- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

UK Growth Stocks With High Insider Ownership For October 2024

Reviewed by Simply Wall St

The UK stock market has recently experienced turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns about global economic recovery. In this climate of uncertainty, investors may look toward growth companies with high insider ownership as these stocks often indicate strong confidence from those closest to the business operations.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 86.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 28.2% |

| Judges Scientific (AIM:JDG) | 10.6% | 23% |

| Enteq Technologies (AIM:NTQ) | 20% | 53.8% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 29.0% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| Tortilla Mexican Grill (AIM:MEX) | 27.4% | 120.4% |

Let's explore several standout options from the results in the screener.

Franchise Brands (AIM:FRAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Franchise Brands plc operates in franchising and related activities across the United Kingdom, North America, and Europe, with a market cap of £320.05 million.

Operations: The company's revenue segments include Azura (£0.81 million), Pirtek (£60.78 million), B2C Division (£5.95 million), Filta International (£25.64 million), and Water & Waste Services (£49.17 million).

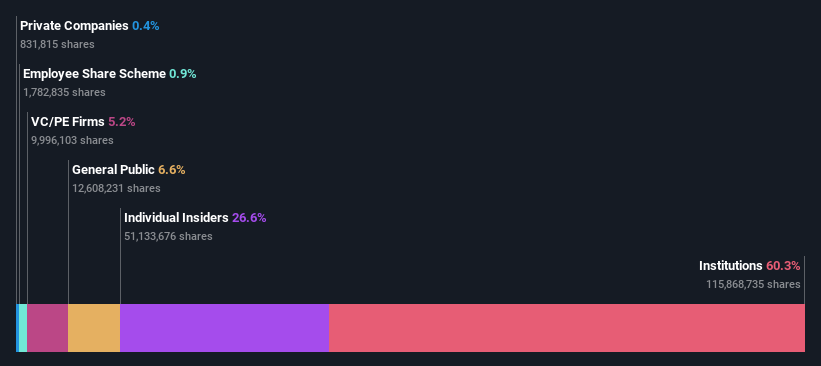

Insider Ownership: 22.9%

Earnings Growth Forecast: 44.2% p.a.

Franchise Brands has demonstrated strong growth, with earnings increasing 82.8% over the past year and expected to grow significantly above the UK market average. Despite some insider selling, analysts predict a potential 94.8% stock price increase. Recent leadership changes aim to optimize governance as the company expands its £400m annual sales across multiple regions. Trading at a discount to its estimated fair value, Franchise Brands is poised for continued expansion through strategic acquisitions and integration efforts.

- Unlock comprehensive insights into our analysis of Franchise Brands stock in this growth report.

- Our expertly prepared valuation report Franchise Brands implies its share price may be lower than expected.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of approximately £1.21 billion.

Operations: The company's revenue segments include $266.70 million from San Jose and $451.91 million from Inmaculada, with a segment adjustment of $79.60 million.

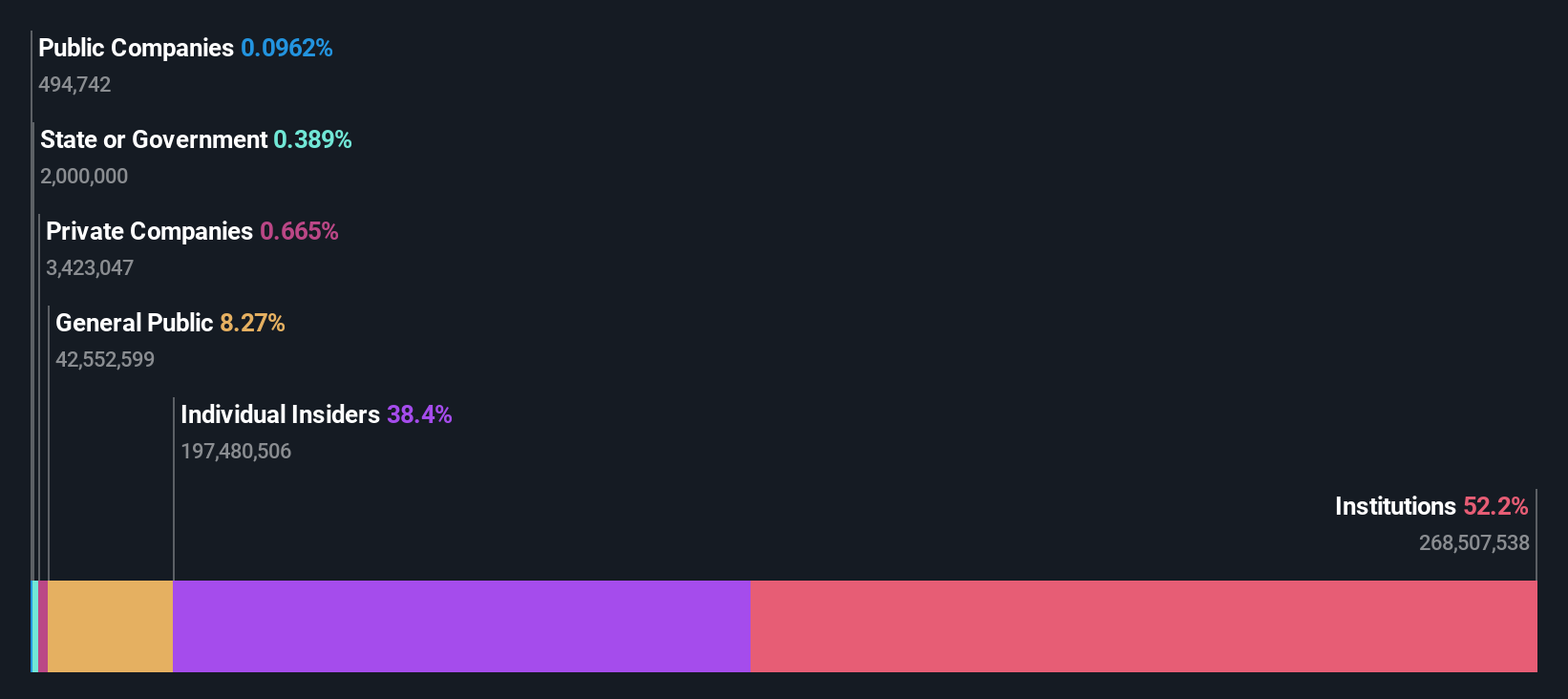

Insider Ownership: 38.4%

Earnings Growth Forecast: 50.4% p.a.

Hochschild Mining, with substantial insider ownership, has recently turned profitable, reporting a net income of US$39.52 million for H1 2024 compared to a loss previously. The company's earnings are projected to grow significantly at 50.39% annually, outpacing the UK market average of 14%. Despite high debt levels and share price volatility, Hochschild's revenue is expected to increase by 8.1% annually—faster than the broader UK market growth rate.

- Click here and access our complete growth analysis report to understand the dynamics of Hochschild Mining.

- Our expertly prepared valuation report Hochschild Mining implies its share price may be too high.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates in Georgia, Azerbaijan, and Uzbekistan offering banking, leasing, insurance, brokerage, and card processing services to both corporate and individual clients with a market cap of £1.59 billion.

Operations: The company's revenue segments include Uzbekistan Operations generating GEL 236.42 million, with a Segment Adjustment of GEL 2.13 billion.

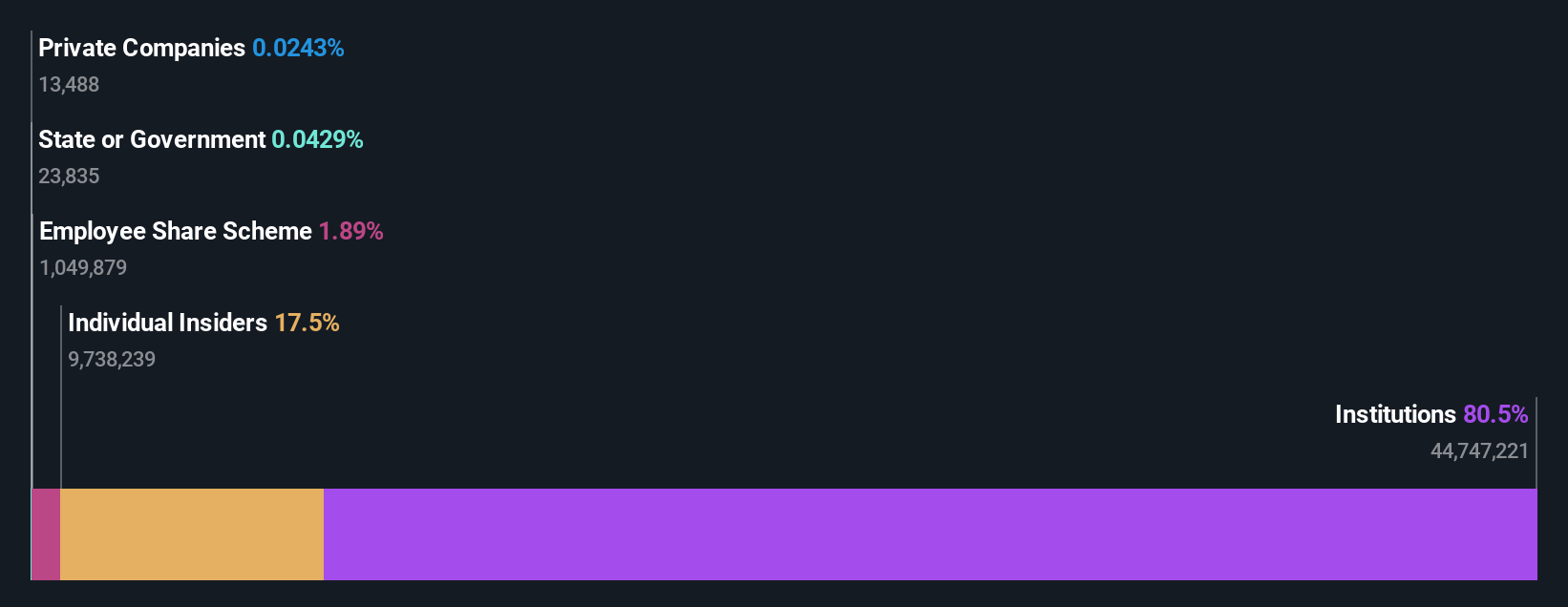

Insider Ownership: 17.6%

Earnings Growth Forecast: 15.3% p.a.

TBC Bank Group shows promising growth prospects with earnings expected to rise by 15.3% annually, surpassing the UK market average. Its revenue is also forecasted to grow at 18.9% per year, indicating strong performance relative to peers. Despite a low allowance for bad loans and an unstable dividend track record, TBC trades at a significant discount to its estimated fair value. Recent leadership changes include appointing Giorgi Giguashvili as Company Secretary, enhancing corporate governance expertise.

- Click here to discover the nuances of TBC Bank Group with our detailed analytical future growth report.

- Our valuation report unveils the possibility TBC Bank Group's shares may be trading at a discount.

Turning Ideas Into Actions

- Dive into all 65 of the Fast Growing UK Companies With High Insider Ownership we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United States, Canada, Brazil, and Chile.

Reasonable growth potential low.