- United Kingdom

- /

- Basic Materials

- /

- LSE:BREE

Breedon Group plc's (LON:BREE) Business And Shares Still Trailing The Market

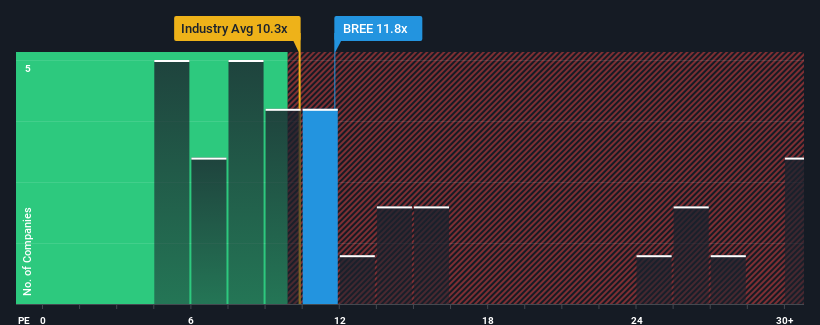

Breedon Group plc's (LON:BREE) price-to-earnings (or "P/E") ratio of 11.8x might make it look like a buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 17x and even P/E's above 28x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for Breedon Group as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Breedon Group

How Is Breedon Group's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Breedon Group's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 6.4%. Still, the latest three year period has seen an excellent 208% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 8.1% per year as estimated by the eleven analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 14% per year, which is noticeably more attractive.

In light of this, it's understandable that Breedon Group's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Breedon Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Breedon Group you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Breedon Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BREE

Breedon Group

Engages in the quarrying, manufacture, and sale of construction materials and building products primarily in the United Kingdom and internationally.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026