- United Kingdom

- /

- Media

- /

- AIM:NFG

Next Fifteen Communications Group (LON:NFC) Has A Rock Solid Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Next Fifteen Communications Group plc (LON:NFC) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Next Fifteen Communications Group

What Is Next Fifteen Communications Group's Debt?

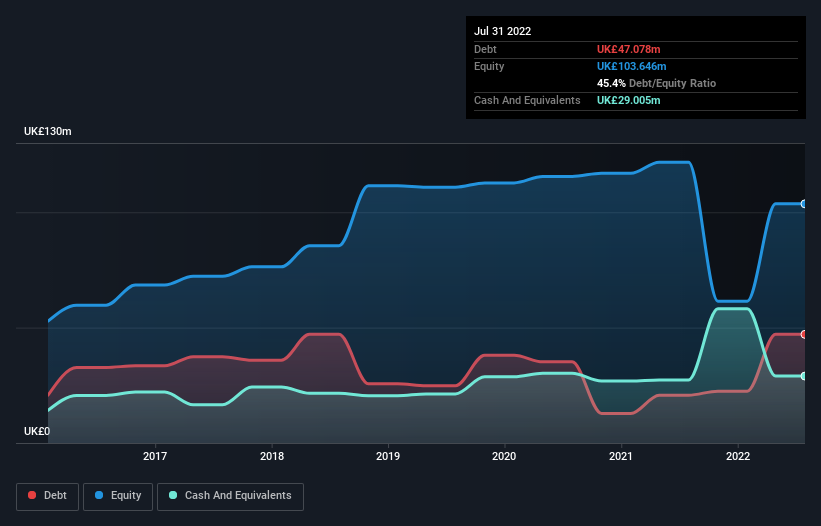

You can click the graphic below for the historical numbers, but it shows that as of July 2022 Next Fifteen Communications Group had UK£47.1m of debt, an increase on UK£20.7m, over one year. However, it does have UK£29.0m in cash offsetting this, leading to net debt of about UK£18.1m.

How Healthy Is Next Fifteen Communications Group's Balance Sheet?

The latest balance sheet data shows that Next Fifteen Communications Group had liabilities of UK£248.4m due within a year, and liabilities of UK£259.8m falling due after that. On the other hand, it had cash of UK£29.0m and UK£185.5m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£293.7m.

This deficit isn't so bad because Next Fifteen Communications Group is worth UK£960.5m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Next Fifteen Communications Group has a low net debt to EBITDA ratio of only 0.21. And its EBIT covers its interest expense a whopping 31.3 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On top of that, Next Fifteen Communications Group grew its EBIT by 99% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Next Fifteen Communications Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Next Fifteen Communications Group actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

The good news is that Next Fifteen Communications Group's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Considering this range of factors, it seems to us that Next Fifteen Communications Group is quite prudent with its debt, and the risks seem well managed. So we're not worried about the use of a little leverage on the balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Next Fifteen Communications Group you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Next 15 Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:NFG

Next 15 Group

Next 15 Group plc, together with its subsidiaries, customer insight, customer delivery, customer engagement, and business transformation services in the United Kingdom, Africa, the United States, Europe, Middle East, and Africa.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success