Forterra plc (LON:FORT) has announced that it will be increasing its dividend from last year's comparable payment on the 7th of July to £0.101. This will take the dividend yield to an attractive 7.0%, providing a nice boost to shareholder returns.

See our latest analysis for Forterra

Forterra's Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, Forterra's dividend was only 54% of earnings, however it was paying out 98% of free cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Looking forward, earnings per share is forecast to fall by 9.7% over the next year. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 63%, which is comfortable for the company to continue in the future.

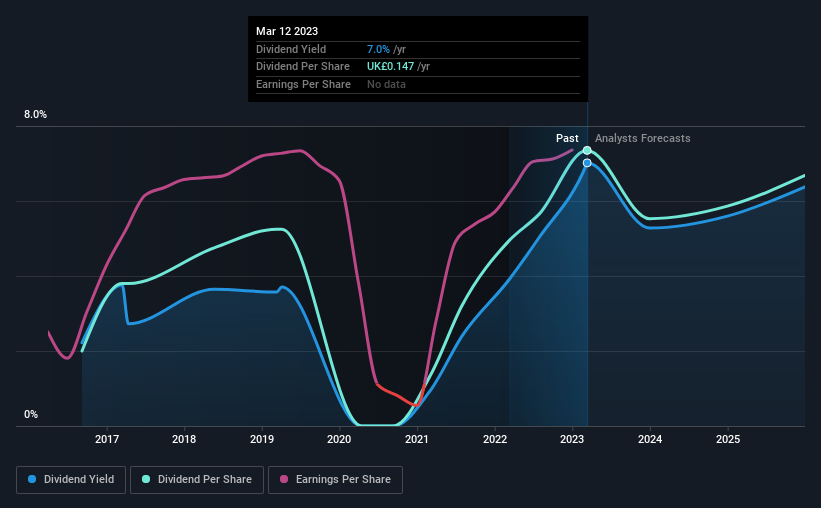

Forterra's Dividend Has Lacked Consistency

Looking back, Forterra's dividend hasn't been particularly consistent. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. The annual payment during the last 6 years was £0.04 in 2017, and the most recent fiscal year payment was £0.147. This works out to be a compound annual growth rate (CAGR) of approximately 24% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Forterra May Find It Hard To Grow The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings have grown at around 3.7% a year for the past five years, which isn't massive but still better than seeing them shrink. Growth of 3.7% may indicate that the company has limited investment opportunity so it is returning its earnings to shareholders instead. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

Our Thoughts On Forterra's Dividend

Overall, we always like to see the dividend being raised, but we don't think Forterra will make a great income stock. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 2 warning signs for Forterra you should be aware of, and 1 of them shouldn't be ignored. Is Forterra not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:FORT

Forterra

Engages in the manufacturing and sale of building products made from clay and concrete in the United Kingdom.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success