- United Kingdom

- /

- Basic Materials

- /

- LSE:BREE

Exploring 3 Undervalued Small Caps On UK With Insider Buying

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting vulnerabilities in sectors tied to global economic conditions. As broader market sentiment remains cautious, investors often seek opportunities in small-cap stocks that may be undervalued but have potential for growth due to insider buying, a factor that can indicate confidence from those closest to the company.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Learning Technologies Group | 15.3x | 1.4x | 30.29% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 25.13% | ★★★★★☆ |

| Sabre Insurance Group | 11.3x | 1.5x | 12.60% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 46.51% | ★★★★☆☆ |

| J D Wetherspoon | 15.3x | 0.4x | 19.73% | ★★★★☆☆ |

| Optima Health | NA | 1.3x | 36.90% | ★★★★☆☆ |

| iomart Group | 18.5x | 0.9x | 10.96% | ★★★☆☆☆ |

| Breedon Group | 15.8x | 1.0x | 46.51% | ★★★☆☆☆ |

| Genus | 143.0x | 1.7x | 26.96% | ★★★☆☆☆ |

| THG | NA | 0.3x | -910.07% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Breedon Group (LSE:BREE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Breedon Group is a leading construction materials company operating primarily in Great Britain and Ireland, with a focus on cement and aggregates.

Operations: Breedon Group generates revenue primarily from its operations in Great Britain, Ireland, and the cement segment. The company has experienced fluctuations in gross profit margin, with a notable decline to 10.33% as of December 2023. Operating expenses have varied across periods, impacting net income margins which were recorded at 6.34% for the quarter ending June 2024.

PE: 15.8x

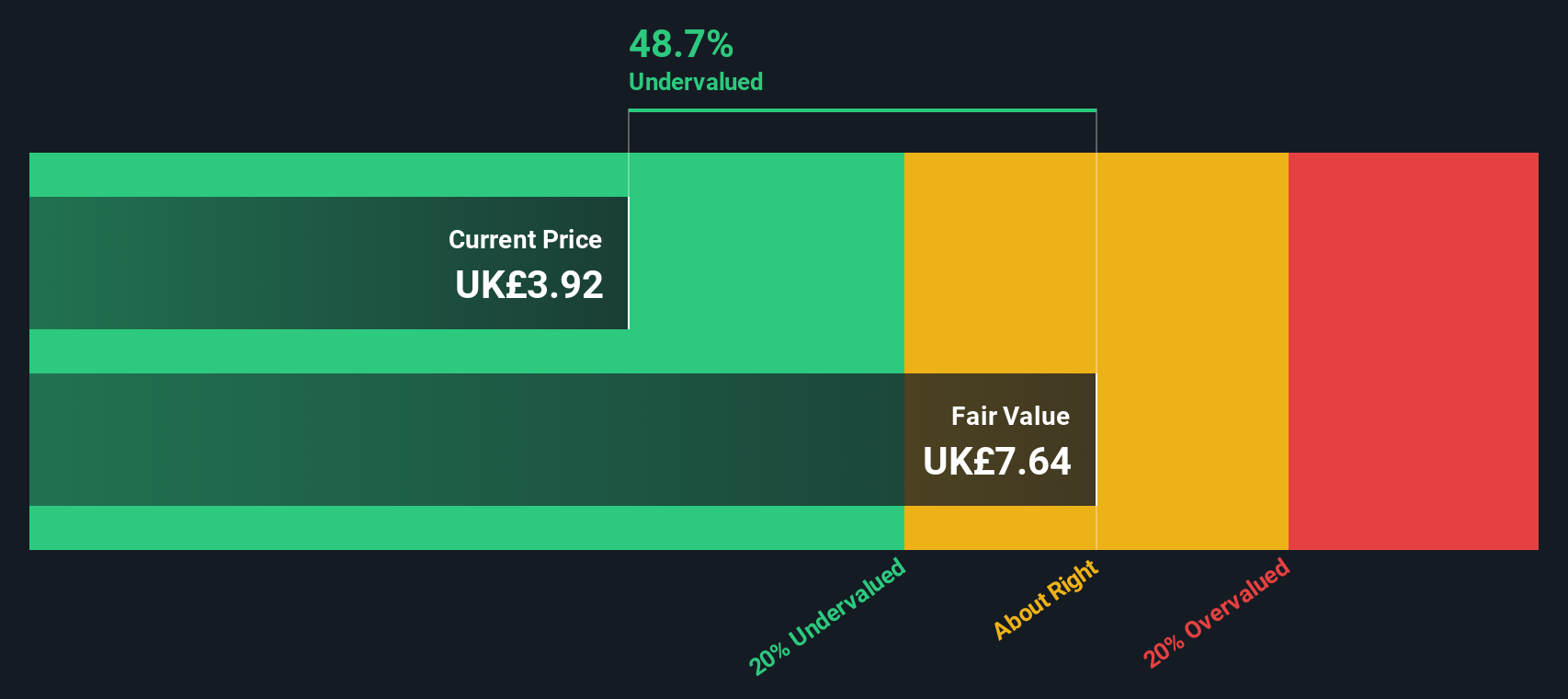

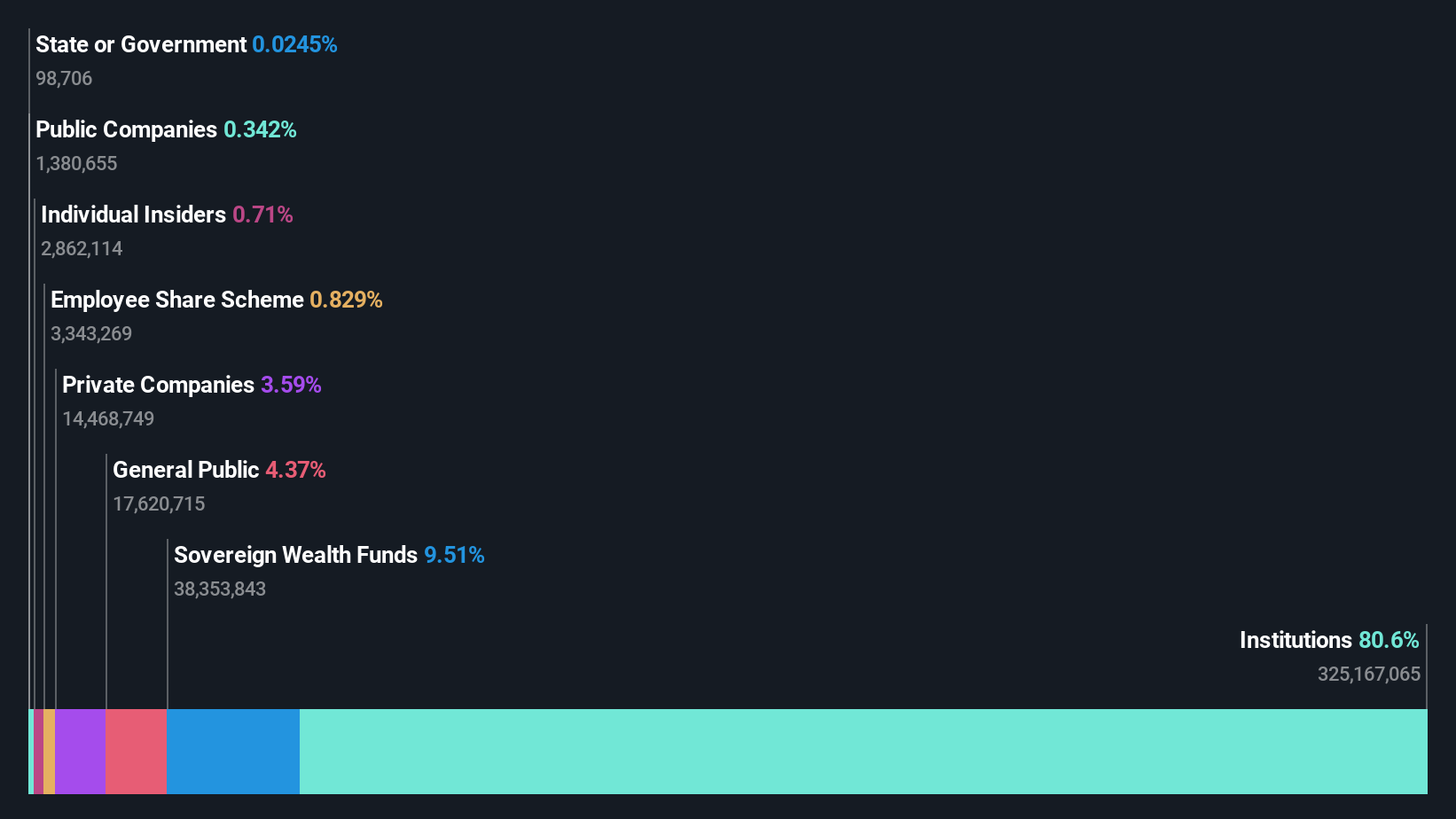

Breedon Group, a construction materials company in the UK, is considered undervalued among its peers. Earnings are expected to grow at 14% annually, suggesting potential for future profitability. However, all liabilities stem from external borrowing rather than customer deposits, indicating higher financial risk. Insider confidence is evident with recent share purchases over the past year. This blend of growth prospects and insider activity paints a picture of cautious optimism for Breedon's future trajectory in the market.

- Click here and access our complete valuation analysis report to understand the dynamics of Breedon Group.

Gain insights into Breedon Group's historical performance by reviewing our past performance report.

Great Portland Estates (LSE:GPE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Great Portland Estates is a UK-based property investment and development company focused on the central London office and retail markets, with a market cap of approximately £1.69 billion.

Operations: GPE's revenue is primarily generated through its operations, with a notable gross profit margin trend reaching 77.28% as of September 2024. The company experiences significant non-operating expenses, which have impacted net income over recent periods. Operating expenses are consistently managed around £38-£41 million, contributing to the overall cost structure.

PE: -48.8x

Great Portland Estates, a smaller UK company, recently reported a significant turnaround with net income of £29.7 million for the half-year ending September 2024, compared to a loss of £253.4 million the previous year. They secured a £150 million ESG-linked revolving credit facility, extending debt maturity over seven years and reflecting financial stability despite higher-risk funding from external borrowing. Their acquisition of Wells Street aims to enhance their Fully Managed offerings in Fitzrovia, indicating strategic growth potential in prime locations.

Supermarket Income REIT (LSE:SUPR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Supermarket Income REIT is a real estate investment trust focused on acquiring and managing grocery store properties in the UK, with a market capitalization of approximately £1.27 billion.

Operations: The company generates revenue primarily from real estate investment, with a recent figure of £107.23 million. Operating expenses have shown an increase, reaching £5.75 million in the latest period. Notably, the net income margin has experienced fluctuations, recently recorded at -0.20%.

PE: -40.3x

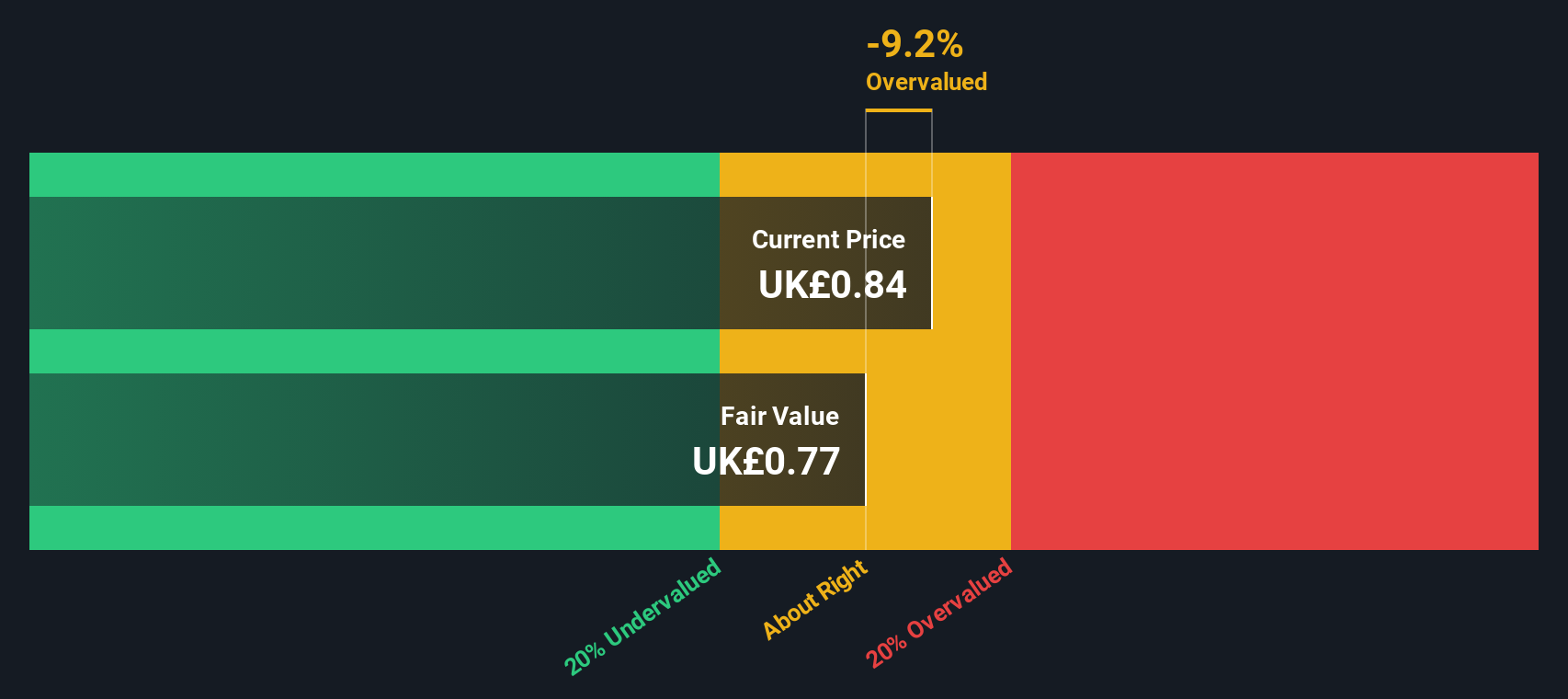

Supermarket Income REIT, a UK-based investment trust focusing on grocery store properties, has shown resilience with sales increasing to £107.23 million for the year ending June 2024 from £95.24 million previously. Despite a net loss of £21.18 million, down significantly from last year's £144.87 million loss, earnings are expected to grow annually by 48%. Insider confidence is evident as insiders have been purchasing shares throughout 2024, indicating potential value recognition in this small-cap stock's future prospects.

- Get an in-depth perspective on Supermarket Income REIT's performance by reading our valuation report here.

Assess Supermarket Income REIT's past performance with our detailed historical performance reports.

Next Steps

- Unlock more gems! Our Undervalued UK Small Caps With Insider Buying screener has unearthed 19 more companies for you to explore.Click here to unveil our expertly curated list of 22 Undervalued UK Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Breedon Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BREE

Breedon Group

Engages in the quarrying, manufacture, and sale of construction materials and building products primarily in the United Kingdom and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives