Stock Analysis

- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

Exploring Three UK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The United Kingdom stock market has shown resilience with a steady performance over the last week and a notable 7.7% rise over the past year, with expectations of earnings growth set at 13% annually. In this context, companies with high insider ownership can be particularly appealing, as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Getech Group (AIM:GTC) | 17.2% | 86.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 50.8% |

| Petrofac (LSE:PFC) | 16.6% | 115.4% |

| Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

| Energean (LSE:ENOG) | 10.7% | 22.4% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

| Plant Health Care (AIM:PHC) | 26.4% | 94.4% |

| Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| Afentra (AIM:AET) | 38.3% | 198.2% |

Underneath we present a selection of stocks filtered out by our screen.

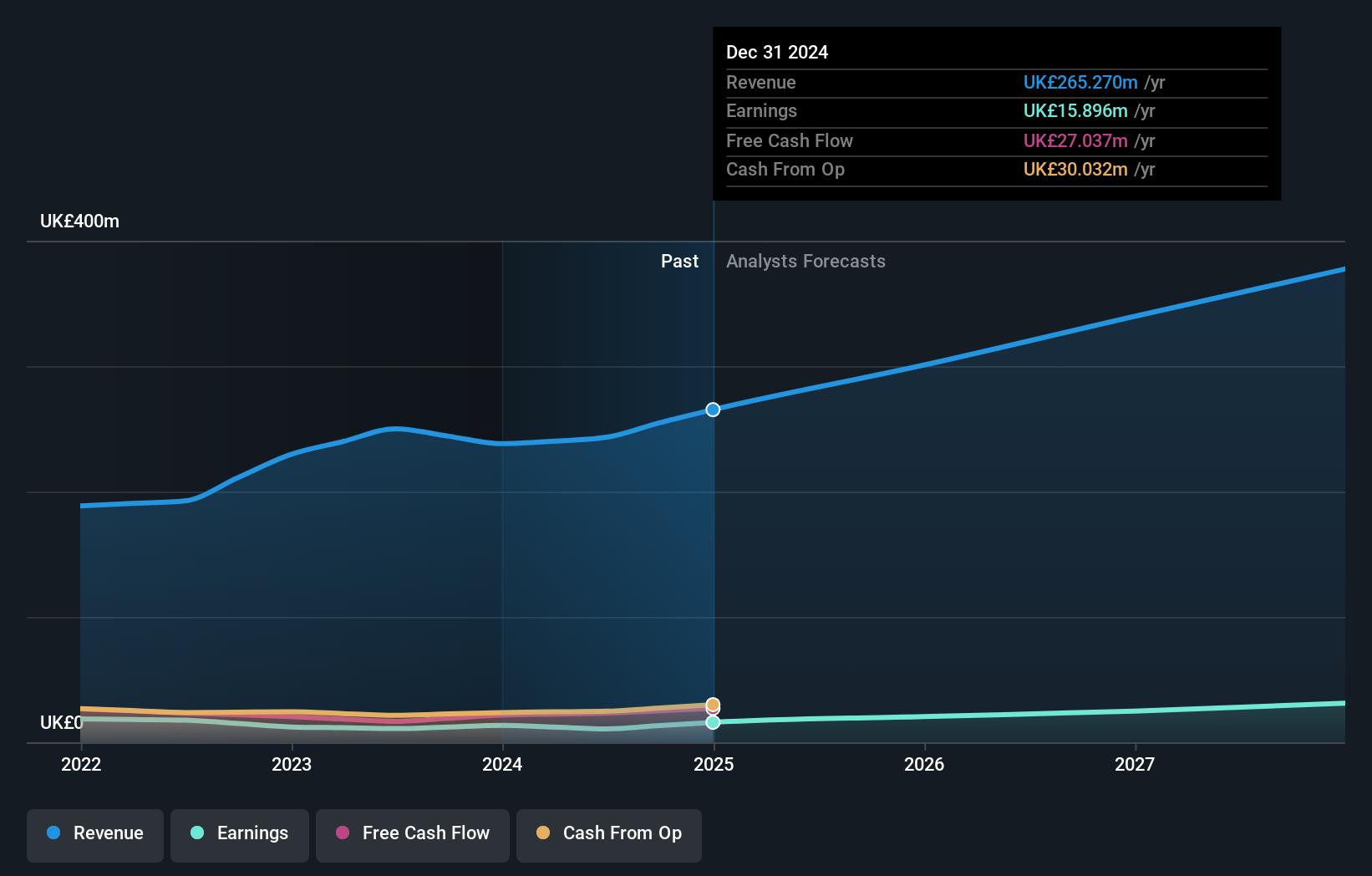

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mortgage Advice Bureau (Holdings) plc operates in the United Kingdom, offering mortgage advice services through its subsidiaries, with a market capitalization of approximately £516.65 million.

Operations: The company generates its revenue primarily through the provision of financial services, amounting to £236.92 million.

Insider Ownership: 20.2%

Mortgage Advice Bureau (Holdings) showcases a blend of stable insider engagement and promising financial forecasts. Recently, insiders have shown balanced trading activity, neither selling nor buying substantial shares, which could indicate confidence in the company's trajectory. The firm has experienced a 10.1% earnings growth over the past year with expectations of a 19.62% annual increase moving forward, outpacing the UK market average. However, its dividend sustainability is under scrutiny as it is not well covered by earnings. Additionally, recent executive appointments suggest an emphasis on strategic leadership to bolster its market position.

- Click here to discover the nuances of Mortgage Advice Bureau (Holdings) with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Mortgage Advice Bureau (Holdings) is priced higher than what may be justified by its financials.

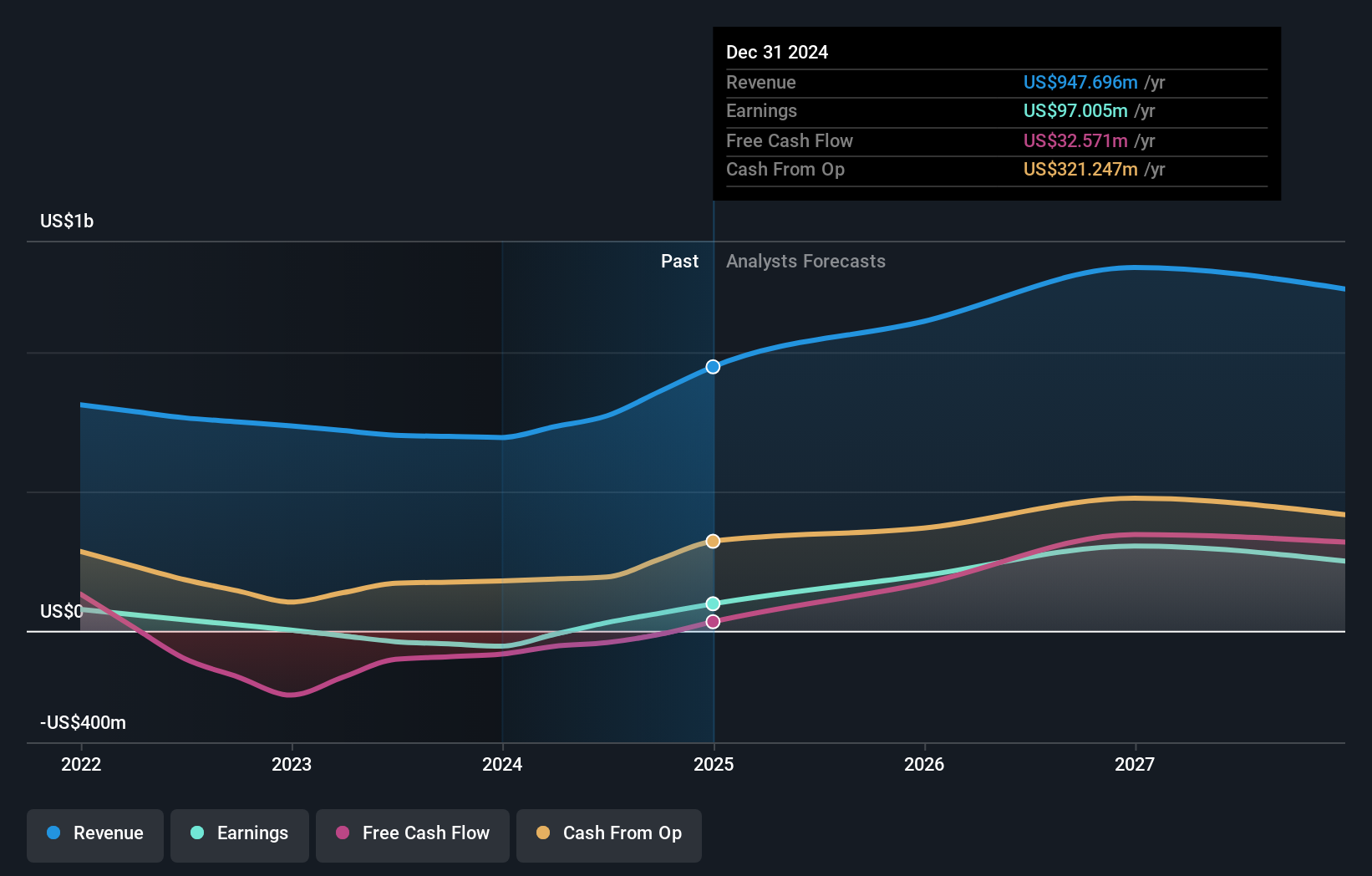

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of approximately £0.85 billion.

Operations: Hochschild Mining's revenue is primarily derived from its Inmaculada mine, which generated $396.64 million, followed by the San Jose mine at $242.46 million, and Pallancata contributing $54.05 million.

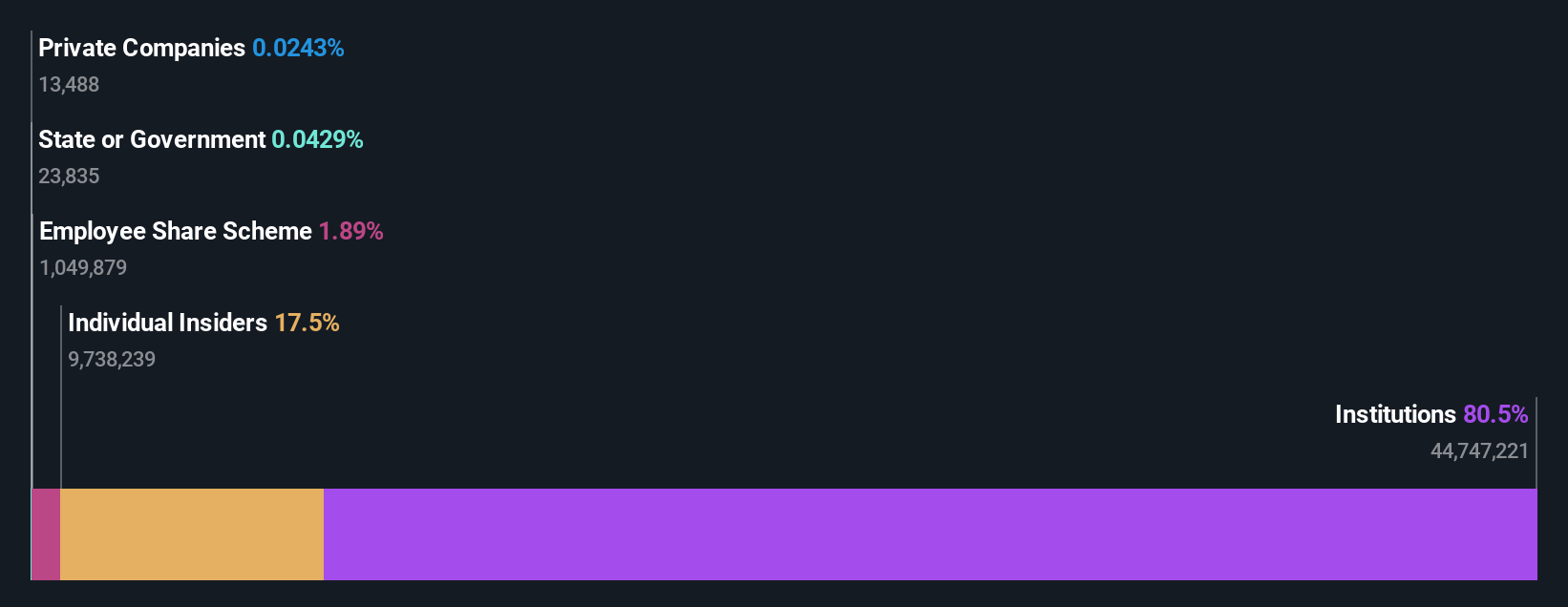

Insider Ownership: 38.4%

Hochschild Mining, a growth-oriented company with significant insider buying in the past three months, is on a path to profitability within three years, outpacing average market growth expectations. Despite a recent net loss of US$55.01 million for 2023 and slower revenue growth at 8.3% annually compared to high-growth firms, it remains proactive in seeking value-accretive mergers and acquisitions, targeting projects like Monte Do Carmo with substantial investment plans around US$200 million.

- Navigate through the intricacies of Hochschild Mining with our comprehensive analyst estimates report here.

- The analysis detailed in our Hochschild Mining valuation report hints at an inflated share price compared to its estimated value.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates in the financial services sector, offering banking, leasing, insurance, brokerage, and card processing services across Georgia, Azerbaijan, and Uzbekistan with a market capitalization of approximately £1.48 billion.

Operations: The company generates its revenue from banking, leasing, insurance, brokerage, and card processing services across three countries.

Insider Ownership: 17.9%

TBC Bank Group, with high insider ownership, is trading at 46.3% below its estimated fair value, presenting a potentially undervalued opportunity in the UK market. Despite challenges like a high bad loans ratio (2.1%) and unstable dividend track record, the company has shown robust recent performance with significant year-over-year earnings growth to GEL 292.81 million and revenue growth forecast at 18.9% annually, outpacing the UK market average significantly. Recent successful fixed-income offerings suggest strong market confidence and financial strategy agility.

- Dive into the specifics of TBC Bank Group here with our thorough growth forecast report.

- According our valuation report, there's an indication that TBC Bank Group's share price might be on the cheaper side.

Taking Advantage

- Explore the 66 names from our Fast Growing UK Companies With High Insider Ownership screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Hochschild Mining is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United States, Canada, Brazil, and Chile.

Reasonable growth potential and fair value.