- United Kingdom

- /

- Basic Materials

- /

- LSE:RHIM

How Is RHI Magnesita's (LON:RHIM) CEO Paid Relative To Peers?

This article will reflect on the compensation paid to Stefan Borgas who has served as CEO of RHI Magnesita N.V. (LON:RHIM) since 2017. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for RHI Magnesita.

See our latest analysis for RHI Magnesita

Comparing RHI Magnesita N.V.'s CEO Compensation With the industry

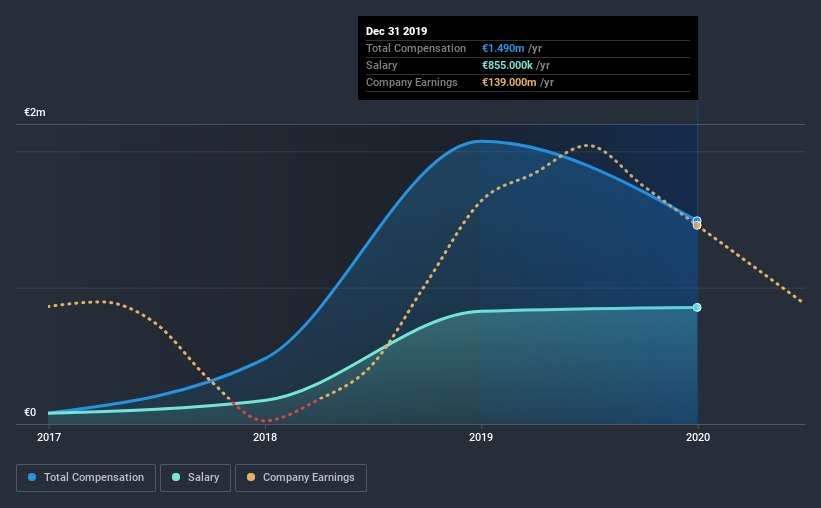

At the time of writing, our data shows that RHI Magnesita N.V. has a market capitalization of UK£1.7b, and reported total annual CEO compensation of €1.5m for the year to December 2019. We note that's a decrease of 28% compared to last year. Notably, the salary which is €855.0k, represents most of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between UK£750m and UK£2.4b had a median total CEO compensation of €1.9m. So it looks like RHI Magnesita compensates Stefan Borgas in line with the median for the industry. Furthermore, Stefan Borgas directly owns UK£604k worth of shares in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | €855k | €826k | 57% |

| Other | €635k | €1.2m | 43% |

| Total Compensation | €1.5m | €2.1m | 100% |

On an industry level, around 43% of total compensation represents salary and 57% is other remuneration. RHI Magnesita pays out 57% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at RHI Magnesita N.V.'s Growth Numbers

RHI Magnesita N.V. saw earnings per share stay pretty flat over the last three years. In the last year, its revenue is down 18%.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has RHI Magnesita N.V. Been A Good Investment?

Given the total shareholder loss of 8.1% over three years, many shareholders in RHI Magnesita N.V. are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we noted earlier, RHI Magnesita pays its CEO in line with similar-sized companies belonging to the same industry. But with negative shareholder returns and unimpressive EPS growth, shareholders will surely be disturbed. CEO pay isn't exceptionally high, but considering poor performance, shareholders will likely hold off support for a raise until results improve.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 4 warning signs for RHI Magnesita that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade RHI Magnesita, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:RHIM

RHI Magnesita

Develops, produces, sells, installs, and maintains refractory products and systems used in industrial high-temperature processes worldwide.

Very undervalued with solid track record.