- United Kingdom

- /

- Consumer Services

- /

- LSE:MEGP

UK Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

As the London markets grapple with weak global cues and faltering trade data from China, the FTSE 100 has recently experienced a downturn, reflecting broader economic uncertainties. Despite these challenges, there remains potential in less conventional investment areas like penny stocks. While often associated with smaller or newer companies, these stocks can offer affordability and growth potential when backed by strong financials. In this article, we explore three UK penny stocks that stand out for their financial resilience and potential opportunities amidst current market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.45 | £507.73M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.85 | £149.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.935 | £14.12M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6575 | $382.22M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.744 | £275.11M | ✅ 5 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.285 | £62.07M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

| ME Group International (LSE:MEGP) | £1.592 | £601.34M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Essentra (LSE:ESNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Essentra plc is involved in the manufacturing and distribution of plastic injection moulded, vinyl dip moulded, and metal items across Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of approximately £274.14 million.

Operations: The company's revenue is derived from its operations in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Market Cap: £274.14M

Essentra plc has demonstrated significant earnings growth, with a very large increase of 1466.7% over the past year, surpassing both its historical average and the industry benchmark. The company's short-term assets comfortably cover both short-term and long-term liabilities, indicating financial stability. Despite this growth, Essentra's Return on Equity remains low at 3.5%, and interest coverage is below optimal levels at 1.3 times EBIT. The management team is experienced with an average tenure of 2.8 years; however, the board lacks similar experience. Trading below estimated fair value presents potential opportunities for investors mindful of its unstable dividend history.

- Jump into the full analysis health report here for a deeper understanding of Essentra.

- Gain insights into Essentra's outlook and expected performance with our report on the company's earnings estimates.

ME Group International (LSE:MEGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market capitalization of £601.34 million.

Operations: The company generates revenue from its Personal Services - Others segment, amounting to £311.32 million.

Market Cap: £601.34M

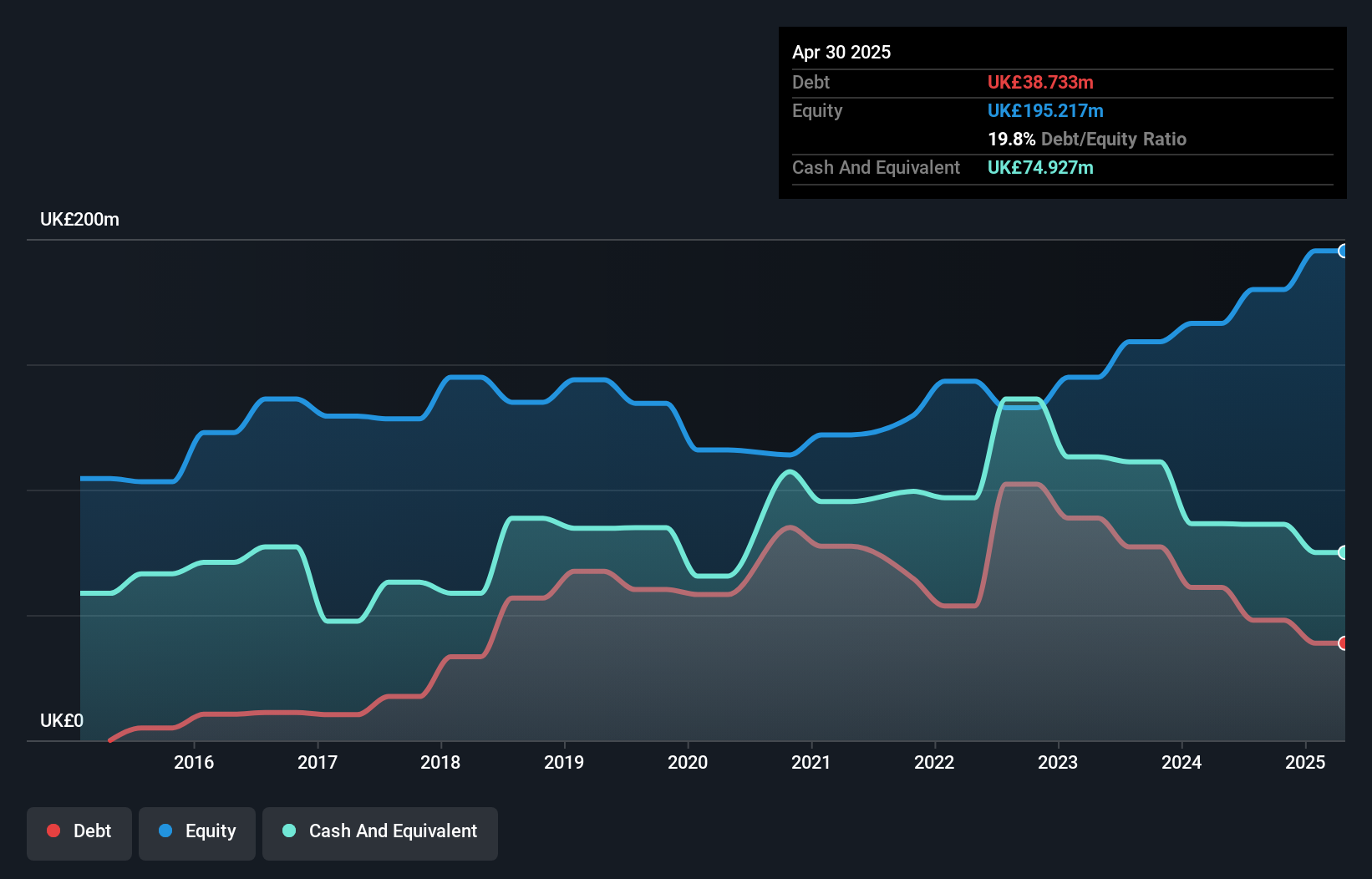

ME Group International plc exhibits strong financial health, with a high Return on Equity of 29.2% and significant earnings growth of 31.3% annually over five years. The company trades at a substantial discount to its estimated fair value, offering potential value opportunities. Its debt is well-managed, covered by operating cash flow at 239.9%, and the firm has more cash than total debt, ensuring stability. Despite stable weekly volatility and experienced management, recent earnings growth slowed to 7.9%, below industry levels, highlighting potential challenges in maintaining past performance momentum amidst an unstable dividend history.

- Click to explore a detailed breakdown of our findings in ME Group International's financial health report.

- Learn about ME Group International's future growth trajectory here.

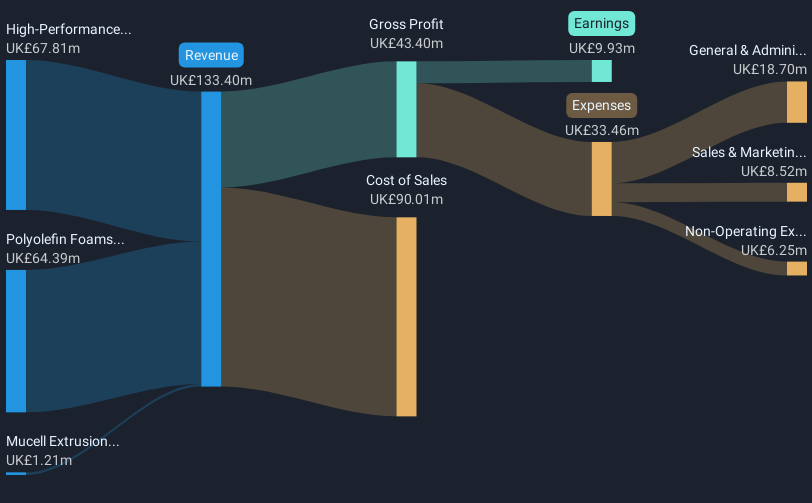

Zotefoams (LSE:ZTF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zotefoams plc, with a market cap of £203.19 million, manufactures, distributes, and sells polyolefin foams in the United Kingdom, Europe, North America, and internationally.

Operations: The company generates revenue from its Mucell Extrusion LLC (MEL) segment, amounting to £0.82 million.

Market Cap: £203.19M

Zotefoams plc, with a market cap of £203.19 million, presents both opportunities and challenges for investors in penny stocks. The company has faced negative earnings growth recently, impacted by a significant one-off loss of £15.2 million. Despite this setback, Zotefoams maintains a satisfactory net debt to equity ratio of 17.9% and strong interest coverage at 9.4 times EBIT, indicating financial resilience. Recent strategic initiatives include the establishment of innovation hubs in the UK and South Korea to drive growth in key markets like footwear and advanced foam solutions, though management's limited tenure may pose execution risks.

- Get an in-depth perspective on Zotefoams' performance by reading our balance sheet health report here.

- Assess Zotefoams' future earnings estimates with our detailed growth reports.

Taking Advantage

- Take a closer look at our UK Penny Stocks list of 301 companies by clicking here.

- Seeking Other Investments? Uncover 12 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MEGP

ME Group International

Operates, sells, and services a range of instant-service equipment in the United Kingdom.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success