- United Kingdom

- /

- Specialty Stores

- /

- LSE:MOTR

UK Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting ongoing global economic uncertainties. Despite these broader market fluctuations, investors often look toward penny stocks for their potential to offer growth opportunities at a lower price point. While the term "penny stocks" might seem outdated, they continue to represent an intriguing investment area for those interested in smaller or newer companies with strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.615 | £526.31M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.02 | £163.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.96 | £14.49M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.645 | $374.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.86 | £74.79M | ✅ 4 ⚠️ 3 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.495 | £72.21M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.505 | £43.53M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £181.95M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Facilities by ADF (AIM:ADF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Facilities by ADF plc offers premium serviced production facilities and equipment hire to the film and high-end television industry in the UK and Europe, with a market cap of £18.87 million.

Operations: The company's revenue segments include £7.20 million from Location One and a segment adjustment of £30.19 million.

Market Cap: £18.87M

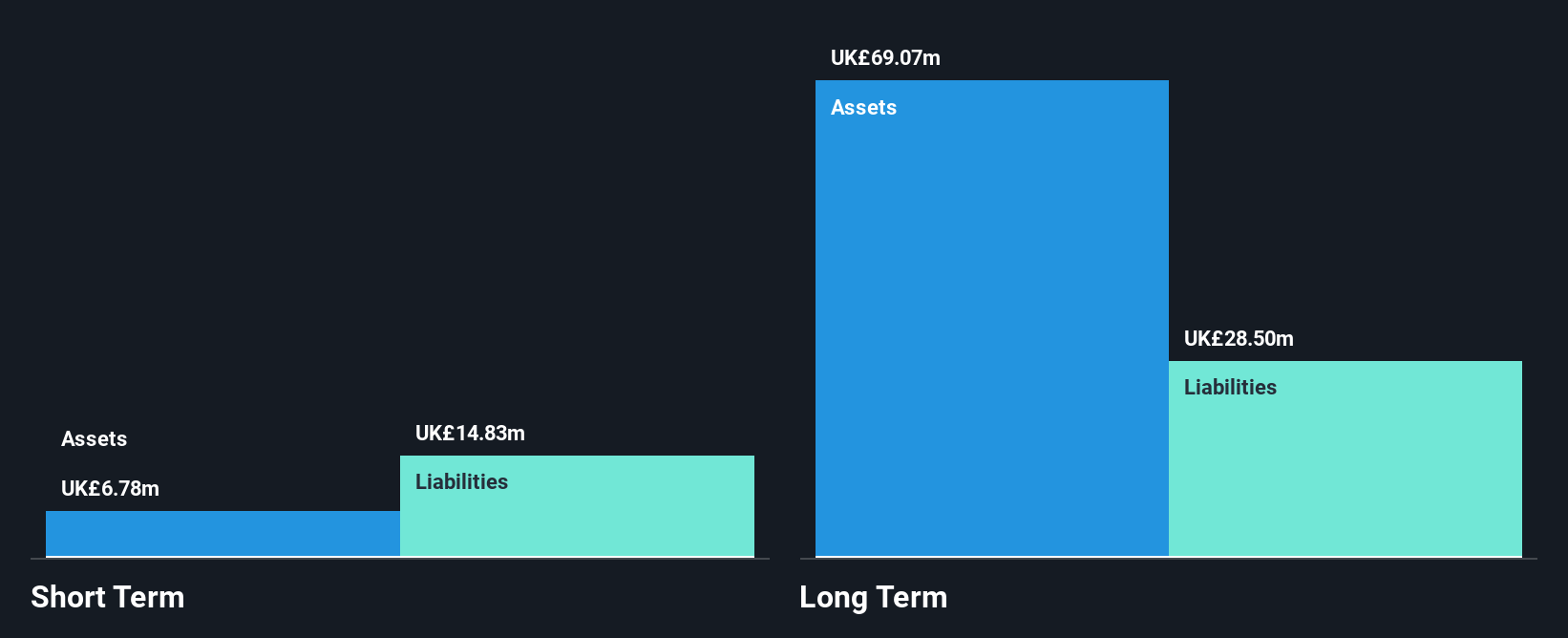

Facilities by ADF plc, with a market cap of £18.87 million, provides serviced production facilities and equipment hire to the film and television industry. Despite being unprofitable with increasing losses over the past five years, it has no debt, which mitigates financial risk. Recent executive changes include Nicola Pearcey as CEO from January 2026, bringing extensive industry experience from roles at Lionsgate and Disney. The company expects revenues in line with market expectations for 2025 at £42.6 million but faces challenges covering liabilities with current assets (£6.8M). Its dividend policy remains progressive despite coverage concerns due to its profitability issues.

- Click to explore a detailed breakdown of our findings in Facilities by ADF's financial health report.

- Gain insights into Facilities by ADF's future direction by reviewing our growth report.

Intercede Group (AIM:IGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Intercede Group plc is a cybersecurity company that develops and supplies identity and credential management software for digital trust across the UK, Europe, the US, and internationally, with a market cap of £79.25 million.

Operations: Intercede Group generates revenue from its Software & Programming segment, amounting to £17.38 million.

Market Cap: £79.25M

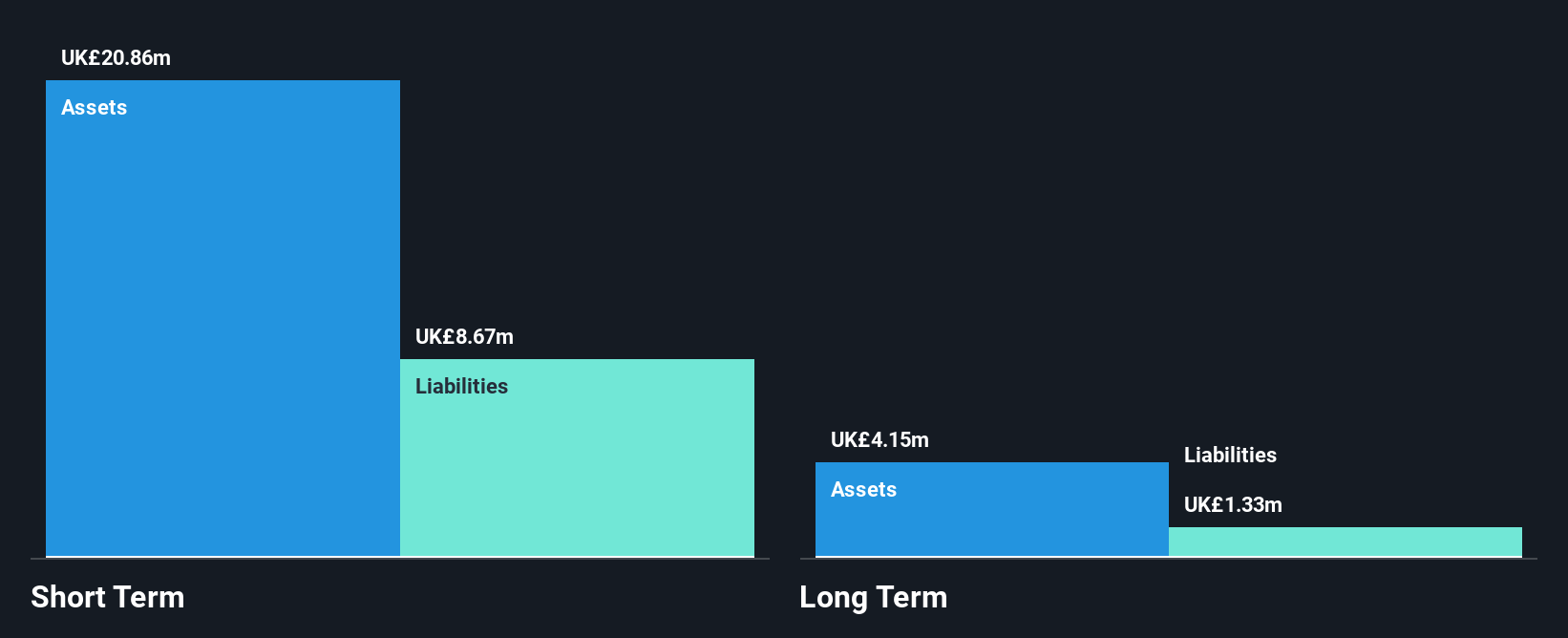

Intercede Group plc, with a market cap of £79.25 million, operates in the cybersecurity sector and shows financial stability with no debt and short-term assets (£21.0M) exceeding liabilities (£7.5M). Despite a high return on equity (22.1%), recent earnings have declined by 40.8% over the past year, contrasting its significant profit growth of 33.4% annually over five years. The company is actively exploring acquisitions to enhance its digital trust solutions across enterprises while maintaining strategic collaborations that have secured substantial government contracts totaling $4.2 million in Q3 FY2026, indicating robust demand for its credential management offerings globally.

- Dive into the specifics of Intercede Group here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Intercede Group's future.

Motorpoint Group (LSE:MOTR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Motorpoint Group Plc is an omnichannel vehicle retailer in the United Kingdom with a market cap of £111.49 million.

Operations: The company generates revenue through its Retail segment, which accounts for £1.10 billion, and its Wholesale segment, contributing £156.7 million.

Market Cap: £111.49M

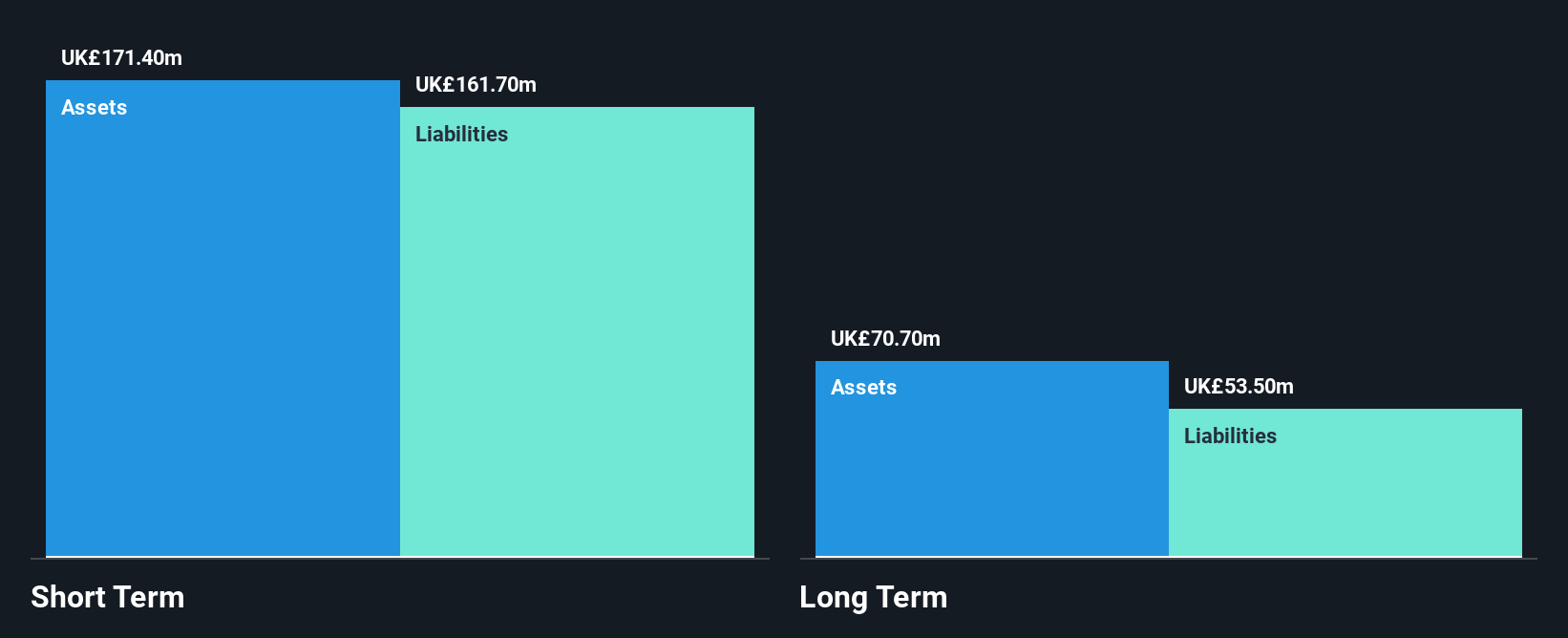

Motorpoint Group Plc, with a market cap of £111.49 million, has demonstrated financial resilience as it transitions to profitability. The company reported half-year sales of £647.7 million, up from £563.1 million the previous year, and net income rose to £2.7 million from £1.5 million. It operates without debt and maintains strong asset coverage over liabilities (£217.9M vs short-term liabilities of £205.9M). Despite a historical decline in earnings by 45% annually over five years, earnings are forecasted to grow significantly at 31% per year moving forward, supported by an experienced management team and board of directors.

- Unlock comprehensive insights into our analysis of Motorpoint Group stock in this financial health report.

- Understand Motorpoint Group's earnings outlook by examining our growth report.

Make It Happen

- Explore the 301 names from our UK Penny Stocks screener here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MOTR

Motorpoint Group

Operates as an omnichannel vehicle retailer in the United Kingdom.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026