- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

Exploring Growth Companies With High Insider Ownership On The UK Exchange

Reviewed by Simply Wall St

As the UK market navigates through new economic policies and shifts in leadership, investors are closely monitoring the evolving landscape. In this context, growth companies with high insider ownership can offer unique investment opportunities, as they often signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 32.7% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.8% | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Helios Underwriting (AIM:HUW) | 23.1% | 14.7% |

| Velocity Composites (AIM:VEL) | 27.8% | 143.4% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

| Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

| Afentra (AIM:AET) | 37.2% | 64.4% |

| Hochschild Mining (LSE:HOC) | 38.4% | 42.6% |

We'll examine a selection from our screener results.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★★☆

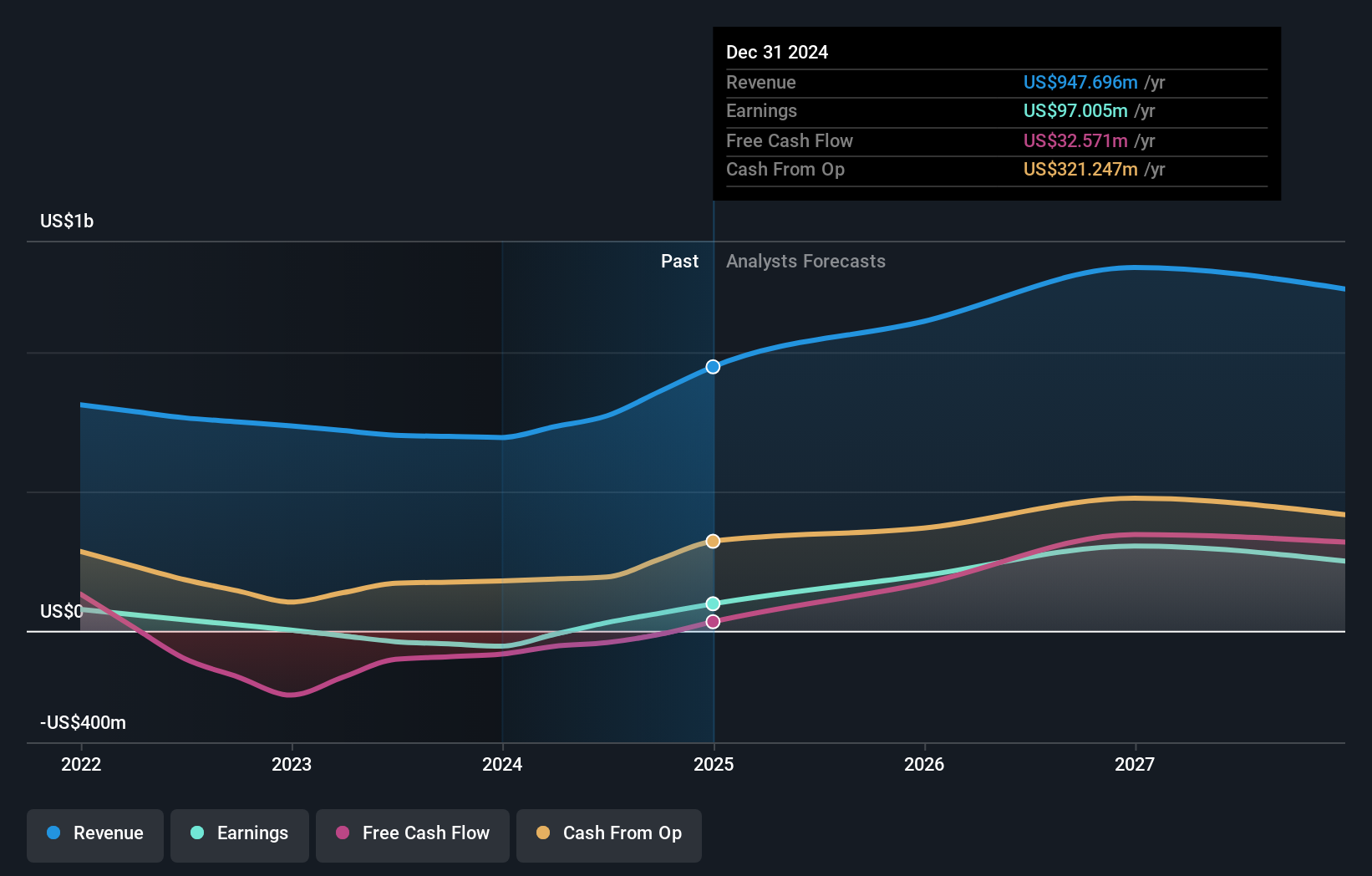

Overview: Hochschild Mining plc is a precious metals company that specializes in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market capitalization of approximately £0.97 billion.

Operations: The company generates revenue primarily from three mining segments: San Jose at $242.46 million, Inmaculada at $396.64 million, and Pallancata at $54.05 million.

Insider Ownership: 38.4%

Hochschild Mining, with substantial insider buying in the past three months and no significant selling, is trading at 37.7% below its estimated fair value. The company's revenue is expected to grow at 11.3% annually, outpacing the UK market's 3.5%, and it is forecasted to become profitable within three years. Recent operational results show a stable production with an increase in gold output and a slight decrease in silver year-over-year, supporting a positive outlook for future profitability growth.

- Click here to discover the nuances of Hochschild Mining with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Hochschild Mining's share price might be too pessimistic.

Playtech (LSE:PTEC)

Simply Wall St Growth Rating: ★★★★☆☆

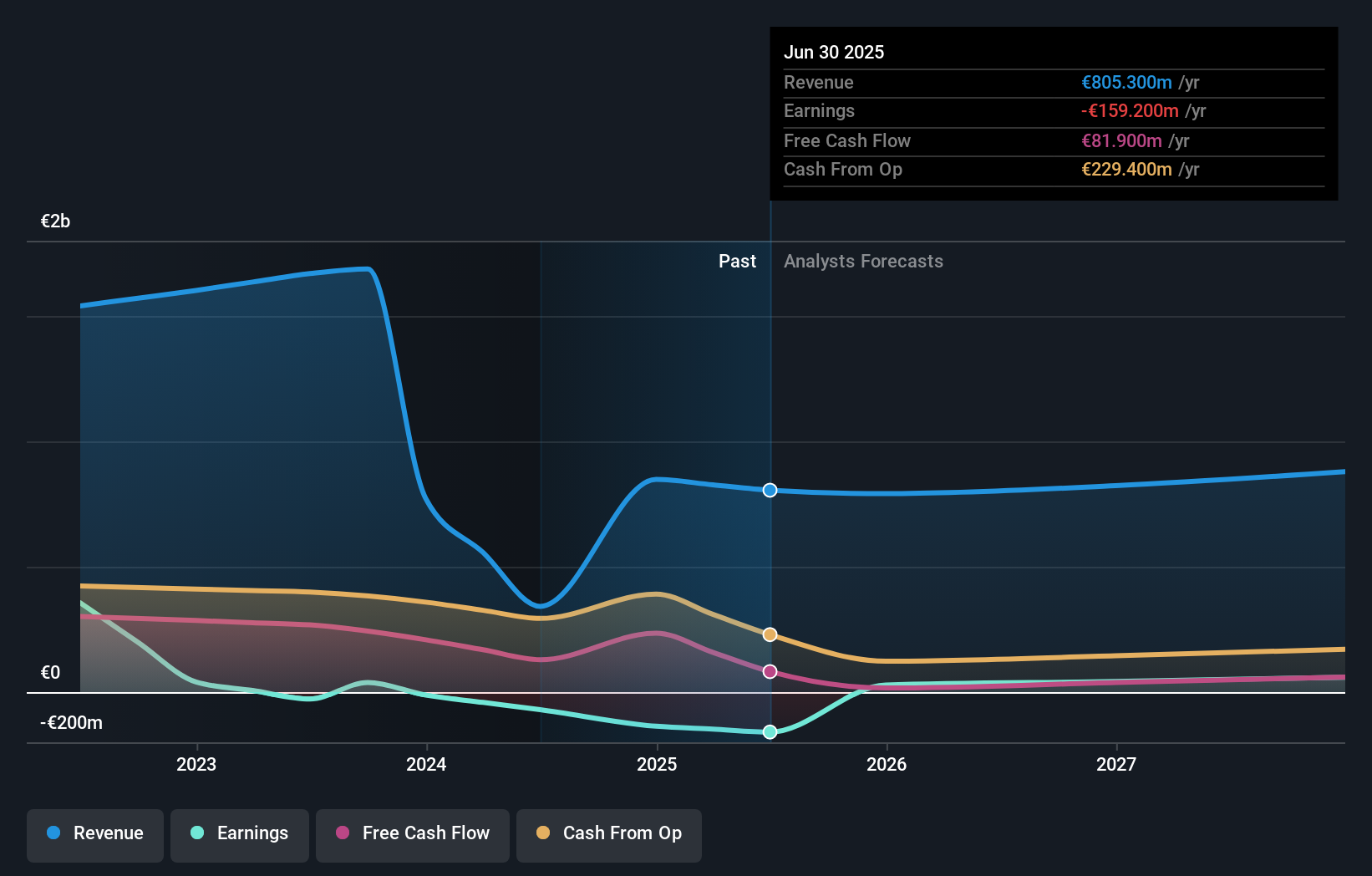

Overview: Playtech plc is a global technology firm specializing in gambling software, services, content, and platform technologies with a market capitalization of approximately £1.54 billion.

Operations: The company's revenue is primarily generated through its Gaming B2B and Gaming B2C segments, which collectively brought in approximately €1.63 billion, with additional contributions from specific B2C operations including HAPPYBET and Sun Bingo totaling €91.60 million.

Insider Ownership: 13.5%

Playtech is currently trading at 53.8% below its estimated fair value, presenting a potentially attractive entry point. Despite large one-off items affecting recent financial results, the company's earnings are expected to grow by 20.62% annually over the next three years, outpacing the UK market forecast of 12.6%. Additionally, Playtech recently announced a strategic partnership with MGM Resorts to provide immersive live casino content, signaling potential revenue growth and market expansion opportunities despite a forecasted low return on equity of 8.9% in three years.

- Delve into the full analysis future growth report here for a deeper understanding of Playtech.

- The analysis detailed in our Playtech valuation report hints at an deflated share price compared to its estimated value.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★☆☆

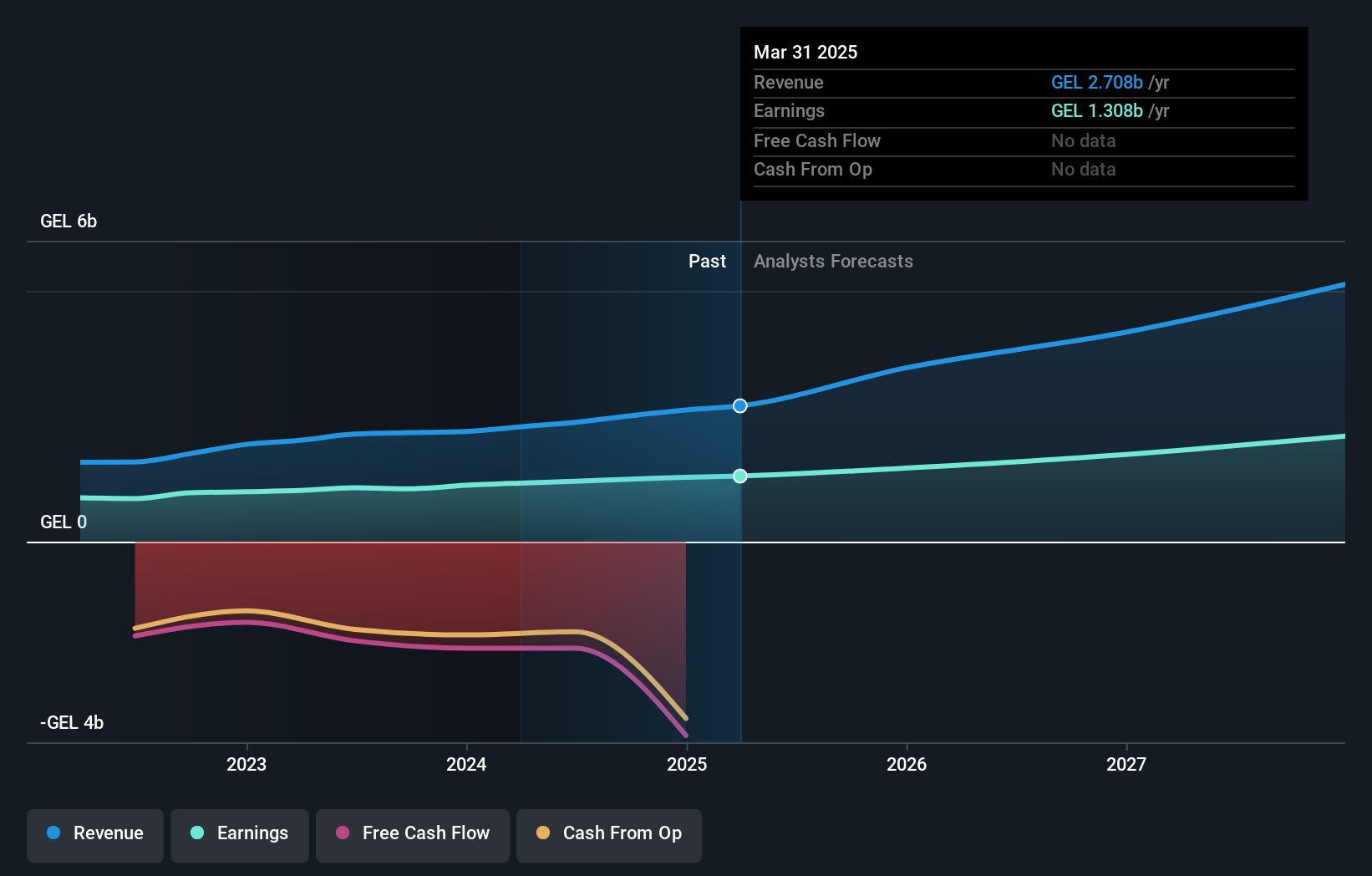

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of financial services including banking, leasing, insurance, brokerage, and card processing with a market capitalization of approximately £1.49 billion.

Operations: The company generates its revenue from diverse financial services such as banking, leasing, insurance, brokerage, and card processing across Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 18%

TBC Bank Group's revenue and earnings are set to grow, albeit at a pace below significant market benchmarks. Its revenue growth outstrips the UK market average, while its earnings growth slightly surpasses broader UK market rates. The bank's recent buyback program aims to reduce share capital by up to GEL 75 million, reflecting confidence from management despite a volatile share price and concerns over its high bad loans ratio of 2.1%. Additionally, TBC Bank reported robust first-quarter results with notable increases in net interest income and net income.

- Dive into the specifics of TBC Bank Group here with our thorough growth forecast report.

- According our valuation report, there's an indication that TBC Bank Group's share price might be on the cheaper side.

Next Steps

- Investigate our full lineup of 67 Fast Growing UK Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United States, Canada, Brazil, and Chile.

Reasonable growth potential and fair value.