- United Kingdom

- /

- Media

- /

- AIM:MRIT

Market Cool On Merit Group plc's (LON:MRIT) Revenues Pushing Shares 44% Lower

Merit Group plc (LON:MRIT) shareholders that were waiting for something to happen have been dealt a blow with a 44% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

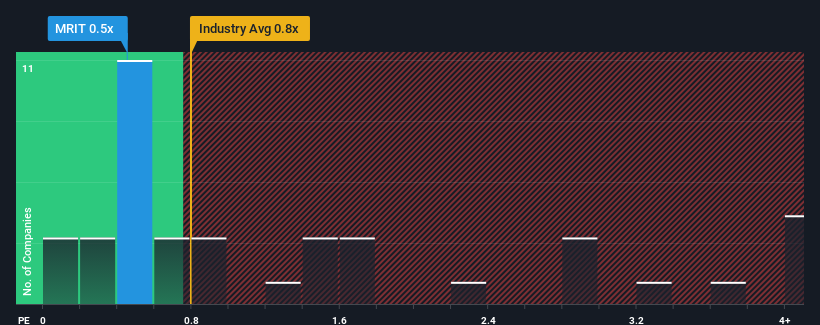

Even after such a large drop in price, it's still not a stretch to say that Merit Group's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Media industry in the United Kingdom, where the median P/S ratio is around 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Merit Group

How Has Merit Group Performed Recently?

There hasn't been much to differentiate Merit Group's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Merit Group will help you uncover what's on the horizon.How Is Merit Group's Revenue Growth Trending?

In order to justify its P/S ratio, Merit Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 7.0% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 19% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth will show minor resilience over the next year growing only by 4.0%. While this isn't a particularly impressive figure, it should be noted that the the industry is expected to decline by 2.3%.

Even though the growth is only slight, it's peculiar that Merit Group's P/S sits in line with the majority of other companies given the industry is set for a decline. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Merit Group looks to be in line with the rest of the Media industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Merit Group currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 3 warning signs for Merit Group (2 can't be ignored!) that we have uncovered.

If you're unsure about the strength of Merit Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:MRIT

Merit Group

Merit Group plc gathers, organizes, and enriches data that informs b2b intelligence brands in the United Kingdom, Belgium, the United States, France, Germany, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026