- United Kingdom

- /

- Chemicals

- /

- LSE:JMAT

Did Changing Sentiment Drive Johnson Matthey's (LON:JMAT) Share Price Down By 18%?

As an investor its worth striving to ensure your overall portfolio beats the market average. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term Johnson Matthey Plc (LON:JMAT) shareholders, since the share price is down 18% in the last three years, falling well short of the market return of around 16%. Furthermore, it's down 15% in about a quarter. That's not much fun for holders.

See our latest analysis for Johnson Matthey

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Johnson Matthey actually managed to grow EPS by 9.0% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

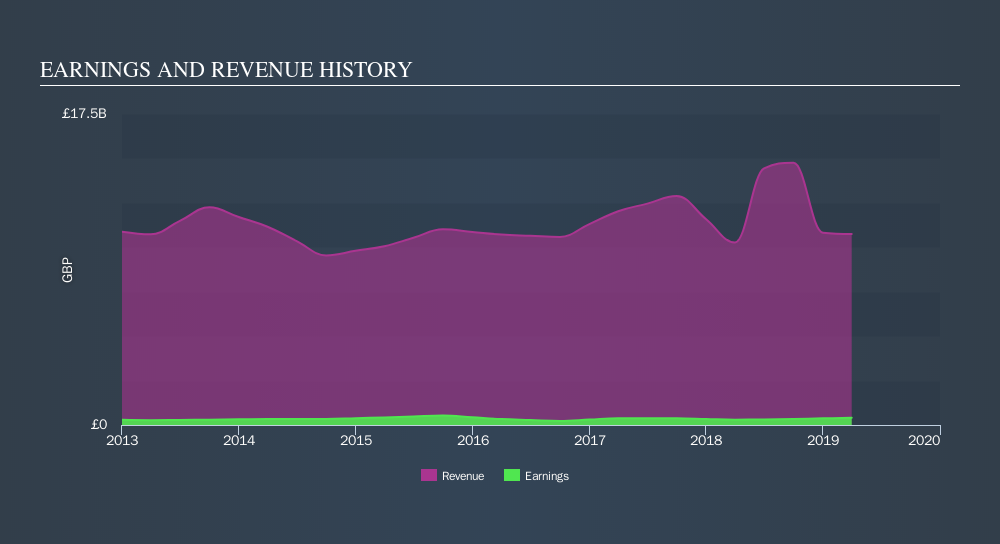

We note that, in three years, revenue has actually grown at a 4.2% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Johnson Matthey further; while we may be missing something on this analysis, there might also be an opportunity.

The graphic below depicts how revenue has changed over time.

Johnson Matthey is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Johnson Matthey stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Johnson Matthey the TSR over the last 3 years was -12%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Investors in Johnson Matthey had a tough year, with a total loss of 13% (including dividends) , against a market gain of about 1.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 3.4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before spending more time on Johnson Matthey it might be wise to click here to see if insiders have been buying or selling shares.

But note: Johnson Matthey may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:JMAT

Johnson Matthey

Engages in the clean air, catalyst and hydrogen technology, and platinum group metals (PGM) service businesses in the United Kingdom, Germany, rest of Europe, the United States, rest of North America, China, rest of Asia, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026