- United Kingdom

- /

- Healthtech

- /

- AIM:CRW

UK Growth Companies With High Insider Ownership In September 2025

Reviewed by Simply Wall St

In the current economic climate, the UK market faces challenges as evidenced by recent declines in major indices like the FTSE 100 and FTSE 250, largely influenced by weak trade data from China. Amidst these fluctuations, growth companies with high insider ownership can present potential opportunities as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 24.3% | 91.4% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 18.2% | 20.8% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20.8% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 85.7% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 24.6% | 62% |

| ENGAGE XR Holdings (AIM:EXR) | 15.3% | 84.5% |

| B90 Holdings (AIM:B90) | 22.1% | 138.6% |

| ASA International Group (LSE:ASAI) | 18.4% | 23.3% |

| ActiveOps (AIM:AOM) | 21.6% | 43.3% |

Here's a peek at a few of the choices from the screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, along with its subsidiaries, develops, licenses, and supports computer software for the healthcare industry in the United States and has a market cap of £819.45 million.

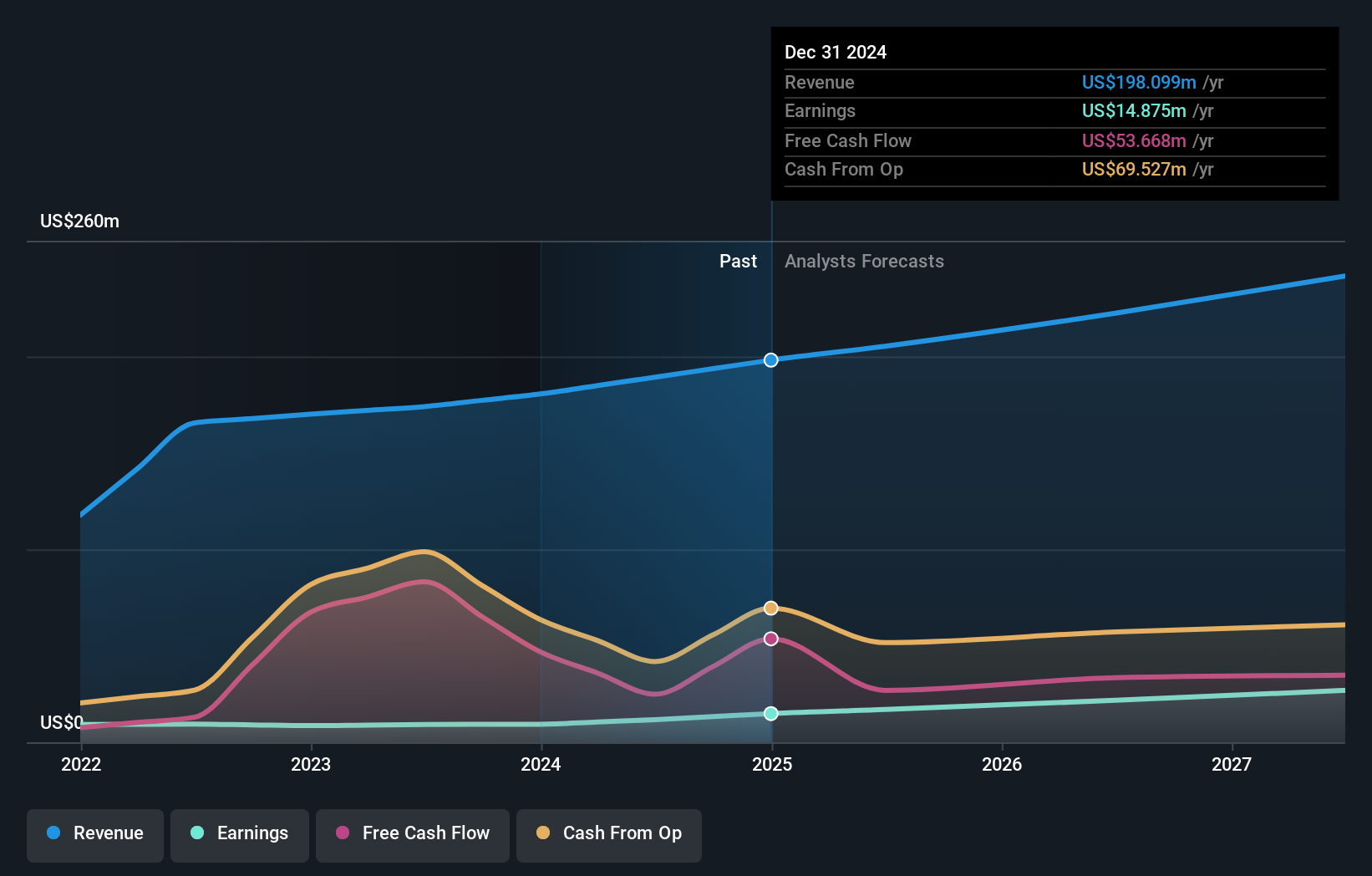

Operations: The company generates revenue through its healthcare software segment, which reported $198.10 million.

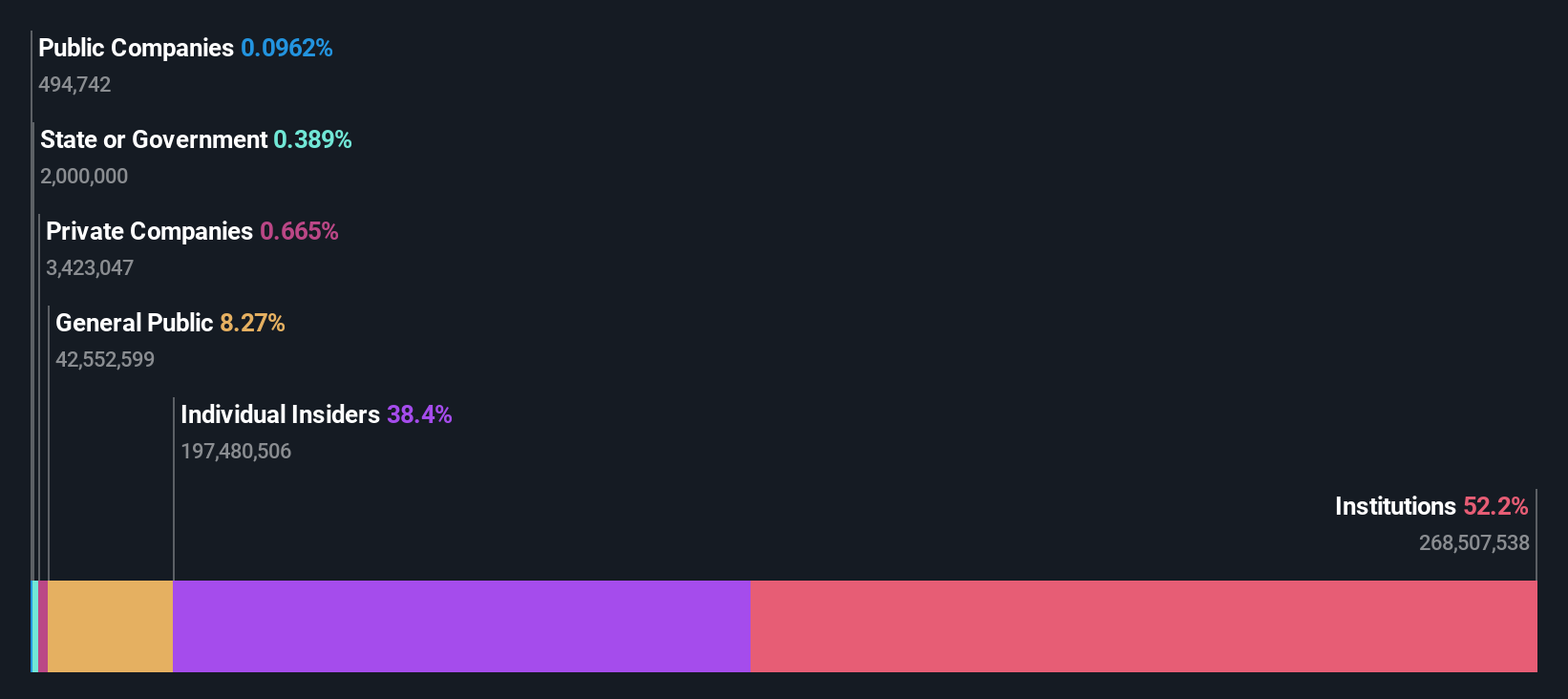

Insider Ownership: 17.4%

Craneware, with high insider ownership, is on a growth trajectory. Its earnings are expected to grow significantly at 23.1% annually, outpacing the UK market. The company's recent refinancing of its $100 million Revolving Credit Facility enhances financial flexibility for potential M&A activities and shareholder returns. Positive trading in FY2025 resulted in strong revenue growth and increased profitability, supported by robust cash reserves and reduced debt levels of $27.7 million as of June 2025.

- Unlock comprehensive insights into our analysis of Craneware stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Craneware shares in the market.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile with a market cap of £1.70 billion.

Operations: The company's revenue is primarily derived from its operations at the Inmaculada mine ($568.64 million), the San Jose mine ($320.31 million), and the Mara Rosa project ($186.58 million).

Insider Ownership: 38.4%

Hochschild Mining, characterized by substantial insider ownership, is experiencing robust growth. Recent earnings surged to US$90.89 million for H1 2025 from US$39.52 million the previous year, driven by increased gold and silver production. Despite a downward revision in production guidance for 2025, revenue is forecasted to grow faster than the UK market at 7.3% annually. Trading significantly below its estimated fair value suggests potential upside as earnings are expected to grow substantially over the next three years.

- Click to explore a detailed breakdown of our findings in Hochschild Mining's earnings growth report.

- The analysis detailed in our Hochschild Mining valuation report hints at an deflated share price compared to its estimated value.

LSL Property Services (LSE:LSL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LSL Property Services plc operates in the United Kingdom, offering business-to-business services to mortgage intermediaries and estate agent franchisees, as well as valuation services to lenders, with a market cap of £283.57 million.

Operations: The company's revenue is derived from three main segments: Financial Services (£48.40 million), Surveying and Valuation (£97.82 million), and Estate Agency excluding Financial Services (£26.96 million).

Insider Ownership: 10.6%

LSL Property Services is trading at 51.2% below its estimated fair value, offering potential upside as earnings are forecast to grow 16.46% annually, outpacing the UK market's 13.8%. Insider activity has been positive, with more shares bought than sold recently, though not in large volumes. Despite an unstable dividend track record and slower revenue growth at 6.7%, LSL's return on equity is projected to be high at 24.2% in three years.

- Dive into the specifics of LSL Property Services here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that LSL Property Services is priced lower than what may be justified by its financials.

Key Takeaways

- Explore the 63 names from our Fast Growing UK Companies With High Insider Ownership screener here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRW

Craneware

Develops, licenses, and supports computer software for the healthcare industry in the United States.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives