- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

Undervalued Small Caps In United Kingdom Backed By Insider Buying

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced turbulence, with the FTSE 100 index closing lower due to weak trade data from China and broader global economic concerns. Despite these challenges, certain small-cap stocks in the UK present intriguing opportunities, particularly those that are undervalued and have seen insider buying. Identifying such stocks can be advantageous in a volatile market environment where insider confidence may signal potential resilience or growth prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 24.4x | 5.5x | 13.33% | ★★★★★☆ |

| Essentra | 848.9x | 1.6x | 47.21% | ★★★★★☆ |

| GB Group | NA | 3.1x | 32.72% | ★★★★★☆ |

| Norcros | 7.4x | 0.5x | 3.23% | ★★★★☆☆ |

| NWF Group | 9.1x | 0.1x | 32.36% | ★★★★☆☆ |

| CVS Group | 22.5x | 1.2x | 40.33% | ★★★★☆☆ |

| Hochschild Mining | NA | 1.8x | 37.68% | ★★★★☆☆ |

| Foxtons Group | 27.2x | 1.3x | 46.10% | ★★★☆☆☆ |

| Franchise Brands | 115.2x | 2.9x | 49.48% | ★★★☆☆☆ |

| Watkin Jones | NA | 0.2x | -10.21% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

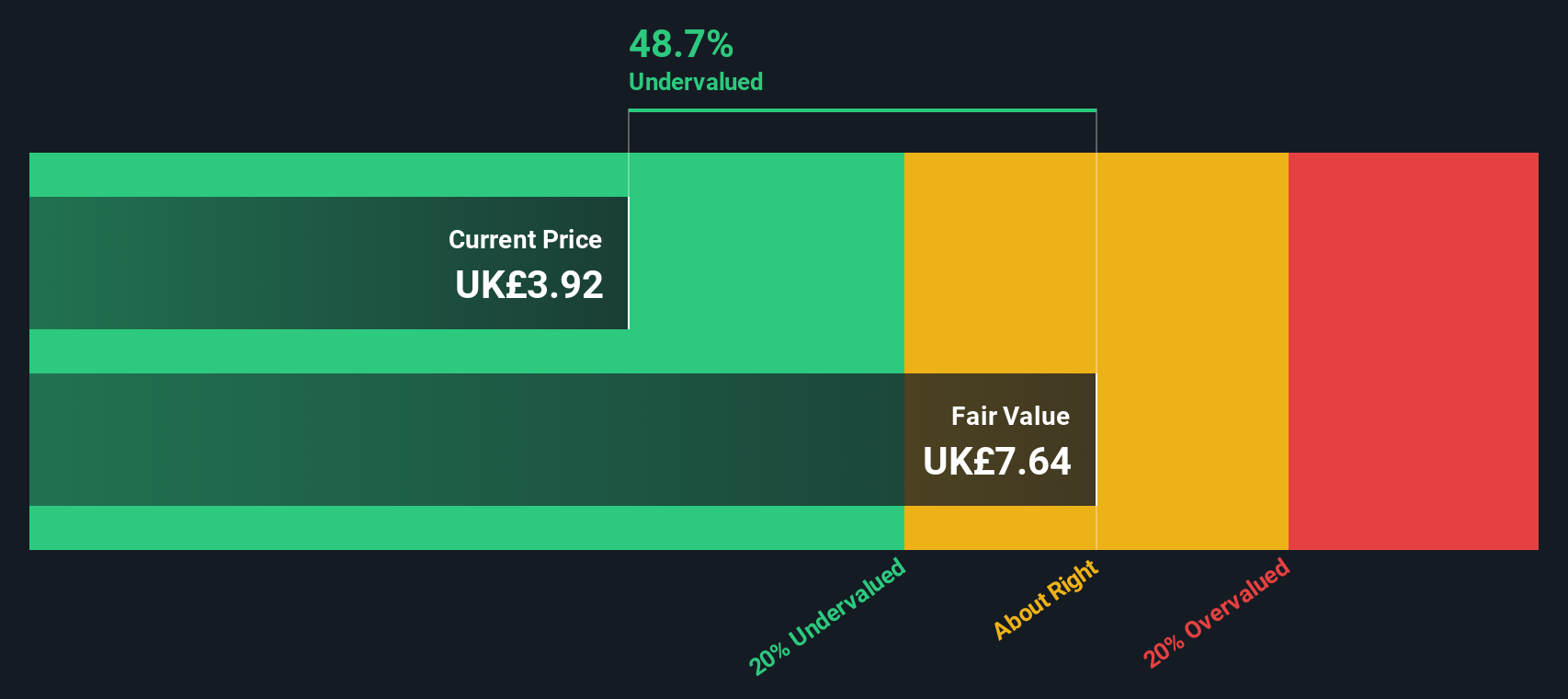

Breedon Group (LSE:BREE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Breedon Group is a construction materials company with operations in cement, aggregates, asphalt, ready-mixed concrete, and contracting services across Great Britain and Ireland, holding a market cap of approximately £1.40 billion.

Operations: Breedon Group generates revenue primarily from its Cement (£311.30 million), Ireland (£237.60 million), and Great Britain (£1006.60 million) segments, with total revenue reaching £1509.4 million as of August 2024. The company's gross profit margin has varied, with a recent value of 0.10819% in June 2024, reflecting changes in cost structures and operational efficiencies over time.

PE: 15.1x

Breedon Group, a small cap stock in the UK, has shown insider confidence with share purchases over the past six months. For H1 2024, they reported sales of £764.6 million and net income of £34.1 million, down from £43.9 million last year. Despite this dip, earnings are forecasted to grow 14% annually. The company relies entirely on external borrowing for funding but continues to show potential for future growth given its revenue trajectory and insider activity.

- Click to explore a detailed breakdown of our findings in Breedon Group's valuation report.

Review our historical performance report to gain insights into Breedon Group's's past performance.

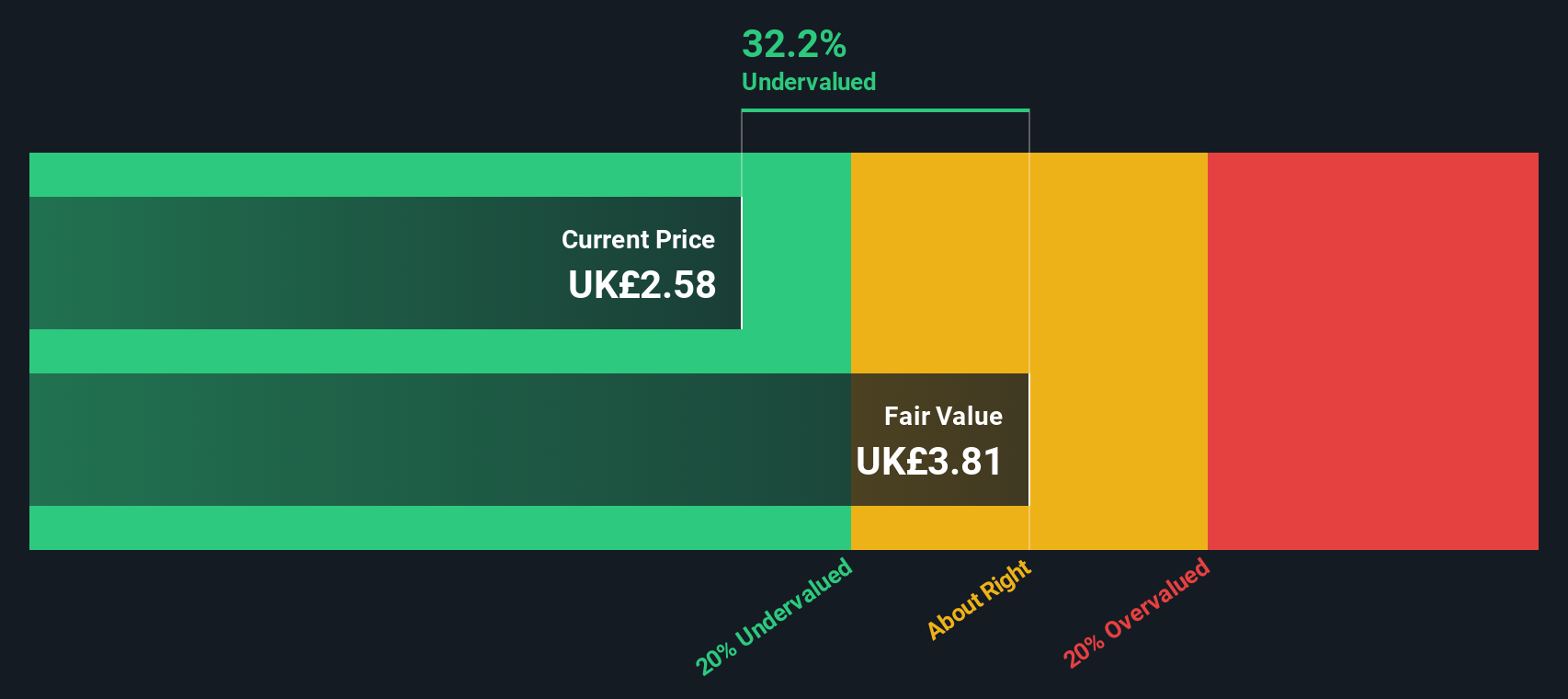

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates a network of franchise and corporate pizza stores, generating income from sales to franchisees, corporate store operations, advertising and e-commerce, property rentals, and various fees, with a market cap of approximately £1.50 billion.

Operations: The company generates revenue primarily through sales to franchisees (£461 million), corporate store income (£42.90 million), national advertising and e-commerce income (£85.50 million), rental income on leasehold and freehold property (£1.90 million), and royalties, franchise fees, and change of hands fees (£82.40 million). The net profit margin has shown a notable trend, reaching 18.28% in the most recent period ending June 2023 from 7.72% in September 2013 while gross profit margin was at its highest at 47.48% in June 2024 from an initial value of around 36%.

PE: 15.6x

Domino's Pizza Group, a small cap in the UK, has seen insider confidence with notable share purchases over the past year. Despite a decline in profit margins from 18.2% to 11.4%, earnings are forecasted to grow by 9.73% annually. The company repurchased around 6.12% of its shares for £90.1 million and announced an interim dividend of £0.035 per share payable on September 27, 2024, signaling potential value for investors amidst high debt levels and external borrowing risks.

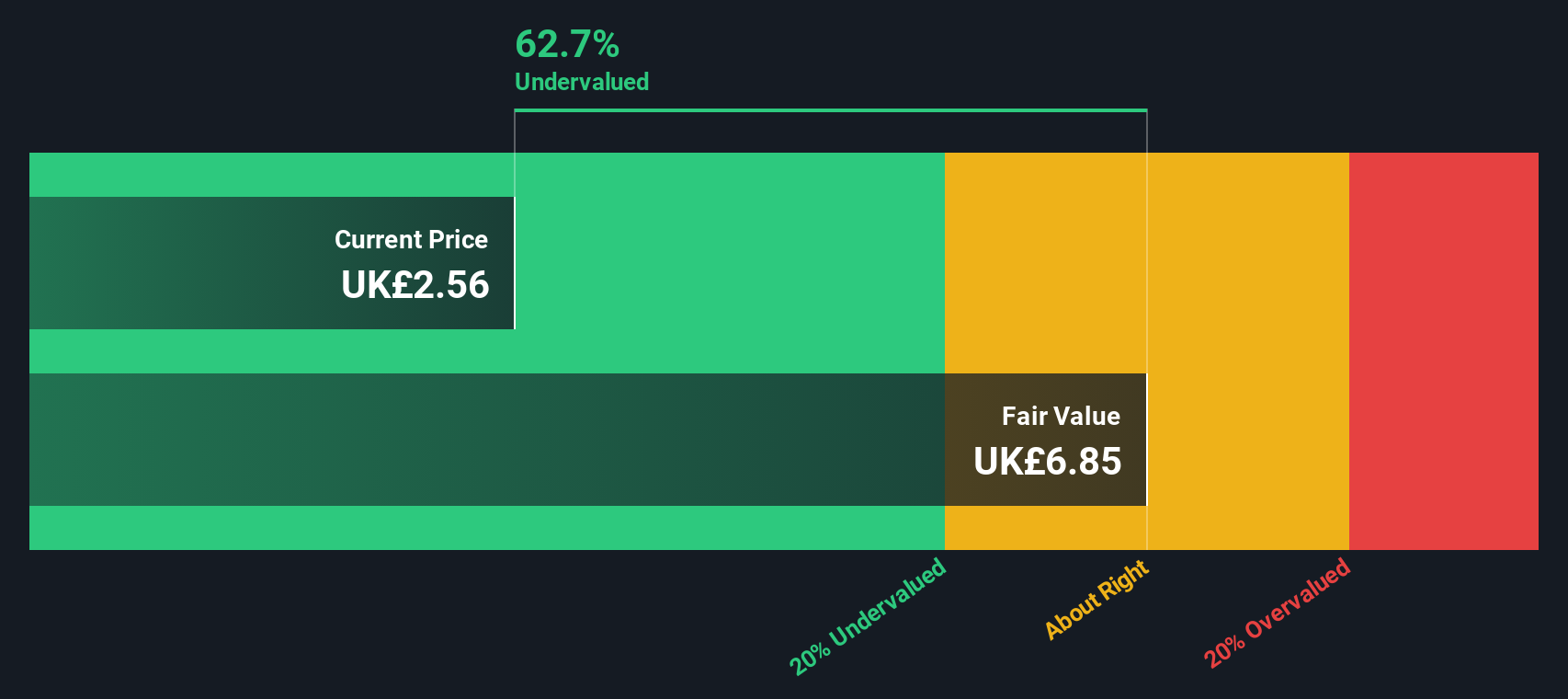

Hochschild Mining (LSE:HOC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hochschild Mining is a precious metals company primarily engaged in the exploration, mining, and sale of silver and gold from its operations in San Jose, Inmaculada, and Pallancata with a market cap of £0.54 billion.

Operations: Hochschild Mining's revenue primarily comes from its Inmaculada and San Jose operations, contributing $396.64 million and $242.46 million respectively. The company's gross profit margin has varied over time, with recent figures around 26.46%. Operating expenses have shown fluctuations, with the latest reported at $100.89 million for the period ending December 2023.

PE: -23.2x

Hochschild Mining, a small cap in the UK, has shown promising signs of being undervalued. In July 2024, they reported increased gold production of 66.37 koz for Q2 compared to 54.12 koz last year and reiterated their annual production guidance of up to 360,000 gold equivalent ounces. Insider confidence is evident as CEO Eduardo Navarro purchased 148,000 shares worth £235k in June 2024, increasing their holdings by over half. Despite relying on external borrowing for funding, earnings are forecasted to grow annually by nearly 54%.

- Unlock comprehensive insights into our analysis of Hochschild Mining stock in this valuation report.

Assess Hochschild Mining's past performance with our detailed historical performance reports.

Taking Advantage

- Unlock more gems! Our Undervalued UK Small Caps With Insider Buying screener has unearthed 28 more companies for you to explore.Click here to unveil our expertly curated list of 31 Undervalued UK Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives