- United Kingdom

- /

- Chemicals

- /

- LSE:JMAT

Did You Manage To Avoid Johnson Matthey's (LON:JMAT) 19% Share Price Drop?

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in Johnson Matthey Plc (LON:JMAT), since the last five years saw the share price fall 19%. Furthermore, it's down 10% in about a quarter. That's not much fun for holders.

Check out our latest analysis for Johnson Matthey

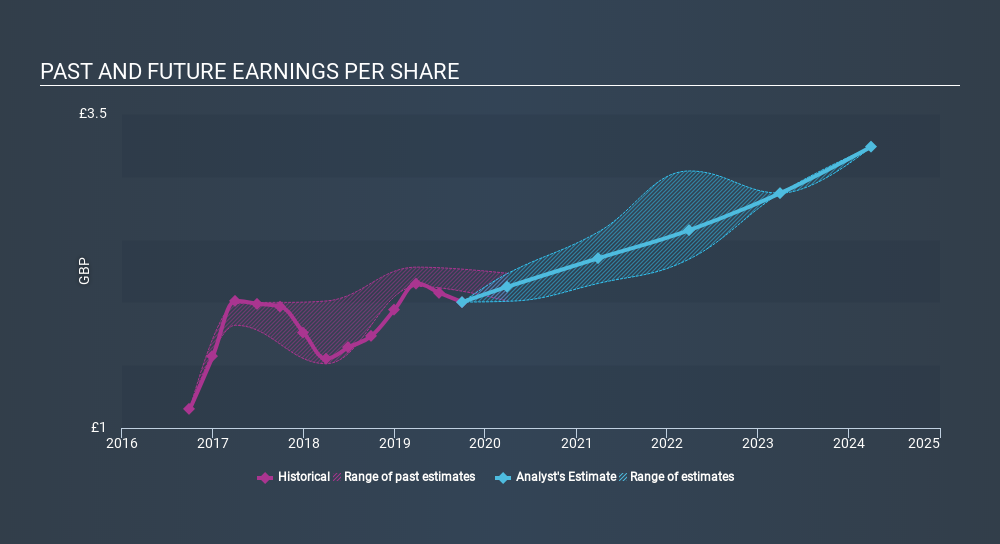

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate half decade during which the share price slipped, Johnson Matthey actually saw its earnings per share (EPS) improve by 2.5% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

With EPS gaining and a declining share price, one would suggest the market is cooling on its view of the company. Generally speaking, though, if the company can keep growing EPS then the share price will eventually follow.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free interactive report on Johnson Matthey's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Johnson Matthey the TSR over the last 5 years was -2.7%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Johnson Matthey had a tough year, with a total loss of 4.6% (including dividends) , against a market gain of about 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Johnson Matthey better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Johnson Matthey , and understanding them should be part of your investment process.

Johnson Matthey is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:JMAT

Johnson Matthey

Engages in the clean air, catalyst and hydrogen technology, and platinum group metals (PGM) service businesses in the United Kingdom, Germany, rest of Europe, the United States, rest of North America, China, rest of Asia, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives