We'd be surprised if Forterra plc (LON:FORT) shareholders haven't noticed that the CEO & Executive Director, Stephen Harrison, recently sold UK£209k worth of stock at UK£2.48 per share. The eyebrow raising move amounted to a reduction of 23% in their holding.

See our latest analysis for Forterra

The Last 12 Months Of Insider Transactions At Forterra

In fact, the recent sale by Stephen Harrison was the biggest sale of Forterra shares made by an insider individual in the last twelve months, according to our records. That means that an insider was selling shares at below the current price (UK£2.52). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. It is worth noting that this sale was only 23% of Stephen Harrison's holding.

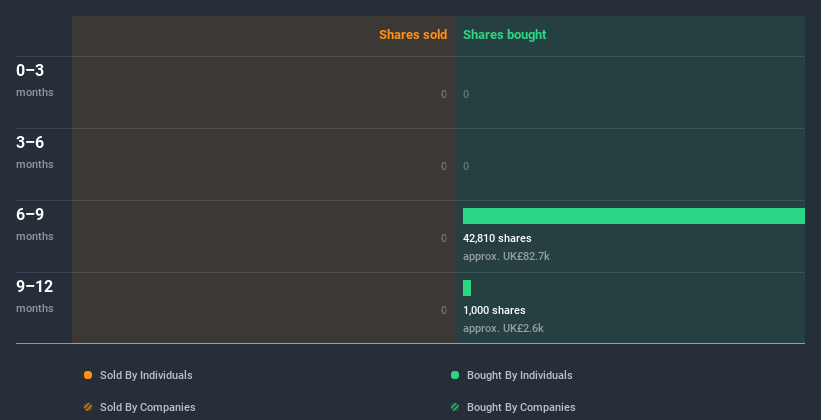

Over the last year, we can see that insiders have bought 43.81k shares worth UK£86k. On the other hand they divested 99.18k shares, for UK£246k. All up, insiders sold more shares in Forterra than they bought, over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Does Forterra Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. From looking at our data, insiders own UK£895k worth of Forterra stock, about 0.2% of the company. I generally like to see higher levels of ownership.

So What Does This Data Suggest About Forterra Insiders?

Insiders haven't bought Forterra stock in the last three months, but there was some selling. And our longer term analysis of insider transactions didn't bring confidence, either. Insiders own relatively few shares in the company, and when you consider the sales, we're not particularly excited about the stock. So we're not rushing to buy, to say the least. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Forterra. At Simply Wall St, we've found that Forterra has 3 warning signs (1 shouldn't be ignored!) that deserve your attention before going any further with your analysis.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Forterra, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:FORT

Forterra

Engages in the manufacturing and sale of building products made from clay and concrete in the United Kingdom.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.