HeiQ Plc (LON:HEIQ) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 79% loss during that time.

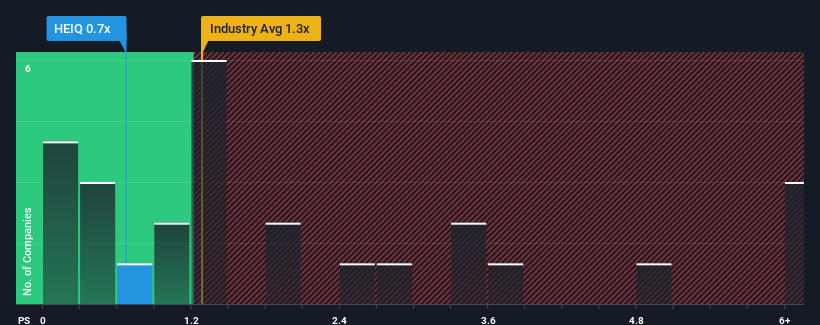

Since its price has dipped substantially, HeiQ may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Chemicals industry in the United Kingdom have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for HeiQ

How HeiQ Has Been Performing

Recent times haven't been great for HeiQ as its revenue has been falling quicker than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on HeiQ will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as HeiQ's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 10% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 5.9%. With the rest of the industry predicted to shrink by 19%, that would be a fantastic result.

With this in mind, we find it intriguing that HeiQ's P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On HeiQ's P/S

The southerly movements of HeiQ's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into HeiQ's analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Before you take the next step, you should know about the 5 warning signs for HeiQ (1 doesn't sit too well with us!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HeiQ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HEIQ

HeiQ

Through its subsidiaries, operates in the antimicrobial fabrics, textiles and flooring, and life sciences businesses in Europe, North and South America, Asia, and internationally.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives