- United Kingdom

- /

- Media

- /

- AIM:DNM

Analysts Just Made A Major Revision To Their Dianomi plc (LON:DNM) Revenue Forecasts

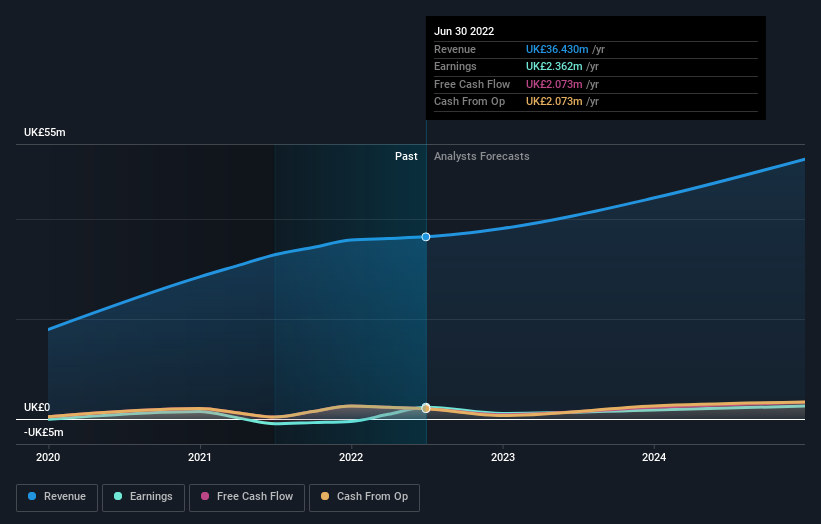

Market forces rained on the parade of Dianomi plc (LON:DNM) shareholders today, when the analysts downgraded their forecasts for this year. Revenue estimates were cut sharply as the analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

After the downgrade, the two analysts covering Dianomi are now predicting revenues of UK£38m in 2022. If met, this would reflect a credible 4.6% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing UK£45m of revenue in 2022. It looks like forecasts have become a fair bit less optimistic on Dianomi, given the substantial drop in revenue estimates.

See our latest analysis for Dianomi

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that Dianomi's revenue growth is expected to slow, with the forecast 4.6% annualised growth rate until the end of 2022 being well below the historical 11% growth over the last year. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 6.8% per year. Factoring in the forecast slowdown in growth, it seems obvious that Dianomi is also expected to grow slower than other industry participants.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Dianomi this year. They're also anticipating slower revenue growth than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Dianomi after today.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Dianomi's financials, such as concerns around earnings quality. For more information, you can click here to discover this and the 1 other flag we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:DNM

Dianomi

Provides native advertising services for the financial services, technology, corporate, and lifestyle sectors in Europe, the Middle East, Africa, the United States, and the Asia Pacific.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026