- United Kingdom

- /

- Basic Materials

- /

- AIM:STCM

Here's Why I Think Steppe Cement (LON:STCM) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Steppe Cement (LON:STCM), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Steppe Cement

Steppe Cement's Improving Profits

In the last three years Steppe Cement's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Steppe Cement boosted its trailing twelve month EPS from US$0.049 to US$0.06, in the last year. I doubt many would complain about that 24% gain.

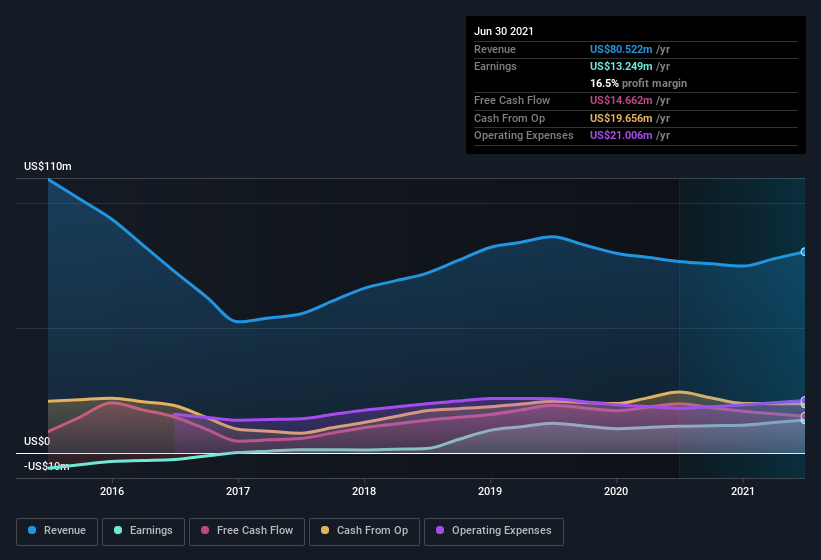

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Steppe Cement maintained stable EBIT margins over the last year, all while growing revenue 5.1% to US$81m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Steppe Cement is no giant, with a market capitalization of UK£79m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Steppe Cement Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Like a sturdy phalanx Steppe Cement insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the , Azmi Hamzah, paid US$146k to buy shares at an average price of US$0.29.

On top of the insider buying, it's good to see that Steppe Cement insiders have a valuable investment in the business. Indeed, they hold US$24m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 31% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Javier del Ser Perez is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Steppe Cement with market caps under US$200m is about US$316k.

The CEO of Steppe Cement was paid just US$30k in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Steppe Cement Worth Keeping An Eye On?

One positive for Steppe Cement is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. It is worth noting though that we have found 3 warning signs for Steppe Cement that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Steppe Cement, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:STCM

Steppe Cement

An investment holding company, engages in the production and sale of cement and clinkers in Kazakhstan.

Excellent balance sheet and good value.

Market Insights

Community Narratives