- United Kingdom

- /

- Metals and Mining

- /

- LSE:AFP

Spotlight On 3 UK Penny Stocks With Market Caps Over £0

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index dipping due to weak trade data from China, highlighting global economic interconnectedness. Despite broader market fluctuations, penny stocks—though an old term—remain a relevant investment area for those seeking growth opportunities at lower price points. By focusing on companies with strong financial fundamentals, investors can uncover potential gems in the realm of penny stocks that might offer both stability and growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Foresight Group Holdings (LSE:FSG) | £3.90 | £444.52M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.90 | £315.07M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.155 | £313.78M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.944 | £150.44M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.655 | £448.73M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.25 | £160.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.25 | £81.05M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.846 | £71.81M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.46 | £225.17M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

African Pioneer (LSE:AFP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: African Pioneer PLC, with a market cap of £2.12 million, explores and develops base metals projects in Zambia, Namibia, and Botswana.

Operations: The company has not reported any revenue segments.

Market Cap: £2.12M

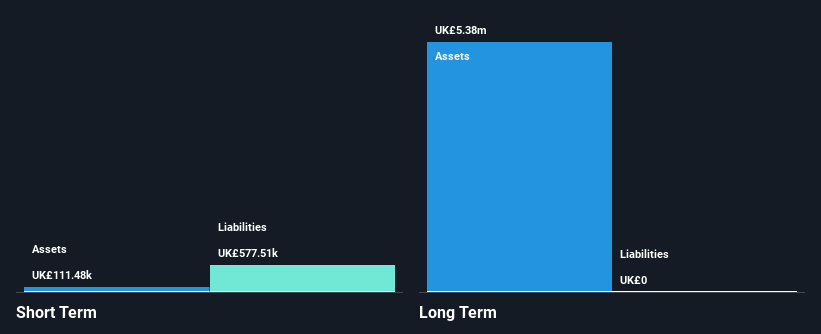

African Pioneer PLC, with a market cap of £2.12 million, is pre-revenue and focused on base metals projects in Zambia, Namibia, and Botswana. The company is debt-free but faces challenges with short-term liabilities exceeding its assets (£111.5K vs £577.5K). It recently raised £0.42 million through a follow-on equity offering to extend its cash runway beyond the previous estimate of 4 months. Despite being unprofitable with increasing losses over the past five years, shareholders have not faced significant dilution recently, and the company has no long-term liabilities to manage at this time.

- Dive into the specifics of African Pioneer here with our thorough balance sheet health report.

- Gain insights into African Pioneer's historical outcomes by reviewing our past performance report.

British & American Investment Trust (LSE:BAF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: British & American Investment Trust plc is a publicly owned investment manager with a market cap of £5.13 million.

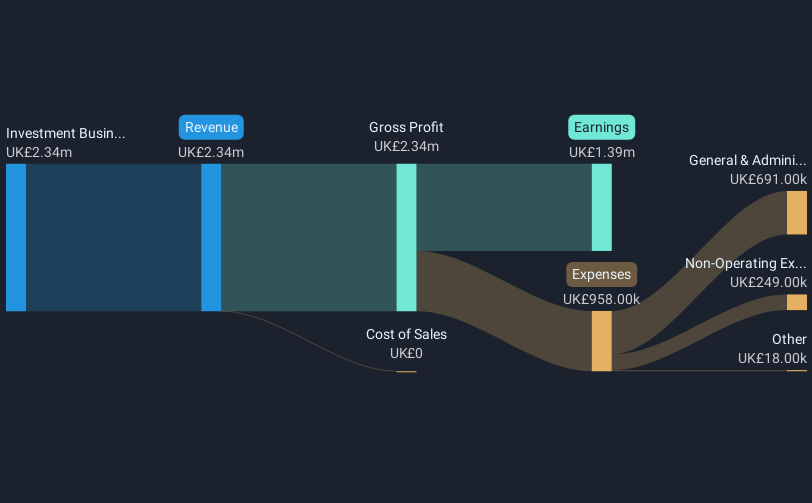

Operations: The company's revenue is derived entirely from its investment business, amounting to £2.34 million.

Market Cap: £5.12M

British & American Investment Trust, with a market cap of £5.13 million, is not pre-revenue but lacks meaningful revenue at £2.34 million. The company has experienced profitability over the past five years, yet recent negative earnings growth poses challenges. Its short-term assets (£376K) fall short of covering both short and long-term liabilities (£2.9M and £3.9M respectively). However, debt management appears prudent with a reduced debt-to-equity ratio from 33.6% to 12.7%. Despite stable weekly volatility, the share price remains highly volatile over three months, reflecting broader market uncertainties for investors in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of British & American Investment Trust.

- Explore historical data to track British & American Investment Trust's performance over time in our past results report.

Kendrick Resources (LSE:KEN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kendrick Resources PLC is engaged in the exploration and development of mineral resource properties across Norway, Sweden, Finland, and Scandinavia with a market cap of £663,157.

Operations: Kendrick Resources currently does not report any revenue segments.

Market Cap: £663.16k

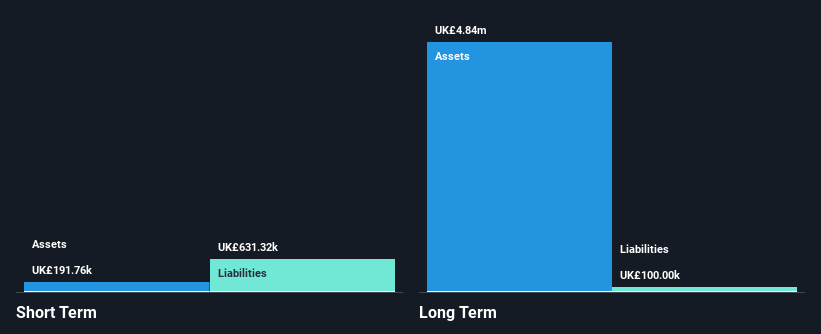

Kendrick Resources, with a market cap of £663,157, is pre-revenue and has faced increasing losses over the past five years. The company’s management and board are considered experienced with average tenures of 2.1 and 3 years respectively. While short-term assets (£191.8K) exceed long-term liabilities (£100K), they do not cover short-term liabilities (£631.3K). Despite having more cash than total debt, Kendrick's cash runway was limited to two months as of June 2024 but has since been extended by recent capital raising efforts through a follow-on equity offering totaling £0.1075 million at £0.0025 per share.

- Click here and access our complete financial health analysis report to understand the dynamics of Kendrick Resources.

- Review our historical performance report to gain insights into Kendrick Resources' track record.

Turning Ideas Into Actions

- Investigate our full lineup of 445 UK Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AFP

African Pioneer

Engages in the exploration and development base metals projects in Zambia, Namibia, and Botswana.

Medium-low risk with mediocre balance sheet.

Market Insights

Community Narratives