The Dianomi plc (LON:DNM) share price has fared very poorly over the last month, falling by a substantial 34%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 72% loss during that time.

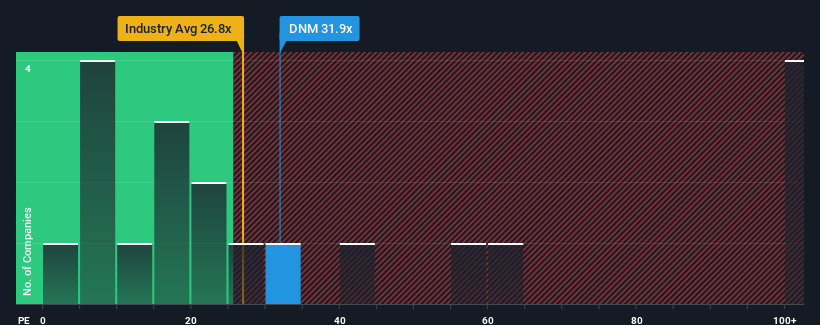

In spite of the heavy fall in price, Dianomi's price-to-earnings (or "P/E") ratio of 31.9x might still make it look like a strong sell right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios below 14x and even P/E's below 8x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For example, consider that Dianomi's financial performance has been pretty ordinary lately as earnings growth is non-existent. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Dianomi

How Is Dianomi's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Dianomi's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.2% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Dianomi's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Dianomi's P/E?

Dianomi's shares may have retreated, but its P/E is still flying high. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Dianomi currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 2 warning signs for Dianomi (1 is a bit unpleasant!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Dianomi. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:DNM

Dianomi

Provides native advertising services for the financial services, technology, corporate, and lifestyle sectors in Europe, the Middle East, Africa, the United States, and the Asia Pacific.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.