- United Kingdom

- /

- Metals and Mining

- /

- LSE:RIO

Rio Tinto Group (LSE:RIO) Eyes Growth with Simandou Project and Strategic Alliances Despite Market Challenges

Reviewed by Simply Wall St

Get an in-depth perspective on Rio Tinto Group's performance by reading our analysis here.

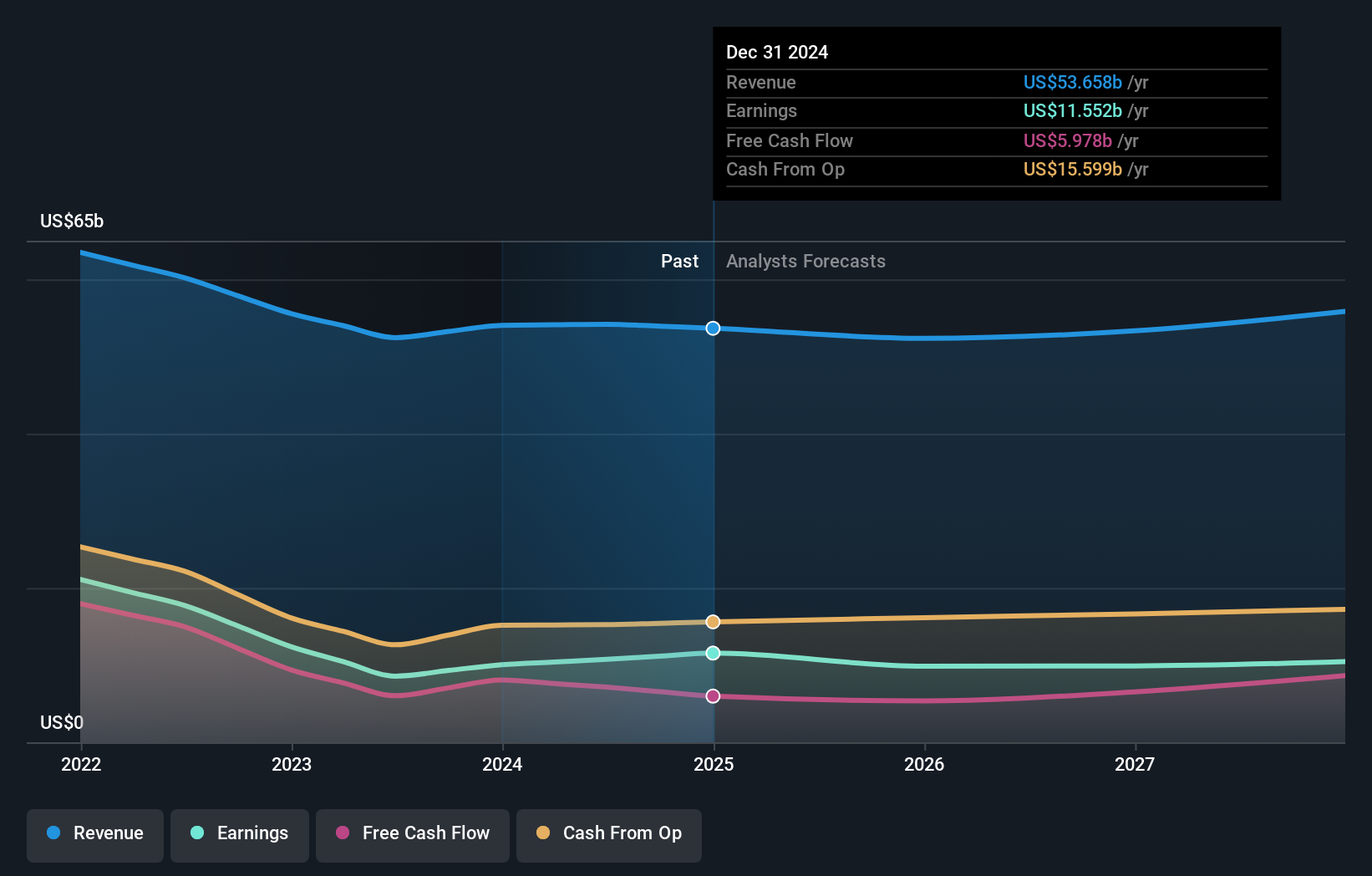

Strengths: Core Advantages Driving Sustained Success For Rio Tinto Group

Rio Tinto's financial health is robust, with underlying earnings of $4.8 billion, a 1% increase year-on-year, reflecting strong profitability and growth. The company also boasts a strong balance sheet and stable cash flow, with $7.1 billion from operations and $2.8 billion in free cash flow, despite rising capital expenditure. This financial stability allows Rio Tinto to maintain attractive returns to shareholders. The management team, led by CEO Jakob Stausholm, has been pivotal in driving production improvements, achieving a 10% boost in the first half. Additionally, Rio Tinto is considered good value with a Price-To-Earnings Ratio of 9.7x, significantly lower than both the peer average of 18.9x and the UK Metals and Mining industry average of 11x, indicating it is trading below its estimated fair value of £79.08.

Weaknesses: Critical Issues Affecting Rio Tinto's Performance and Areas For Growth

Despite its strengths, Rio Tinto faces several challenges. Performance issues at Kennecott highlight operational inefficiencies that need addressing. Market challenges, such as a 30% drop in steel demand from the Chinese property sector, have impacted revenue streams. Higher iron ore unit costs, driven by input price escalation and lower volumes, have also affected profitability. Furthermore, volumes in the TiO2 business have significantly declined due to weak market conditions. Additionally, Rio Tinto's Return on Equity is forecasted to be low at 16% in three years, and earnings are expected to decline by 0.06% per year over the next three years, indicating potential financial headwinds.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Rio Tinto has several strategic opportunities to enhance its market position. The full sanctioning of the Simandou project in Guinea marks a significant expansion in greenfield mining and infrastructure, positioning the company for long-term growth. The energy transition sectors, accounting for nearly one-third of Chinese GDP growth in 2023, present a lucrative market for Rio Tinto's materials. Strategic initiatives, such as the competitive power solutions announced for Boyne, and decarbonization efforts, align with global sustainability trends. Additionally, the joint venture with Aymium to produce renewable metallurgical biocarbon underscores Rio Tinto's commitment to reducing carbon emissions and capitalizing on emerging green technologies.

Threats: Key Risks and Challenges That Could Impact Rio Tinto's Success

Rio Tinto faces several external threats that could impact its success. Competitive pressures and market risks are evident, with global economic conditions not performing optimally, as noted by CFO Peter Cunningham. Regulatory issues also pose a threat, with the current draft of certain laws being impractical, according to CEO Jakob Stausholm. Operational risks, such as geotechnical issues, are ongoing challenges that the company must manage. Economic factors, including high interest rates in the West and overcapacity in China, could further strain Rio Tinto's financial performance. Additionally, the company's dividend, although high at 6.8%, is not well covered by free cash flows, raising concerns about its sustainability.

Conclusion

Rio Tinto's strong financial health, evidenced by its underlying earnings of $4.8 billion and stable cash flow, positions the company well to navigate current market challenges and maintain attractive shareholder returns. Despite operational inefficiencies and market pressures, the company's strategic initiatives, such as the Simandou project and decarbonization efforts, offer significant growth potential. The company's Price-To-Earnings Ratio of 9.7x, significantly lower than the peer average of 18.9x and the UK Metals and Mining industry average of 11x, suggests it is trading below its estimated fair value of £79.08, indicating potential for upward price movement. However, external threats like regulatory issues and economic factors must be managed carefully to sustain long-term performance and financial stability.

Turning Ideas Into Actions

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:RIO

Rio Tinto Group

Engages in exploring, mining, and processing mineral resources worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives