- United Kingdom

- /

- Entertainment

- /

- AIM:AEO

Here's Why Aeorema Communications (LON:AEO) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Aeorema Communications (LON:AEO). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Aeorema Communications with the means to add long-term value to shareholders.

See our latest analysis for Aeorema Communications

How Fast Is Aeorema Communications Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Aeorema Communications has managed to grow EPS by 20% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Aeorema Communications shareholders is that EBIT margins have grown from 3.6% to 6.7% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

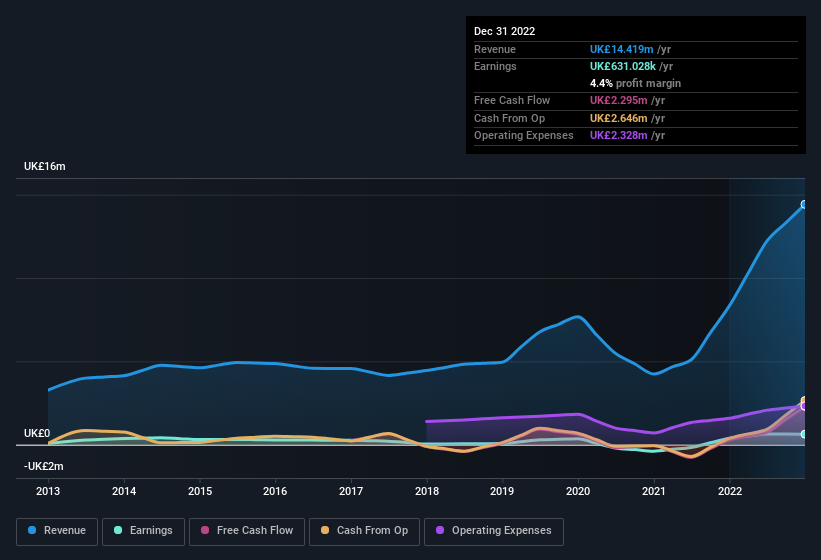

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Aeorema Communications isn't a huge company, given its market capitalisation of UK£6.9m. That makes it extra important to check on its balance sheet strength.

Are Aeorema Communications Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders both bought and sold Aeorema Communications shares in the last year, but the good news is they spent UK£24k more buying than they netted selling. At face value we can consider this a fairly encouraging sign for the company. We also note that it was the CEO & Executive Director, Steven Quah, who made the biggest single acquisition, paying UK£24k for shares at about UK£0.68 each.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Aeorema Communications will reveal that insiders own a significant piece of the pie. In fact, they own 61% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Of course, Aeorema Communications is a very small company, with a market cap of only UK£6.9m. That means insiders only have UK£4.2m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Aeorema Communications' CEO, Steve Quah, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Aeorema Communications, with market caps under UK£163m is around UK£286k.

Aeorema Communications offered total compensation worth UK£159k to its CEO in the year to June 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Aeorema Communications Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Aeorema Communications' strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Even so, be aware that Aeorema Communications is showing 4 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Keen growth investors love to see insider buying. Thankfully, Aeorema Communications isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AEO

Aeorema Communications

Engages in the provision of brand experience, strategic consultancy, and event services in the United Kingdom, the United States, and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives