Treatt plc's (LON:TET) periodic dividend will be increasing on the 10th of August to £0.0255, with investors receiving 2.0% more than last year's £0.025. Despite this raise, the dividend yield of 1.3% is only a modest boost to shareholder returns.

Check out our latest analysis for Treatt

Treatt's Payment Has Solid Earnings Coverage

If it is predictable over a long period, even low dividend yields can be attractive. The last dividend was quite comfortably covered by Treatt's earnings, but it was a bit tighter on the cash flow front. By paying out so much of its cash flows, this could indicate that the company has limited opportunities for investment and growth.

Over the next year, EPS is forecast to expand by 73.0%. If the dividend continues on this path, the payout ratio could be 28% by next year, which we think can be pretty sustainable going forward.

Treatt Has A Solid Track Record

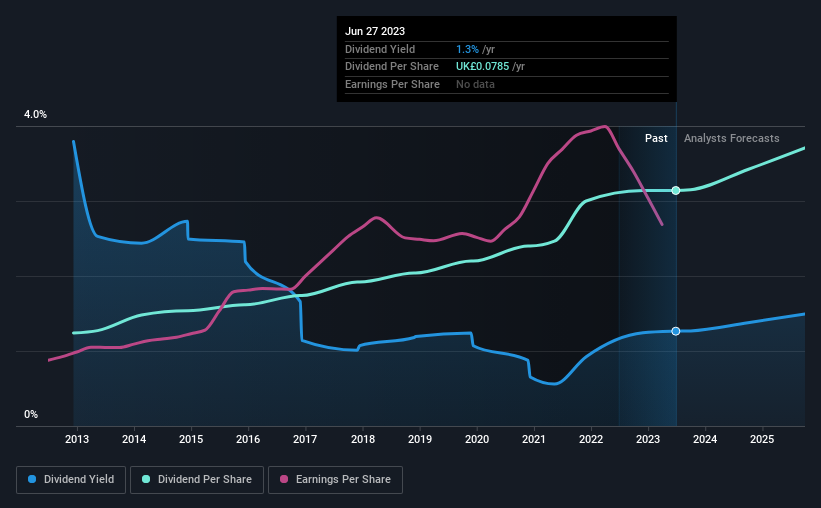

The company has an extended history of paying stable dividends. Since 2013, the dividend has gone from £0.031 total annually to £0.0785. This works out to be a compound annual growth rate (CAGR) of approximately 9.7% a year over that time. Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination as it provides a nice boost to shareholder returns.

Dividend Growth May Be Hard To Achieve

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. Although it's important to note that Treatt's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments Treatt has been making. We don't think Treatt is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for Treatt that investors should take into consideration. Is Treatt not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Treatt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:TET

Treatt

Manufactures and supplies various natural extracts and ingredients to beverage, flavor, fragrance, and consumer goods markets.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026