- United Kingdom

- /

- Metals and Mining

- /

- LSE:CGS

Castings P.L.C.'s (LON:CGS) Stock's Been Going Strong: Could Weak Financials Mean The Market Will Correct Its Share Price?

Castings' (LON:CGS) stock is up by a considerable 11% over the past three months. However, in this article, we decided to focus on its weak fundamentals, as long-term financial performance of a business is what ultimatley dictates market outcomes. Particularly, we will be paying attention to Castings' ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Castings

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Castings is:

2.9% = UK£3.6m ÷ UK£126m (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. Another way to think of that is that for every £1 worth of equity, the company was able to earn £0.03 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Castings' Earnings Growth And 2.9% ROE

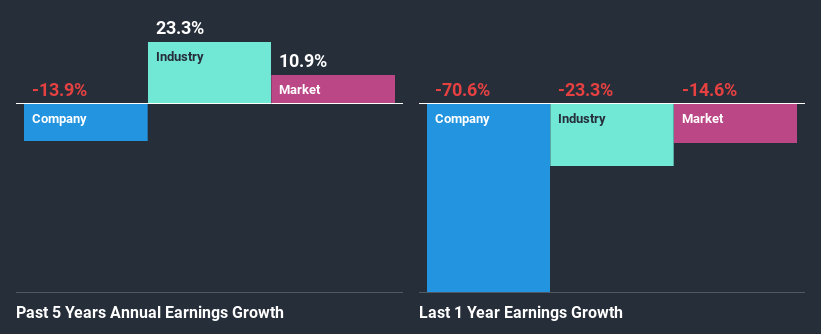

It is hard to argue that Castings' ROE is much good in and of itself. Not just that, even compared to the industry average of 18%, the company's ROE is entirely unremarkable. Given the circumstances, the significant decline in net income by 14% seen by Castings over the last five years is not surprising. We reckon that there could also be other factors at play here. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

However, when we compared Castings' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 23% in the same period. This is quite worrisome.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Castings fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Castings Using Its Retained Earnings Effectively?

Castings' declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 62% (or a retention ratio of 38%). With only very little left to reinvest into the business, growth in earnings is far from likely. To know the 3 risks we have identified for Castings visit our risks dashboard for free.

Additionally, Castings has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 55% of its profits over the next three years.

Conclusion

Overall, we would be extremely cautious before making any decision on Castings. As a result of its low ROE and lack of mich reinvestment into the business, the company has seen a disappointing earnings growth rate. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Castings' past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you decide to trade Castings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:CGS

Castings

Engages in the iron casting and machining activities in the United Kingdom, Germany, Sweden, the Netherlands, rest of Europe, North and South America, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026