- United Kingdom

- /

- Machinery

- /

- AIM:SOM

UK Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic challenges. Amidst these broader market movements, investors often look for opportunities in less conventional areas such as penny stocks. Although the term "penny stocks" might seem outdated, it still refers to smaller or newer companies that can offer significant growth potential when backed by strong financials. In this context, we will explore a selection of UK penny stocks that stand out for their robust fundamentals and potential for long-term success.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.59 | £523.7M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.05 | £165.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.925 | £13.97M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.68 | $395.3M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.37 | £239.76M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.335 | £64.48M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.155 | £184.34M | ✅ 4 ⚠️ 2 View Analysis > |

| ME Group International (LSE:MEGP) | £1.516 | £572.63M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Eagle Eye Solutions Group (AIM:EYE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eagle Eye Solutions Group PLC provides marketing technology software as a service in multiple regions including the UK, France, the US, Canada, Australia, Europe, and Asia Pacific with a market cap of £84.20 million.

Operations: Eagle Eye Solutions Group's revenue is derived from two segments: Eagleai, contributing £5.74 million, and Organic, accounting for £42.45 million.

Market Cap: £84.2M

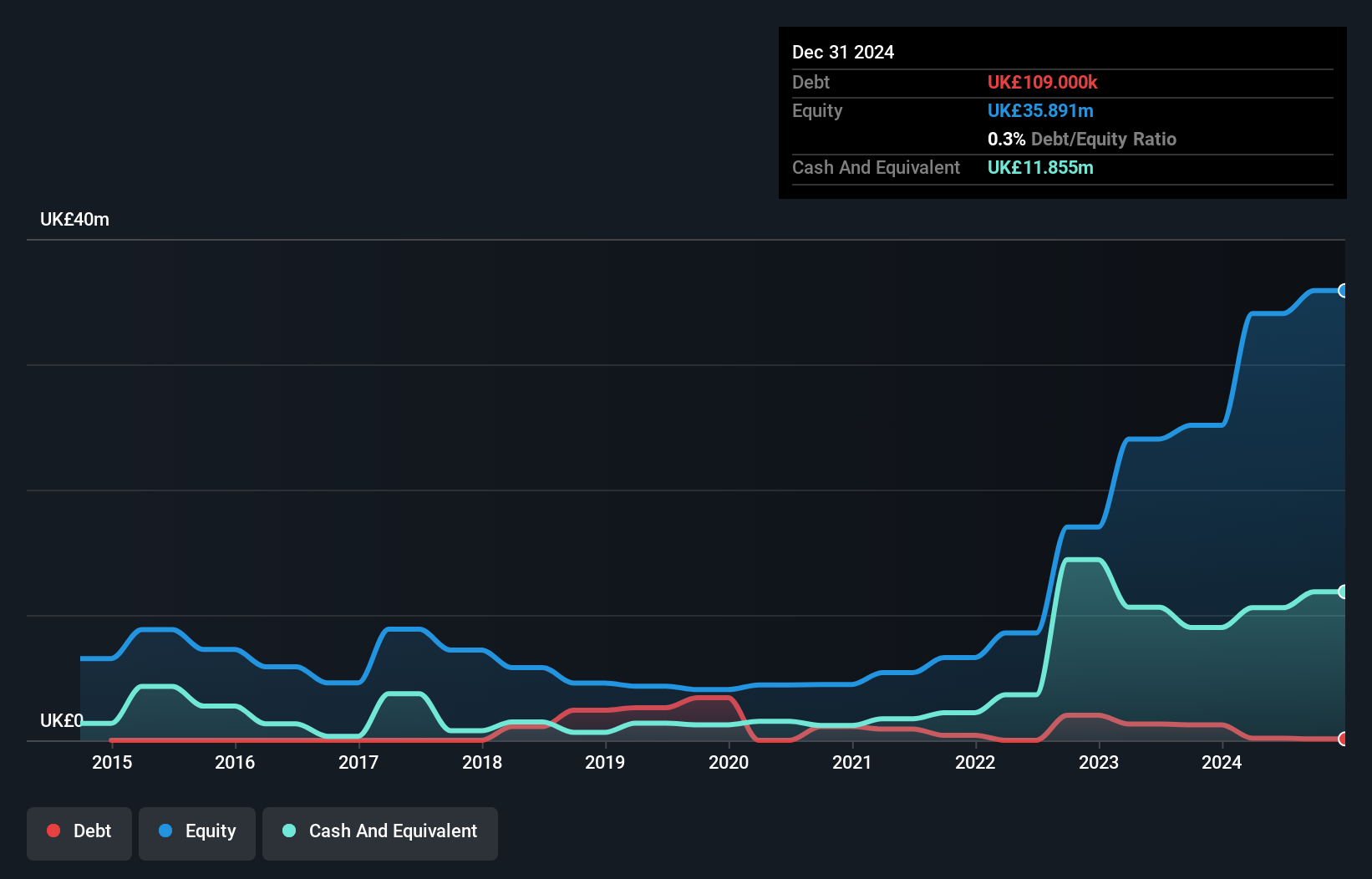

Eagle Eye Solutions Group, with a market cap of £84.20 million, offers marketing technology services across multiple regions. The company has experienced negative earnings growth recently, with net profit margins dropping to 3.4% from 9.5% last year. However, it remains financially stable with short-term assets exceeding liabilities and debt well-covered by operating cash flow. Recent developments include securing a five-year contract with a North American food retailer, indicating strategic focus on this lucrative market. Despite low return on equity at 5%, the company's earnings are forecasted to grow by 25.7% annually, suggesting potential future profitability improvements.

- Click to explore a detailed breakdown of our findings in Eagle Eye Solutions Group's financial health report.

- Gain insights into Eagle Eye Solutions Group's future direction by reviewing our growth report.

Somero Enterprises (AIM:SOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Somero Enterprises, Inc. specializes in designing, assembling, remanufacturing, selling, and distributing concrete leveling, contouring, and placing equipment with a market cap of £120.86 million.

Operations: The company's revenue is primarily derived from its Construction Machinery & Equipment segment, totaling $97.14 million.

Market Cap: £120.86M

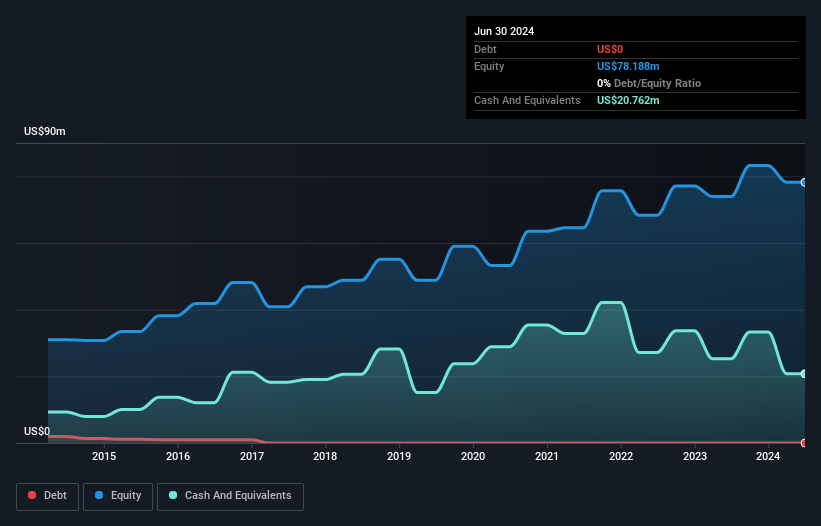

Somero Enterprises, with a market cap of £120.86 million, has faced challenges with declining earnings and profit margins dropping to 13.4% from 20.9% last year, alongside a revenue decrease to US$39.83 million for the half year ended June 30, 2025. Despite these setbacks, the company maintains financial stability with short-term assets significantly exceeding liabilities and remains debt-free. The board's experience is notable; however, dividend sustainability is uncertain given recent reductions to US$0.04 per share. Trading below estimated fair value by 36.8%, Somero's strategic buybacks suggest management confidence despite current profitability pressures.

- Navigate through the intricacies of Somero Enterprises with our comprehensive balance sheet health report here.

- Gain insights into Somero Enterprises' past trends and performance with our report on the company's historical track record.

WeCap (OFEX:WCAP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WeCap plc is a UK-based investment company with a market cap of £11.94 million.

Operations: There are no specific revenue segments reported for this UK-based investment company.

Market Cap: £11.94M

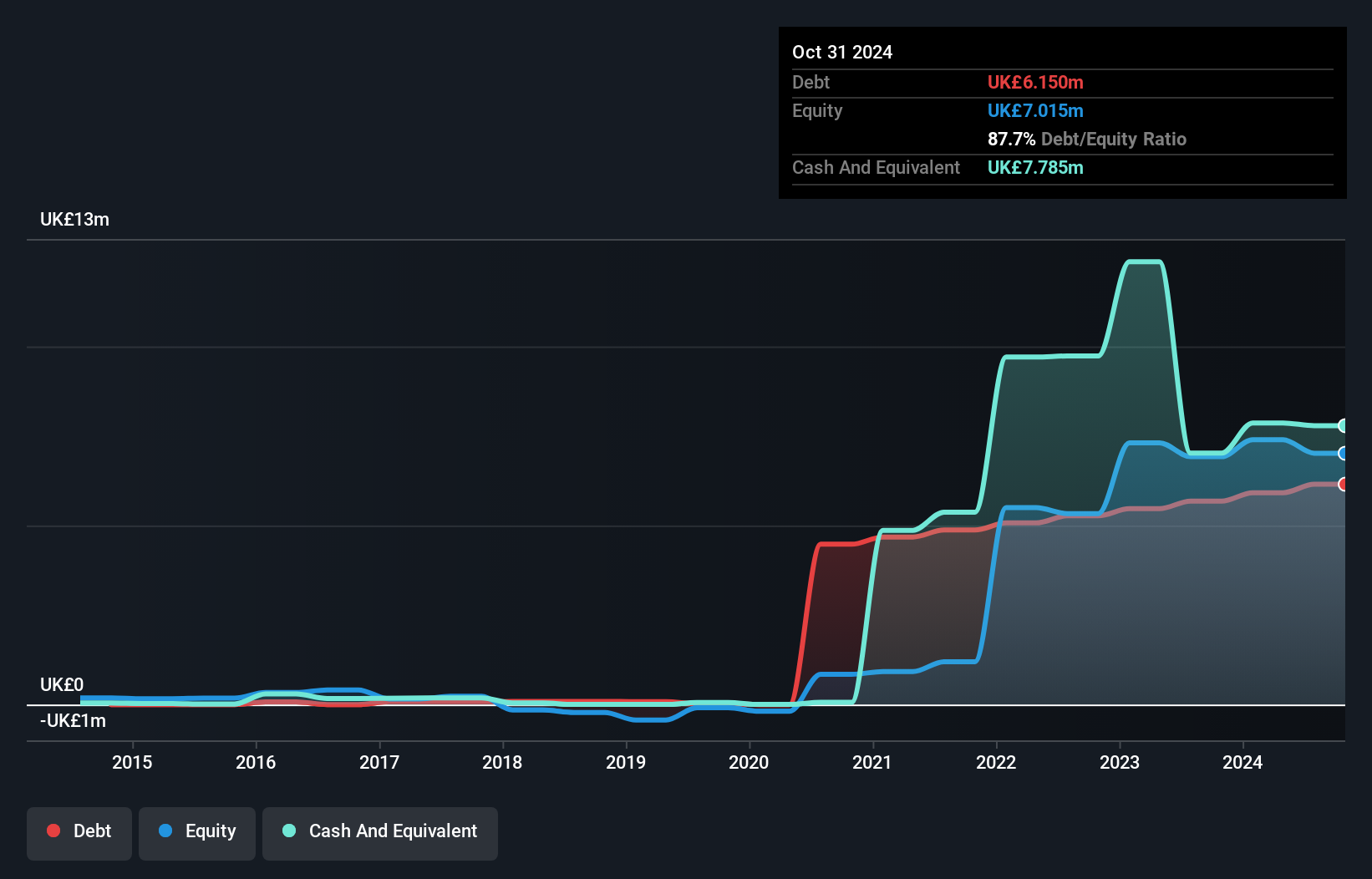

WeCap plc, with a market cap of £11.94 million, is a pre-revenue investment company facing significant financial hurdles. Recent filings reveal an auditor's qualified opinion due to going concern doubts and short-term assets of £92.3K falling well below liabilities of £6.5M. Despite raising £0.1 million through a follow-on equity offering, the company's high net debt to equity ratio (93.5%) and increased share price volatility (21% weekly) highlight its precarious position in the penny stock landscape. With only 4-5 months of cash runway based on free cash flow estimates, WeCap's financial outlook remains challenging without substantial revenue generation or further capital infusion.

- Unlock comprehensive insights into our analysis of WeCap stock in this financial health report.

- Learn about WeCap's historical performance here.

Seize The Opportunity

- Unlock our comprehensive list of 298 UK Penny Stocks by clicking here.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SOM

Somero Enterprises

Designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives