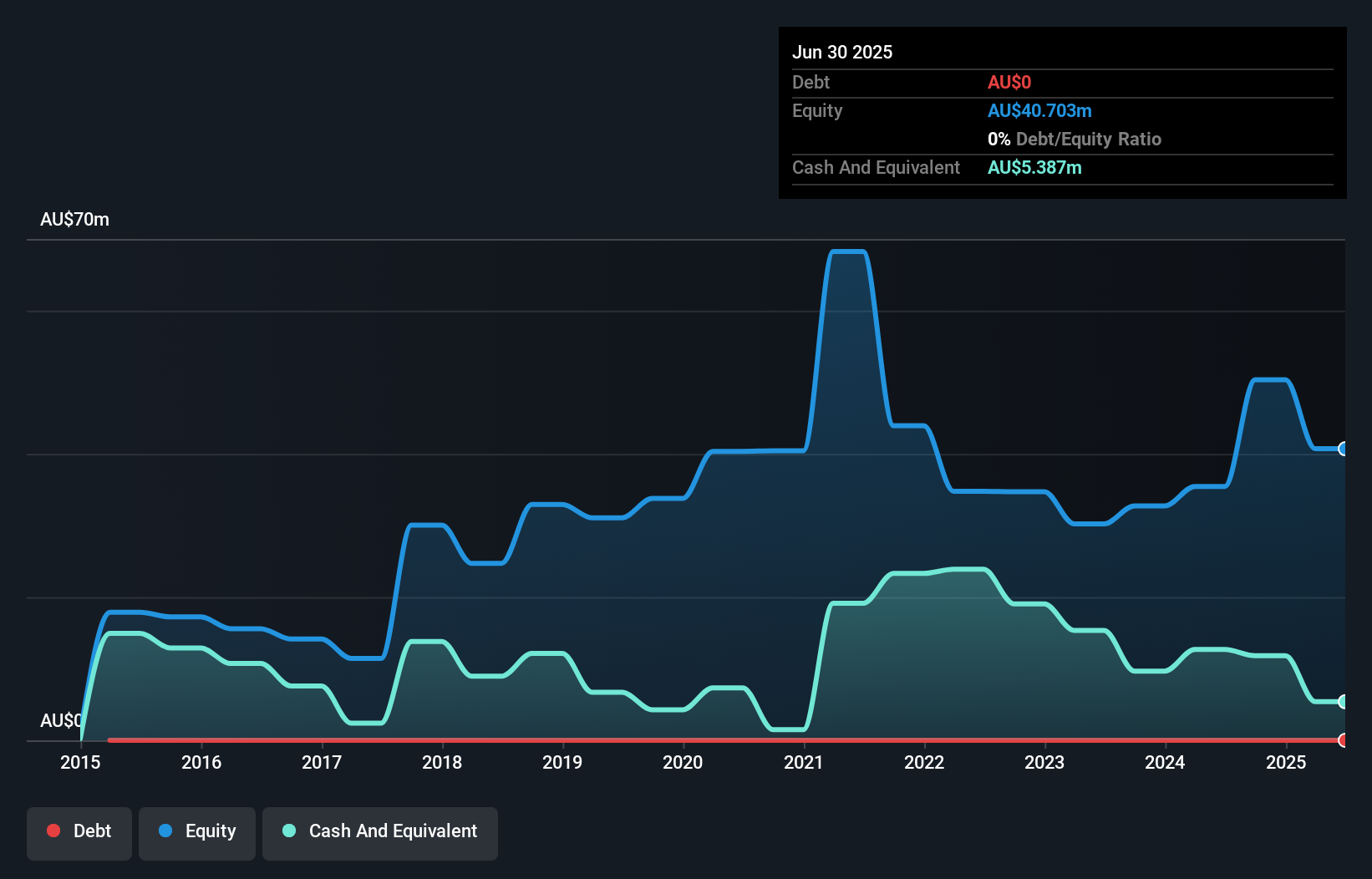

Atlantic Lithium is pre-revenue, with less than US$1 million in earnings, and faces challenges typical of penny stocks. Recent developments include securing a Mine Operating Permit for its Ewoyaa Lithium Project in Ghana, marking significant progress toward construction. However, the company has experienced shareholder dilution and reported a net loss of A$12.65 million for the year ending June 2024. Despite having no debt and sufficient short-term assets to cover liabilities, its auditors have expressed doubts about its ability to continue as a going concern. The company recently raised A$10 million through equity offerings to bolster its cash runway.

- Navigate through the intricacies of Atlantic Lithium with our comprehensive balance sheet health report here.

- Understand Atlantic Lithium's earnings outlook by examining our growth report.

Next 15 Group (AIM:NFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Next 15 Group plc, along with its subsidiaries, offers communications services across the United Kingdom, Europe, Africa, the United States, and the Asia Pacific with a market cap of £415.73 million.

Operations: Next 15 Group plc does not report distinct revenue segments.

Market Cap: £415.73M

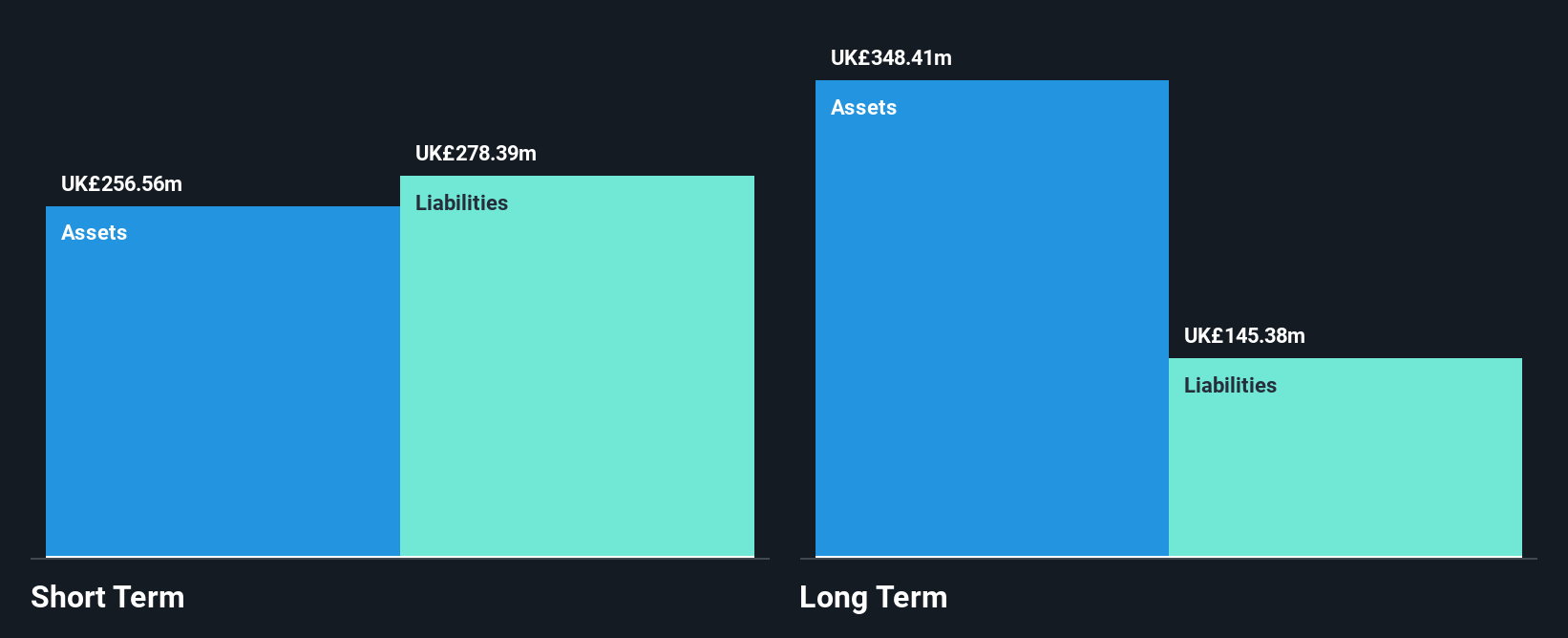

Next 15 Group plc has demonstrated significant earnings growth, with a 132% increase over the past year, surpassing its five-year average growth rate. Despite this, the company's forecast suggests an average annual earnings decline of 8% over the next three years. The stock trades at a substantial discount to estimated fair value and shows high return on equity at 36.7%. However, it faces challenges such as increased debt levels and heightened share price volatility recently. While short-term assets cover both short-term and long-term liabilities comfortably, its dividend history is unstable.

- Take a closer look at Next 15 Group's potential here in our financial health report.

- Evaluate Next 15 Group's prospects by accessing our earnings growth report.

FDM Group (Holdings) (LSE:FDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FDM Group (Holdings) plc offers IT services across the UK, North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £355.13 million.

Operations: The company generates revenue of £294.27 million from its global professional services operations.

Market Cap: £355.13M

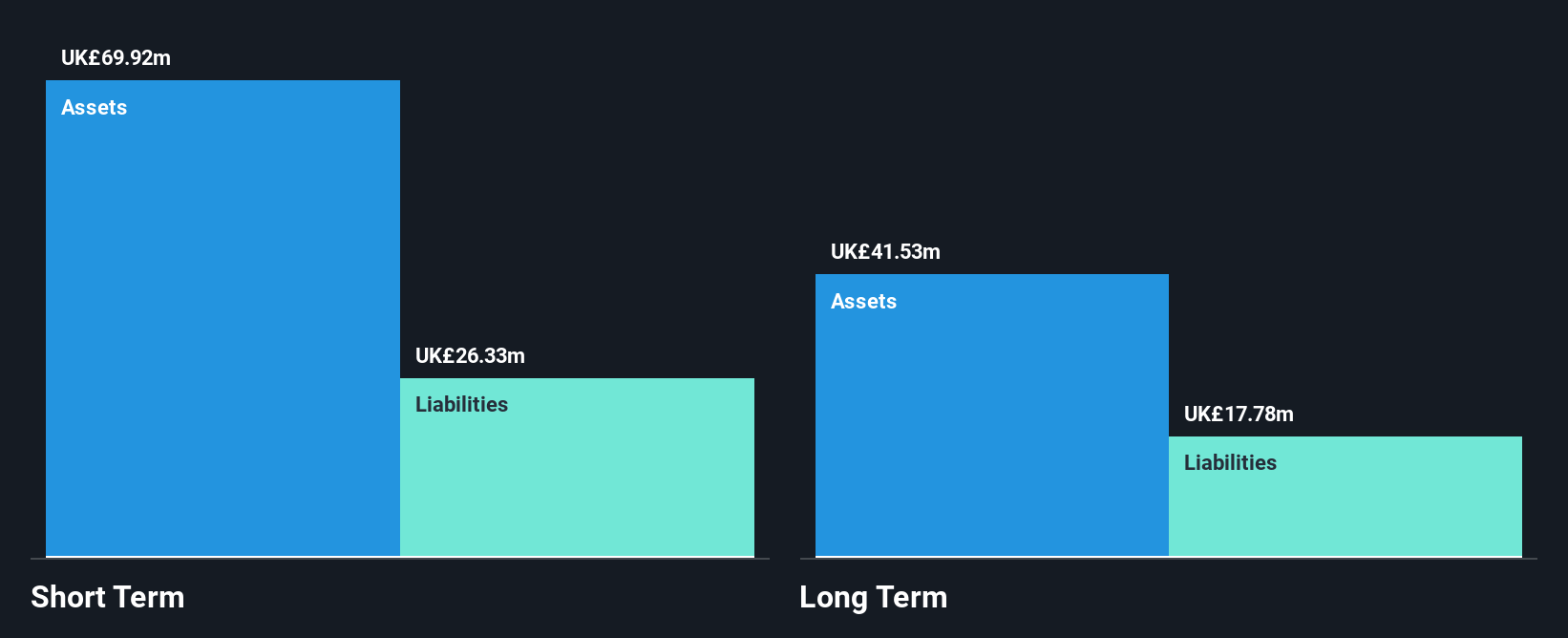

FDM Group (Holdings) plc, with a market cap of £355.13 million and revenue of £294.27 million, is debt-free and maintains strong liquidity, as short-term assets exceed both short-term and long-term liabilities. Despite a seasoned management team and board, FDM faces challenges with negative earnings growth over the past year (-22.9%) and declining profit margins from 11% to 10.3%. The company's dividend yield of 8.91% is not well covered by earnings, indicating potential sustainability issues. Trading at a price-to-earnings ratio of 11.7x below the UK market average suggests it offers good relative value despite forecasted earnings declines.

- Click here and access our complete financial health analysis report to understand the dynamics of FDM Group (Holdings).

- Gain insights into FDM Group (Holdings)'s future direction by reviewing our growth report.

Taking Advantage

- Click through to start exploring the rest of the 461 UK Penny Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FDM

FDM Group (Holdings)

Provides information technology (IT) services in the United Kingdom, North America, Europe, the Middle East, Africa, rest of Europe, and the Asia Pacific.

Flawless balance sheet average dividend payer.