- United Kingdom

- /

- Metals and Mining

- /

- AIM:TRR

Shareholders May Not Be So Generous With Trident Royalties Plc's (LON:TRR) CEO Compensation And Here's Why

Key Insights

- Trident Royalties' Annual General Meeting to take place on 7th of June

- CEO Adam Davidson's total compensation includes salary of US$412.0k

- Total compensation is 188% above industry average

- Trident Royalties' EPS declined by 31% over the past three years while total shareholder return over the past three years was 2.6%

CEO Adam Davidson has done a decent job of delivering relatively good performance at Trident Royalties Plc (LON:TRR) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 7th of June. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Trident Royalties

Comparing Trident Royalties Plc's CEO Compensation With The Industry

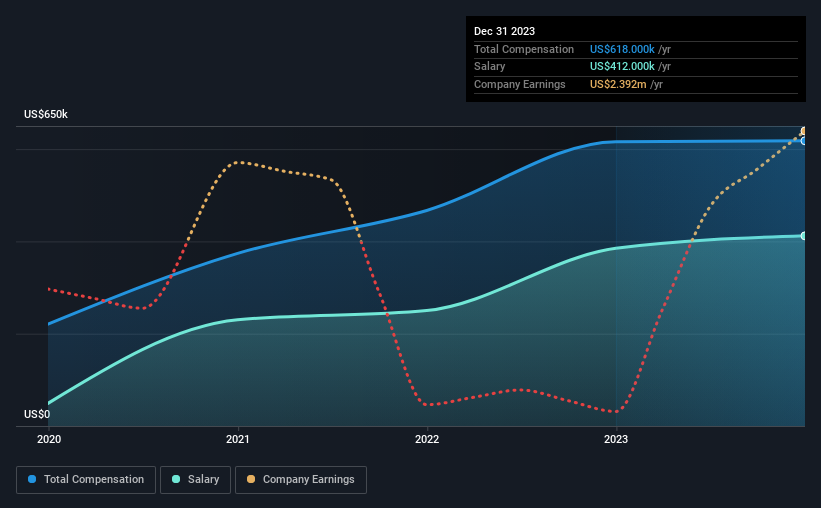

Our data indicates that Trident Royalties Plc has a market capitalization of UK£117m, and total annual CEO compensation was reported as US$618k for the year to December 2023. This means that the compensation hasn't changed much from last year. Notably, the salary which is US$412.0k, represents most of the total compensation being paid.

For comparison, other companies in the British Metals and Mining industry with market capitalizations below UK£157m, reported a median total CEO compensation of US$215k. Hence, we can conclude that Adam Davidson is remunerated higher than the industry median. What's more, Adam Davidson holds UK£220k worth of shares in the company in their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$412k | US$385k | 67% |

| Other | US$206k | US$231k | 33% |

| Total Compensation | US$618k | US$616k | 100% |

Talking in terms of the industry, salary represented approximately 67% of total compensation out of all the companies we analyzed, while other remuneration made up 33% of the pie. Our data reveals that Trident Royalties allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Trident Royalties Plc's Growth Numbers

Over the last three years, Trident Royalties Plc has shrunk its earnings per share by 31% per year. In the last year, its revenue is up 21%.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Trident Royalties Plc Been A Good Investment?

Trident Royalties Plc has generated a total shareholder return of 2.6% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

The overall company performance has been commendable, however there are still areas for improvement. Until EPS growth picks back up, we think shareholders may find it hard to justify increasing CEO pay given that they are already paid above industry average.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 1 warning sign for Trident Royalties that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Trident Royalties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TRR

Trident Royalties

Operates as a diversified mining royalty and streaming company.

High growth potential and slightly overvalued.

Market Insights

Community Narratives