- United Kingdom

- /

- Metals and Mining

- /

- LSE:GLEN

Assessing the Value of Glencore Stock After a 21% Price Rally in 2025

Reviewed by Bailey Pemberton

Thinking about Glencore stock lately? You are not alone, and for good reason. With a reputation for weathering commodities cycles and bold moves in both metals and energy markets, Glencore often splits opinion among investors. Over the past month, this stock has caught a fresh gust of momentum, climbing an impressive 21.2%. Even though the stock is still down 4.1% year-to-date and has fallen 17.4% in the past year, that recent surge stands out, especially against a longer-term backdrop where Glencore has delivered a remarkable 157.2% return over five years.

This kind of price action tends to spark debate. Is the rally just a quick correction or the start of a new phase of strength as market participants adjust their risk perception? Optimism around stabilized metals prices and improving demand projections has helped the shares bounce from their recent lows, even though broader industry uncertainty lingers. While recent days have brought a 3.6% weekly gain, investors are still cautiously weighing the risks and potential of this global commodities powerhouse.

Thinking about whether to buy, sell, or hold Glencore now? The numbers show that, by common valuation checks, the company scores a 3 out of 6 for being undervalued, something that hints at hidden strengths but also signals possible caution. In the next section, we will break down these main valuation approaches one by one. And if you are searching for an even more insightful way to understand what Glencore is truly worth, stay with us as there is a smarter perspective coming up before we wrap things up.

Why Glencore is lagging behind its peers

Approach 1: Glencore Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation method that estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to their present value. This approach helps investors understand what Glencore could be worth today, based on its ability to generate cash in the future.

Currently, Glencore has a last twelve months (LTM) free cash flow of approximately $987 Million. Analysts have projected this figure to grow significantly, reaching around $4.15 Billion by 2029. Projections beyond five years are not based on analyst consensus but are extrapolated to provide a longer-term view of future cash generation.

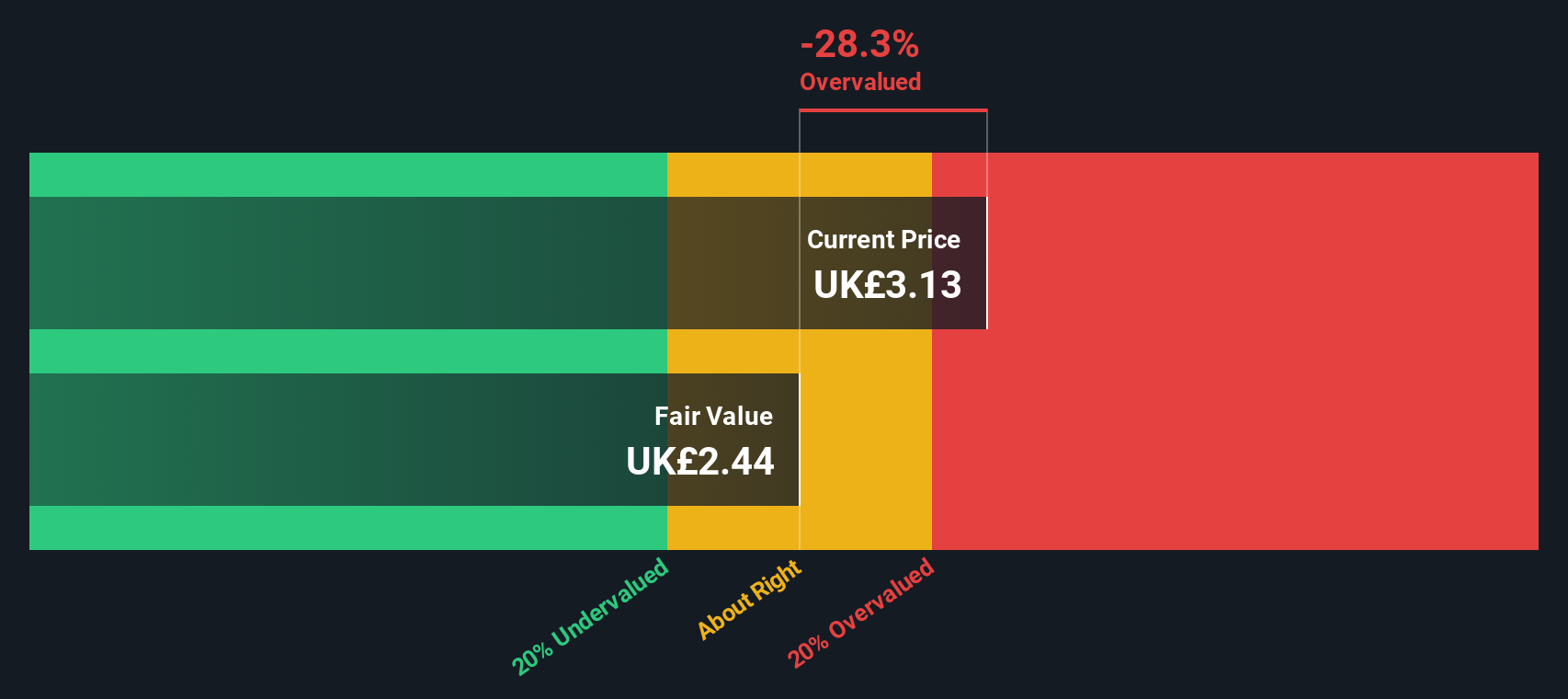

Based on this two-stage Free Cash Flow to Equity model, the estimated intrinsic value per share is $2.46. When compared to the current share price, this suggests Glencore is about 41.3% overvalued according to the DCF analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Glencore may be overvalued by 41.3%. Find undervalued stocks or create your own screener to find better value opportunities.

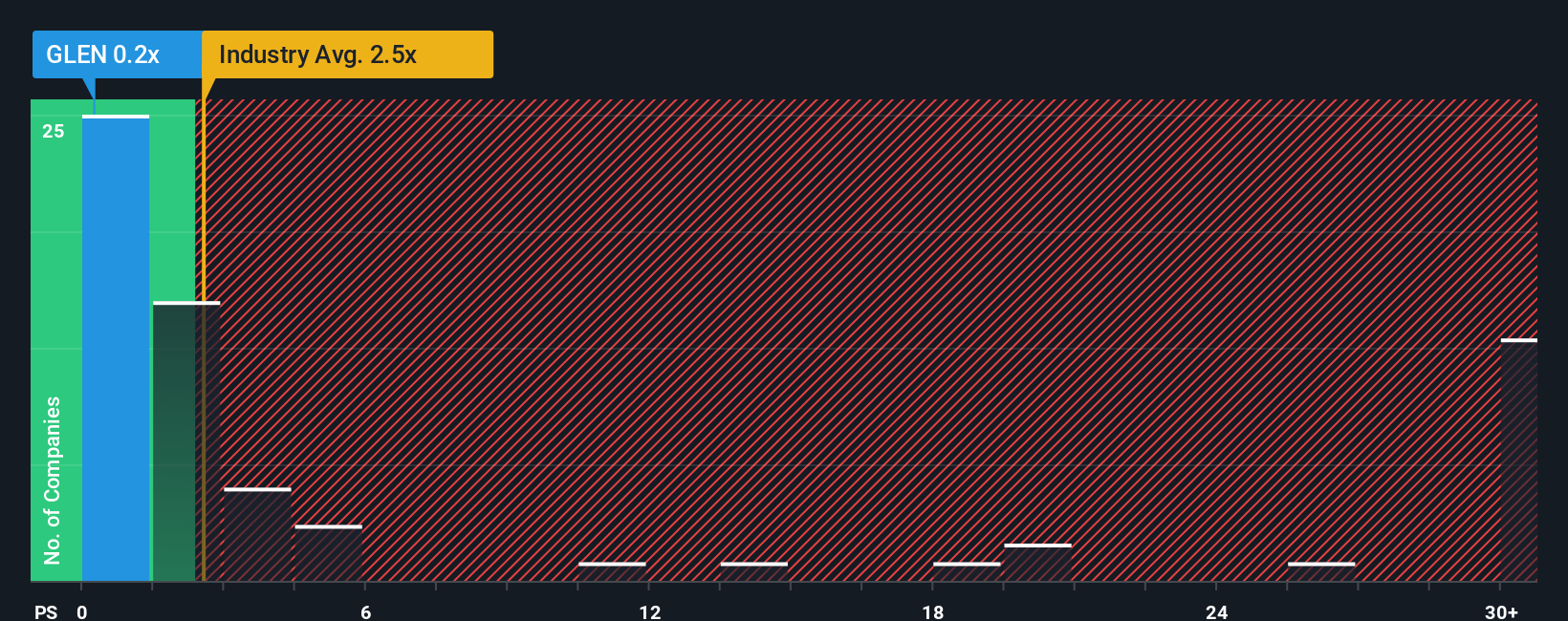

Approach 2: Glencore Price vs Sales

Price-to-Sales (P/S) is often a practical valuation measure for companies like Glencore, where profit margins can be volatile due to commodity price swings. By focusing on sales rather than earnings, this multiple gives investors a clearer sense of a company’s revenue-generating power without being distorted by short-term profitability issues.

Growth expectations and a company’s risk profile are key in deciding what a “normal” or “fair” P/S ratio should be. Fast-growing businesses or companies with more predictable sales streams usually command higher multiples, while cyclical or riskier businesses tend to trade at lower ones.

Currently, Glencore trades at a P/S ratio of just 0.24x. That is considerably lower than the Metals and Mining industry average of 2.54x and its closest peers at 3.55x. Rather than just looking at these broad comparisons, Simply Wall St calculates a proprietary “Fair Ratio,” which adjusts for factors such as Glencore’s earnings outlook, risk level, profit margins, market cap, and broader industry trends. The Fair Ratio for Glencore is estimated at 0.81x, providing a more tailored benchmark for valuation.

This Fair Ratio approach is considered more accurate than comparing Glencore to the raw industry or peer benchmarks alone, because it considers company-specific attributes and market realities instead of a one-size-fits-all average. With the current P/S ratio below its Fair Ratio, Glencore appears attractively valued using this perspective.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Glencore Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your investment story for Glencore: your outlook for future revenue, earnings, profit margins, and ultimately, what you believe is a fair value for the shares. Instead of just plugging numbers into formulas, Narratives allow you to connect the company's strategy, industry drivers, and recent updates with your financial forecasts.

By linking Glencore’s business story to numbers and a fair value, Narratives empower you to see how new information or events such as earnings announcements, M&A deals, or global copper demand dynamically shift your outlook. On Simply Wall St’s Community page, you can easily create and update your own Narrative, compare it with those shared by millions of other investors, and see if your Fair Value is above or below the current Price. This makes your buy or sell decision much clearer.

For example, one investor's bull case for Glencore might focus on rising copper production and margin improvements, leading to a high target price of £4.61 per share. A more cautious investor might emphasize decarbonization risks and regulatory challenges, arriving at a more conservative fair value of £3.09. Narratives put every possible perspective at your fingertips, letting you decide your best course of action as facts evolve.

Do you think there's more to the story for Glencore? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GLEN

Glencore

Engages in the production, refinement, processing, storage, transport, and marketing of metals and minerals, and energy products in the Americas, Europe, Asia, Africa, and Oceania.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives