- United Kingdom

- /

- Metals and Mining

- /

- LSE:GLEN

**Glencore (LSE:GLEN) Eyes Major M&A Opportunities Amid Strong Financial Health and ESG Commitment**

Reviewed by Simply Wall St

Unlock comprehensive insights into our analysis of Glencore stock here.

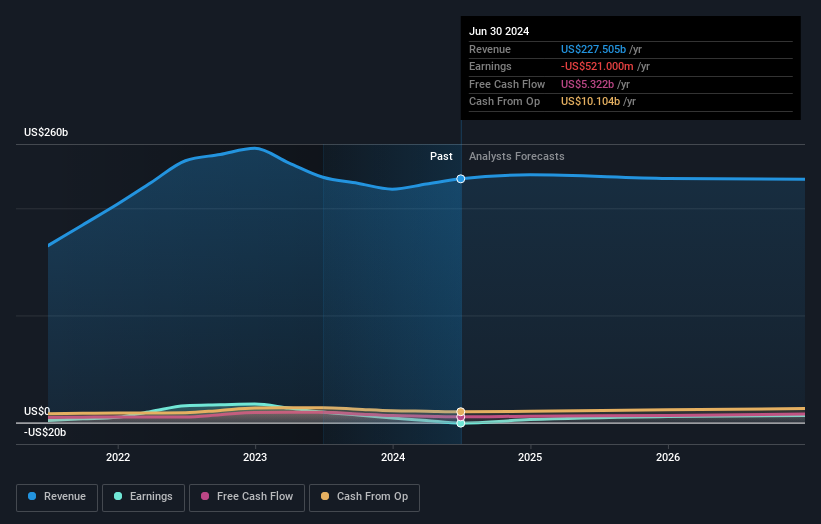

Strengths: Core Advantages Driving Sustained Success For Glencore

Glencore's diversified business model is a significant strength, providing stability across various market conditions. The company reported a pleasing financial result with an adjusted EBITDA of $6.3 billion for the first half of the year, indicating robust financial health. The marketing segment also performed well, achieving an adjusted Marketing EBIT of $1.5 billion. Additionally, Glencore's commitment to ESG initiatives garnered over 90% shareholder support, highlighting strong stewardship in climate strategy. The acquisition of high-quality, low-cost assets further strengthens Glencore's market position. GLEN is currently trading below its estimated fair value, with a target price over 20% higher than its current share price, indicating it is considered a good value investment compared to industry averages.

Weaknesses: Critical Issues Affecting Glencore's Performance and Areas For Growth

Despite its strengths, Glencore faces several challenges. The decline in coal earnings contributed to a lower adjusted Industrial EBITDA of $4.5 billion, down from the previous year. Lower realizations on key metals like cobalt and nickel also impacted financial performance. High operational costs, including maintenance and fuel expenses, have further strained profitability. Moreover, the company experienced a significant slope failure, adding to operational challenges. Additionally, Glencore's revenue is forecast to decline by 1% per year over the next three years, and its Return on Equity is expected to be relatively low at 14.5% in three years' time.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Glencore has several opportunities to leverage for growth. The company plans to expand its copper production by up to another 1 million tonnes, positioning itself to meet increasing demand. Argentina is identified as a key frontier for copper growth. Potential synergies from marketing initiatives, particularly in the EVR segment, could enhance profitability. The strong global demand for energy and steelmaking coal presents additional growth avenues. Furthermore, Glencore's forecasted annual profit growth of 40.11% per year is considered above average market growth, indicating a positive outlook for future profitability.

Threats: Key Risks and Challenges That Could Impact Glencore's Success

Glencore faces several external threats that could impact its success. Market challenges in key commodities, such as historically low TC/RC levels, have depressed earnings in custom smelting operations. Competitive pressures and economic factors, including supply concerns in the copper market, pose additional risks. Regulatory and operational risks are also significant, with potential shutdowns of non-value-adding smelters. Logistical challenges in South Africa, despite collaborative efforts with Transnet management, continue to constrain operations. Additionally, interest payments are not well covered by earnings, and the dividend of 2.53% is not well covered by earnings, highlighting financial vulnerabilities.

Conclusion

Glencore's diversified business model and strong financial health, as evidenced by its adjusted EBITDA of $6.3 billion, provide a solid foundation for navigating market fluctuations. Despite challenges such as declining coal earnings and high operational costs, the company's strategic focus on expanding copper production and leveraging marketing synergies positions it well for future growth. External threats, including market and regulatory risks, remain significant, but Glencore's commitment to ESG initiatives and acquisition of low-cost assets bolster its competitive edge. Trading below its estimated fair value with a target price over 20% higher than its current share price, Glencore presents a compelling investment opportunity with a positive outlook for future profitability.

Next Steps

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade Glencore, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:GLEN

Glencore

Engages in the production, refinement, processing, storage, transport, and marketing of metals and minerals, and energy products in the Americas, Europe, Asia, Africa, and Oceania.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives